Roth IRAs are for retirement, right? Generally speaking, yes.

But because of their general flexibility, they’ve also come to be an increasingly important way to pay for college.

A recent GFC reader question prompted me to write this article explaining the ins and outs of using a Roth IRA to pay for college.

Here was the question…

“Jeff, we have an 8 and a 6-year-old and are a little behind in saving for their college education. But the kicker is we’re also a little behind in saving for our own retirement. We know how much you love the Roth IRA so we’re very interested in starting one. A friend of ours had mentioned we could also use the Roth IRA to pay for college? Curious to know your thoughts. Love the blog!!”

Okay, let’s see if we answer the reader’s question on using a Roth IRA to pay for college. But first, a quick primer on my favorite retirement too, the Roth IRA…

Table of Contents

The Basics of Roth IRAs

Roth IRAs are like traditional IRAs, with a couple of twists. One is that the contributions that you make to the plan are not tax-deductible when made. Another is that funds can be withdrawn from the plan tax-free as long as you’re at least 59 1/2 years old and have participated in a Roth plan for at least five years.

In 2024, you can contribute up to $7,000 to a Roth IRA or $8,000 if you’re aged 50 or older. Similarly, in 2022, the contribution limit was $6,000, with an increased limit of $7,000 for those 50 or older.

There are income limits in order to be able to participate in the plan. The Roth IRA income limitation for married taxpayers filing a joint return is $214,000 for 2022 and $240,000 for 2024. For all others (other than married filing separately), it’s $144,000 for 2022 and $161,000 for 2024.

There’s no tax deduction on the contributions, but that is more than offset by the fact that withdrawals can be taken on a tax-free basis. That’s the biggest advantage of the plan.

Since a Roth IRA is, first and foremost, a retirement plan, why should you even consider it for funding a college education?

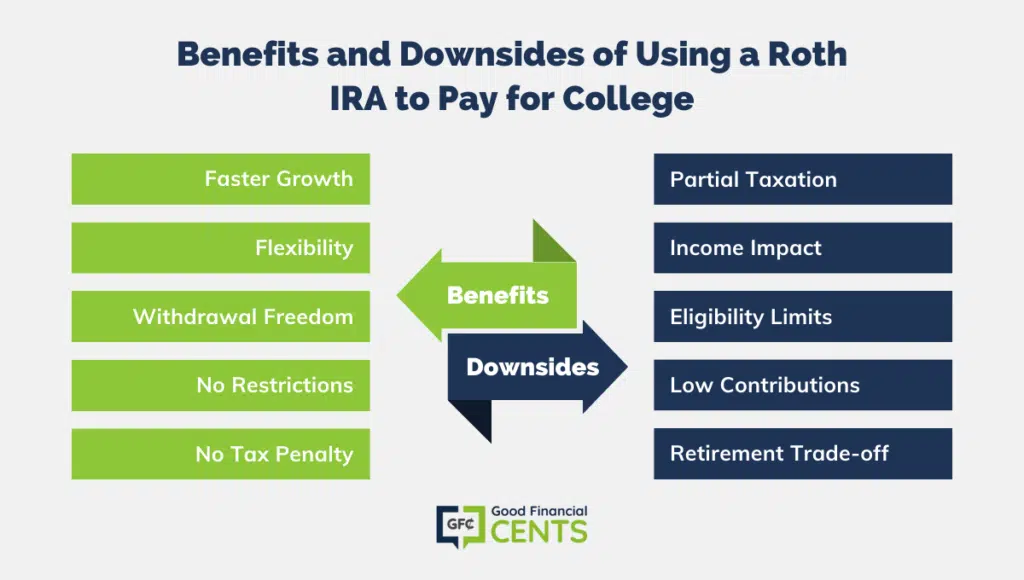

The Benefits of Using a Roth IRA to Pay for College

Even though the Roth IRA was never intended to fund a college education, it has gradually developed into an important secondary purpose. And there are a lot of smart reasons why this is happening.

Here are a few:

Roth IRAs Grow Faster Than Taxable Accounts. Investment income accumulates on a tax-deferred basis in a Roth IRA. That means that the investment earnings grow much more quickly in a Roth than they will in a taxable account, such as a brokerage account or mutual fund.

Roth IRAs Are Self-Directed Accounts. This means that you can invest your account anywhere you like and in any investments that you prefer.

You Can Withdraw Money at Any Time. This, of course, is a mixed bag. Your contributions can be withdrawn at any time without being subject to tax since there was no tax deduction taken when they were made. The distributions will be pro-rated between your contributions and investment earnings. That means that at least some of the distribution will be taxable if the money is withdrawn prior to your turning 59 1/2 and being invested in the plan for at least five years.

No Restrictions on How the Money Is Spent. Dedicated college savings plans, like 529 plans, restrict distributions for educational purposes only. There are no such restrictions on distributions from a Roth IRA. You could use the money to pay for college – or you could use it for retirement – it’s your choice.

No Tax Penalty for Education-Related Withdrawals. If you withdraw the money before reaching age 59 1/2, you’ll generally have to pay a 10% penalty tax. However, the penalty tax is waived if the funds are used for education.

So far, so good.

The Downsides of Using a Roth IRA to Pay for College

In the interest of balance, I should also disclose that using a Roth IRA to pay for college is not without a few drawbacks.

The Distributions Will Be Partially Taxable if Taken Early. There’s good news and bad news here – let’s start with the good news. Since there is no tax deduction for making contributions into a Roth IRA, the portion that is withdrawn that represents the contributions will not be subject to income tax.

Also, the 10% penalty tax for early withdrawals can be waived if the money is used to fund a college education. And if you are at least 59 1/2 and have been participating in your plan for at least five years, the entire distribution – including investment earnings on your contributions – can be withdrawn tax-free. The downside is if you are not 59 1/2 and/or have not been participating in the plan for at least five years, in which case the earnings will be fully taxable, even if the 10% penalty is waived.

Roth Distributions Can Inflate Your Income. Speaking of distributions, the amount of the withdrawal will be added to your regular income and must be reported on your FAFSA application. That will increase your income and could hurt your ability to obtain financial aid and other benefits.

You May Not Be Eligible to Start a Roth IRA. Not everyone is eligible to participate in a Roth IRA, as I noted with the income limitations described earlier in this post. Even if you are eligible right now, if you start a Roth IRA for the purpose of funding your children’s education when they are very young, it’s entirely possible that you will exceed the income threshold at some point in the future, at which point you’ll be forced to stop the contributions.

Low Contribution Limits. As noted at the beginning of this post, your contributions are limited to $7,000 or $8,000 per year. That will probably be inadequate if you’re trying to fund college for multiple children, especially if only a few years are left before college begins.

You May Be Compromising Your Own Retirement. The primary purpose of a Roth IRA is, of course, retirement, not college funding. If your Roth IRA is a major component of your retirement plan, you may want to seriously consider whether you want to divert money into education and away from retirement. There are, after all, other ways to finance a college education.

Speaking of which –

Using a 529 Plan Instead

The 529 plan is specifically designed to fund a college education, and they are generally more effective for that purpose than Roth IRAs. 529 plans are actually state-sponsored and state-specific, so there will be some limits on how and where you can hold the accounts.

A 529 plan functions much like a retirement plan and is very close to the Roth IRA. Just as is the case with a Roth, the contributions you make to the plan are not tax-deductible. However, the money in the account earns tax-free investment income for federal income tax purposes.

Funds that are later withdrawn for qualified higher education expenses can be taken without being subject to income tax. If, however, funds are withdrawn and used for purposes other than qualified higher education expenses, the distribution will be subject to both federal income tax and the 10% penalty tax. Both the tax and the penalty apply only to investment income in the account and not to your actual contributions.

One of the biggest advantages of a 529 plan compared to a Roth IRA is that there are no income restrictions limiting your participation in the program.

And the contributions are also a lot more generous. You can contribute up to $17,000 per year per taxpayer and beneficiary. That means that you and your spouse can contribute up to $34,000 to a 529 plan established for each of your children.

You can actually contribute more than this. However, $17,000 is the threshold that triggers the federal gift tax. If you plan to exceed the threshold, you’ll need to consult with your tax advisor about the best way to proceed and the specific returns that will need to be filed.

So, Should You Use a Roth IRA to Pay for College?

In a perfect world, you have a 529 plan set up for each of your children that would represent the foundation of your education planning. But if you can’t afford to do that, and you still want to make at least loose plans to fund your education in advance, a Roth IRA is an excellent way to go.

If you are in a position to do so, having both a 529 – as the base plan – supplemented by a Roth IRA is solid financial planning. The Roth IRA can be set up primarily for retirement but still be available as a secondary source of college education funding, should it be necessary.

If you do elect to use the Roth IRA for college savings, please don’t make the mistake of saving more for your kids and not enough for your retirement.

The Bottom Line – Should We Use a Roth IRA to Pay for Our Kids College?

In determining whether to use a Roth IRA to finance your children’s college education, it’s crucial to weigh both its advantages and drawbacks.

While Roth IRAs offer tax-free growth, flexibility, and no restrictions on usage, they might affect financial aid eligibility and compromise your retirement savings.

Ideally, a 529 plan, specifically designed for education savings, serves as the primary funding source, with Roth IRAs as a supplementary option.

The primary intent of Roth IRAs remains retirement savings, so it’s essential to strike a balance between future security and educational needs.

Before making a decision, consulting a tax advisor to understand the implications of your unique situation is paramount.

Really good points here Jeff, and I agree 529s or ESAs are usually better options than your ROTH. I meet a lot of parents who have been told by their advisors financial advisors to go with a ROTH before going into a 529 for education because of the flexability. My main gripe with that is this: you’re going to get old and need $$ – don’t kill the golden goose that will be feeding you. Great post (as usual) Jeff