$2 million is a lot of money.

But let’s face it, it’s not as much as it was a decade ago.

So when a hopeful retiree approaches me with a nest egg worth $2 million and wants to know if they’ll be able to successfully retire, there isn’t a clear-cut answer as many would think.

There are many factors that go into the equation such as:

- Retirement goals

- Spending habits

- Dependents

- Desired retirement location

- Health

- Investment risk tolerance

- And much more

This is what makes financial planning tricky but also a ton of fun because every situation and story is unique.

The following is a sample case study of retirees who are seeking to retire with a nest egg worth $2 million. Some of the details have been changed for their protection.

While this case study focuses on soon-to-be retirees, this should also be an important lesson for any Gen X’er or Gen Y’er wanting to retire one day.

A portfolio worth $2 million does not grow overnight.

And while it may seem impossible for some to attain, it’s very doable with discipline and a plan of attack.

Table of Contents

The Petersons’ Story

First, here’s some of their back story:

Joseph Peterson is 58 years old, started working for Ameren Corporation at age 24 as a lineman, and is now a Training and Simulation Supervisor – part of Ameren’s Crisis Management Team.

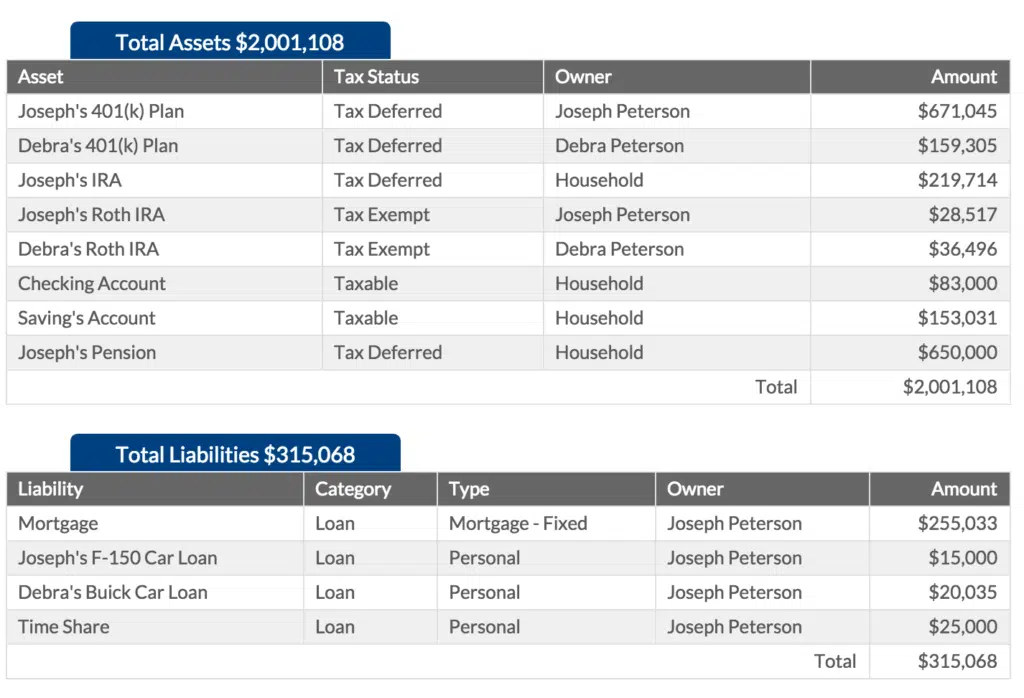

Joseph is looking to retire in four years at the age of 62. Joseph currently has a tax-deferred 401(k) plan worth $671,045. Four years ago Joseph opened a tax-exempt Roth IRA and contributes $6,500 per year – it’s worth $28,517 today.

Joseph also has a Traditional IRA worth $219,714. Additionally, Joseph has a defined benefit pension plan as part of his employment benefits with Ameren. The current value of the pension plan is $650,000.

Debra Peterson is 57 years old, started working as an RN at 22, and at the age of 30, she quit working to become a full-time stay-at-home mom. Debra stayed at home with her children for 10 years and went back to work at age 40 as an RN.

She has a tax-deferred 401(k) plan worth $159,305 through her employer at the hospital. Debra opened a tax-exempt Roth IRA five years ago, and contributes $6,500 per year – it’s worth $36,496 today.

Together, Joseph and Debra have a checking account balance of $83,000 and a savings account valued at $153,031.

They currently owe $155,033 on their mortgage, Joseph owes $15,000 on his truck loan, and Debra owes $20,035 on her car loan.

Joseph and Debra have three children: Matt who is 27 years old and works as a line cook in St. Louis; Morgan who is 25 years old, still lives at home, and is in the process of finishing graduate school; and Samantha who is 18 years old and is getting ready to start college. Joseph and Debra are going to pay for Samantha’s college education.

Here’s a total of their assets and liabilities:

- Assets: $2,001,108

- Liabilities: $315,068

- Total: $1,811,040

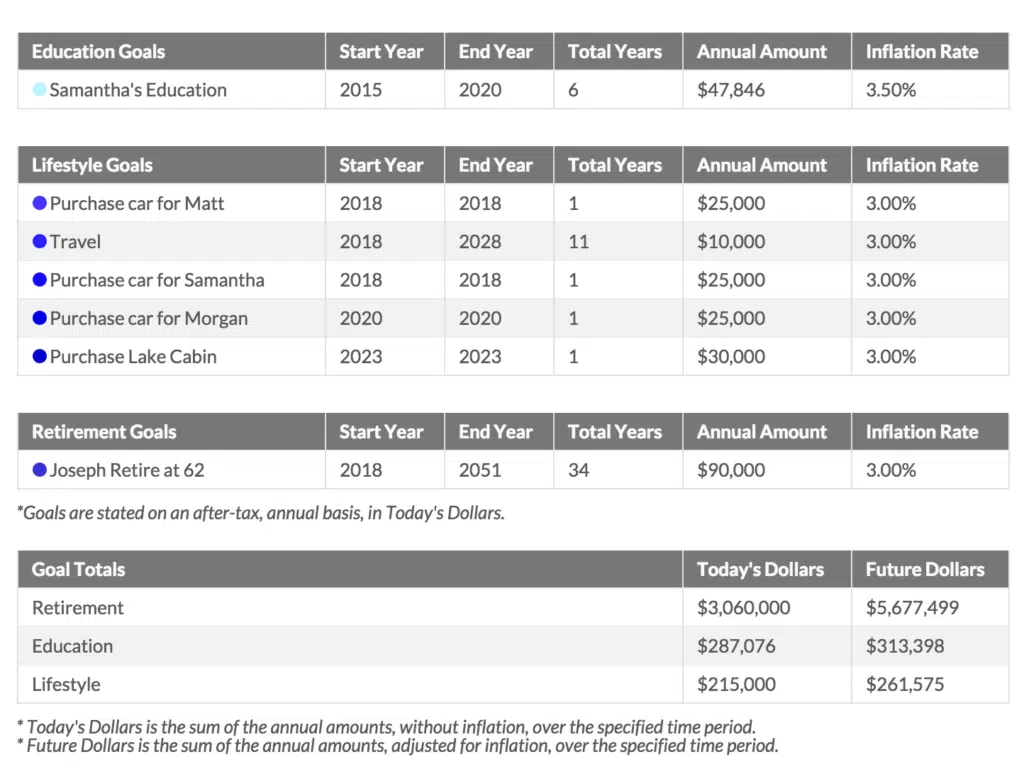

Joseph and Debra wish to have $90,000 per year for retirement and have certain goals they wish to fulfill while living comfortably in retirement.

First, when Joseph retires he plans to spend $25,000 to buy a new car for his son Matt, and then two years later $25,000 to buy a new car for his daughter Morgan, and then four years from now $25,000 to buy a car for Samantha.

Joseph and Debra also want to start traveling as soon as Joseph retires so they plan to have $10,000 budgeted per year to travel for 10 years straight. They wish to travel to Italy, Rome, and Greece together. They also want to take their children to New Zealand.

In 2023, five years after Joseph retires, he plans to buy a lakeside cabin for himself and his family where they can spend their summers. He plans to spend $30,000 on the cabin.

Our Unique Process

If one of my clients asks if they can retire with $2 million, we have to go beyond the numbers to find a solid answer.

That’s why before we begin the number-crunching, I like to get the clients really thinking about retirement and what the next few years are going to look like. Here’s the simple question I ask them:

“If we were meeting three years from today – and you were to look back over those three years to today – what has to have happened during that period, both personally and professionally, for you to feel happy about your progress?”

Obviously, their investments’ performance and our working together will be a part of this equation, but I want to know more:

- What will a typical day look like for them in retirement?

- What do they think will keep them the busiest?

- What will they be doing in retirement that they are not able to do now?

- What are the challenges, opportunities, and strengths that will either help them or prohibit them from achieving these goals?

After they answer some of those questions we dive into the numbers. We use an account aggregator called Blueleaf which allows all our clients to see their entire portfolio in one place.

I’m amazed how many people will have multiple 401(k) investment accounts spread out amongst five, six, seven, or eight different institutions, but never look at it under one microscope. That’s what Blueleaf offers.

Initially, we’ll just take a look at their current allocations and then start conducting stress tests to see how those portfolios will hold up over time.

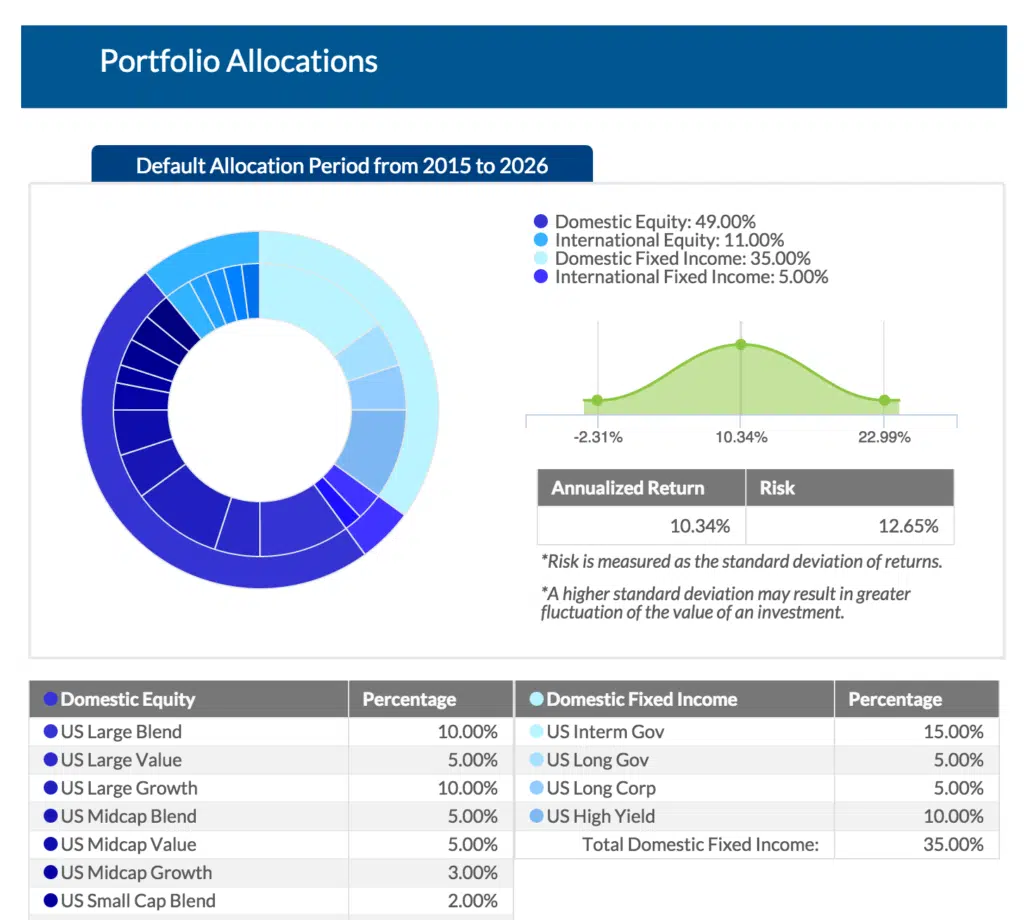

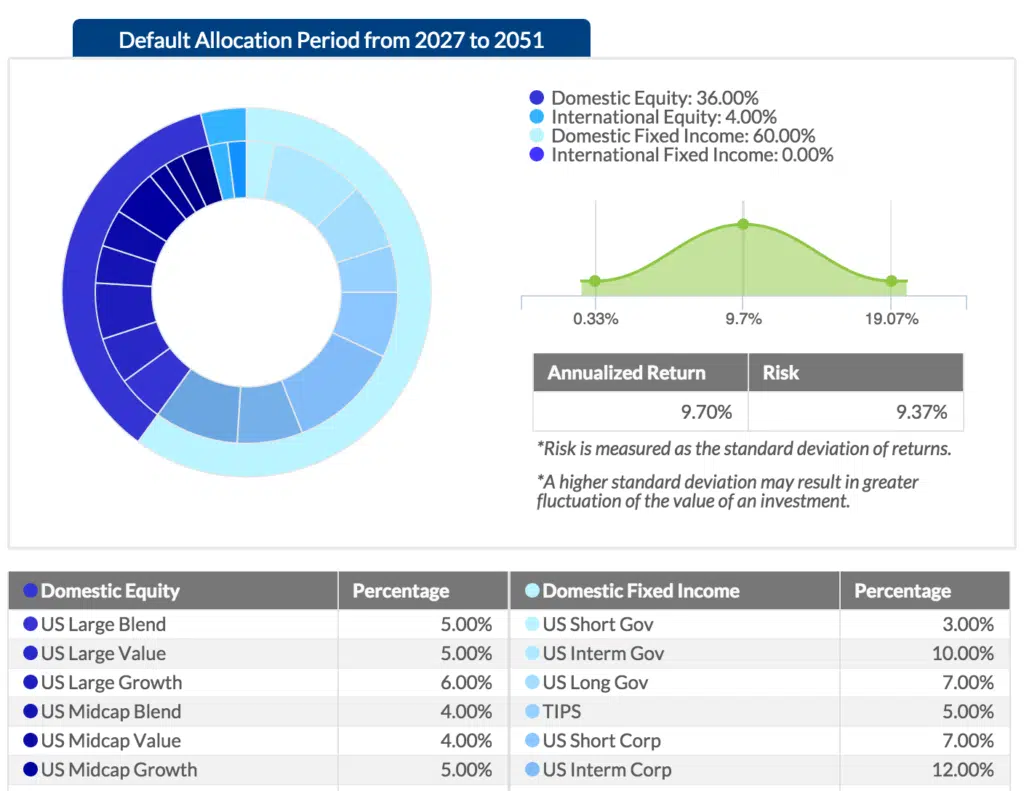

Based on their risk tolerance and their income needs, we determined that Joseph and Debra needed roughly 60% of their investments in stocks and 40% in bonds for the first 10 years of retirement.

After some of their goals of buying a timeshare and buying their kids’ graduation gifts, we felt we could tone down the allocation to 40% stocks and 60% bonds (that’s what these two graphs represent).

I tell all our clients that the output is only as good as the input so we have to do our best to have a clear understanding of our financial goals and what our income needs are going to be in retirement.

I know this is difficult for some, but it just reinforces how important having some sort of budget is if you want to have a successful retirement.

Are They Going to Make It?

Based on all these numbers, do the Petersons stand a chance? Can they retire with $2 million at Joseph’s desired age of 62? Let’s take a look.

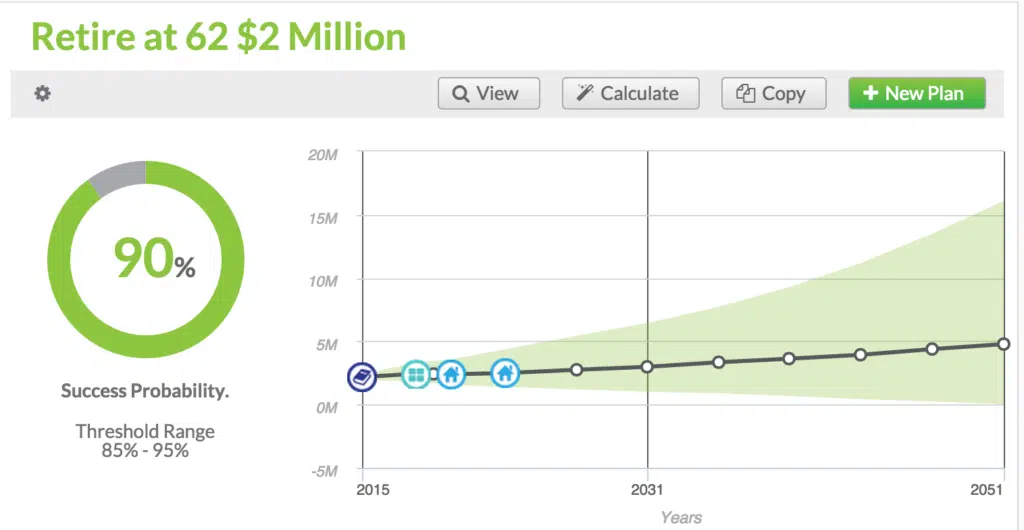

According to our financial planning software, they have a 90% probability of success in achieving this goal.

What exactly does this 90% number represent?

The financial planning software runs 1,000 different scenarios taking a look at every single market that we’ve experienced, good and bad, and then takes a look at their income needs, adjusted for inflation. So based on all of this, they have a 90% chance of succeeding with their goal of not running out of retirement money which would be at Joseph’s age of 95.

In case you’re wondering, this is good news. Typically, we like to see clients in the 85% or above range, so anything in the 90s leaves us feeling pretty confident.

Shortfall Analysis

So is there a chance that they’ll run out of retirement funds? Is there a chance they’ll really run out of money with $2 million in their portfolio?

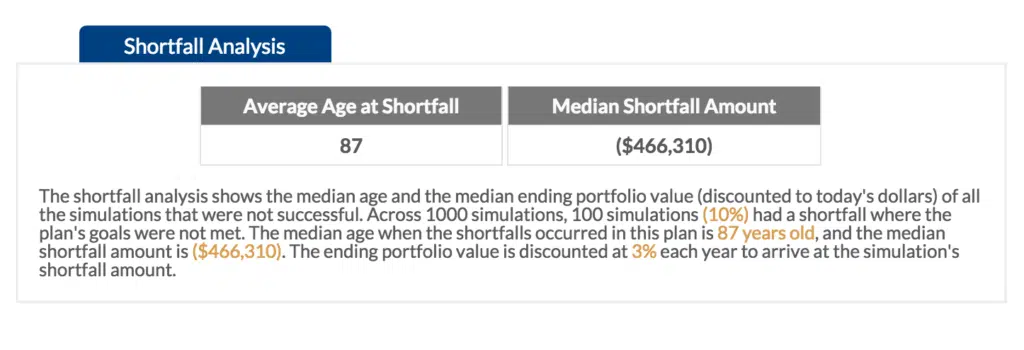

A shortfall analysis looks at the mean age of when they run out of money based on the 1,000 different simulations.

As you can see, the average age shortfall is 87 which is well past their most crucial years in retirement.

The other factor we’re assuming is that their retirement spending is increasing due to inflation each and every year.

I tell a lot of clients that usually retirement spending is more like a bell curve where the first couple of years they’re spending much more of their retirement nest egg.

After the first years of traveling and doing things that they’ve been waiting to do in retirement, the bell curve starts to decline and their spending decreases. This is typically the case, but usually predicting the future isn’t easy.

The Tricky Business of Prediction

As you can see, there are many factors that go into a prediction. Predicting the most plausible performance of a portfolio is no easy task. In fact, it’s a tricky business.

Thankfully, there are a number of tools available that can help financial advisors give the best possible advice to their clients. But the problem is that many of these tools are underused and the right questions usually aren’t being asked.

Consider this, too: Just because a certain investment performed a certain way for a certain number of years, that doesn’t mean the investment will perform similarly in the future.<

Past performance is not directly correlated to future performance. It can be easy for clients – not to mention financial advisors – to forget this and make assumptions without considering all the possible consequences of a particular action.

That’s why when I sit down with clients I remind them that even though there may be a high degree of certainty of this or that outcome, there is still a possibility that a different outcome may come to pass.

While there’s no way to predict the future with 100% accuracy, one may become better at prediction by considering all of the known factors such as planned vacation time, major purchases, and more.

Financial Advisors Who Promise Fantastic Gains

I, for one, am always careful when suggesting the future performance of a fund. Scott Beaulier writing for Forbes has it right when he asserts:

“Just” being average in the world of finance is actually being pretty darn good.

If you hear a financial advisor claim they can consistently get you a 12% return year after year, that might be just one of many reasons you should fire them and run the other direction.

The Petersons have a good chance at living the retirement dream they envisioned, but if I were to cast their projections in a more favorable light, I would probably be giving them too much confidence. The truth is, there is a chance that they might run into unexpected setbacks. It’s not likely, but it’s possible, and they need to know that.

Find a Financial Advisor Who Discloses Risks and Makes a Plan

Can the Petersons have a comfortable retirement with $2 million? Most likely, yes. But they need to understand the risks involved, as little as they may be.

Can you retire with $2 million? How about $1 million? Mitch Tuchman writing for Forbes says:

You can retire with a million dollars – or any other amount – by setting your sights on a goal and taking saving seriously. A well-designed investment portfolio will get you there, almost inevitably.

The keywords here are that you need a “well-designed” investment portfolio. How do you get one of those?

Sit down with a professional, make sure they consider as many variables as possible and design a plan. Take your time when you’re asking yourself if you can retire with any particular amount of money – you can’t afford to get it wrong. You can also check out our unique financial planning process The Financial Success Blueprint.

I agree with this. And even if the house is completely paid for, it couldn’t be considered an asset. Property taxes, insurance, general maintenance, utilities… a house is an investment because it has value but not an asset as it doesn’t bring in cash flow

On the total assets you forgot to add the house, car, etc…but did add the total liabilities from those items

No mention of medical insurance cost, we see this as a major reason to keep working until my wife reaches 65, 68 for me…

Many today work just to keep health insurance.

I see not mention of health care. This would be a big consideration for anyone retiring before age 65!

This is a great article and the detailed example is wonderful. Thank you.

My only criticism/addition to this: Talk your client out of buying their kids $25000 cars! They would be better off helping them buy a used car, and taking half that money and helping their kids start an IRA and saving some toward their first down payment on a home. What is the obsession with wasting money on cars for kids! I hope you consider this! I think a financial adviser should always give “other options”, even though in the end of course the client must choose. They may someday thank you for it!

Your advice is spot on, but people are going to do what they’re going to do with their money. When they have a lot of it, many do tend to lavish it on their kids without thinking of how it will affect the kids.

Thank you for your empowering website and teaching!! This article has much to offer in wise warnings and ideas.

But.golly, Jeff, the second largest part of this scenario is a huge pension, In the real world, very very few have a defined benefit pension,something that was not all that common even decades ago, especially for white collar workers. And now those have gone the way of the dinosaur unless one is a union state or federal employee, a teacher, a fireman or a policeman. An example for the pensionless, 401K fund it yourself crowd would be most welcome. (Even the ‘matching funds’ thing is usually only applying to the first 1-3% of the employee’s contribution these days.)

I will keep reading

Man, you counted mortgage as liability, but forgot to count house as an asset, depending on where they are, house might be the largest chunk in their total asset.

Or you want to exclude the primary house, assuming that is indispensable throughout their life, and they are determined to pass the house as gift to their kids. Kind of an acceptable assumption.

Hi Ping – Generally, the house is an asset only if they plan to sell. If not, it’s the place they live, so it really can’t be counted.

Hi Jeff,

Interesting post and analysis thanks for sharing.

How much of your time do you spend with your financial advising business vs. your blog at this point in your career?

Thanks,

Damn Millennial

Usually financial advising gets most of my time. But it really depends on activity level with both.

Impressive that you can spend more time on that and be so successful with your blog. Way to go managing all of that.