With the economy finally out of recession, it’s never been more important to take a look at your financial situation and ‘tweak’ what you can to improve your debt management skills.

With so many of us falling into debt – and the nation’s finances a lot weaker than they were – it’s best that you do what you can to keep on top of your debts.

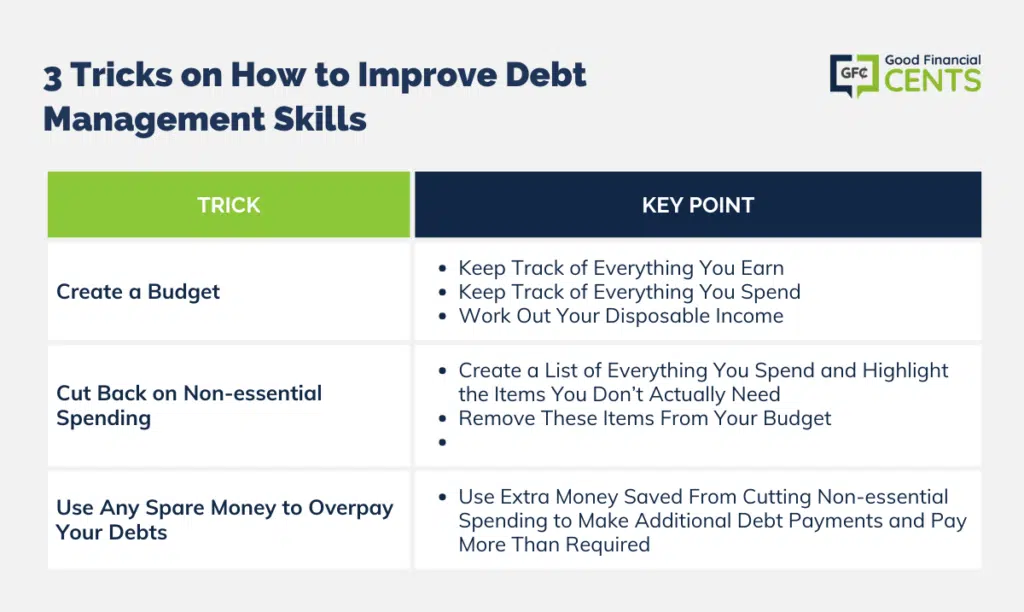

Here are a few tips on how you could improve your debt management skills:

Table of Contents

1. Create a Budget

Budgeting is about knowing how your finances work and controlling what you do with your money – in other words, not letting your money control you! When you create a budget you will need to:

a. Keep Track of Everything You Earn

The very first thing you need to understand when budgeting is exactly how much money comes into your house each month. So, you should start by writing down everything your household earns/receives in a month – this includes salaries, benefits, grants, etc.

b. Keep Track of Everything You Spend

Now you know exactly how much money comes into your house each month, you need to be aware of how much actually leaves your household too. A good way to do this is to track your spending for one month, writing down everything you spend.

This will obviously take one full month – which will delay your attempts to improve your debt management skills – but it’s a good way to get a complete picture of your spending.

So, start by writing down your priority debts (payments to mortgage/rent, utility bills, secured loans, etc.) and your everyday living costs (such as food and travel). Don’t forget to factor in the things you might pay for on an annual basis – like car insurance, for instance.

NOTE:

c. Work Out Your Disposable Income

Once you are confident that you’ve accounted for all your essential living costs, you can work out your disposable income.

Your disposable income is essentially the amount you have left on a monthly basis to pay towards your non-priority debts and, if you have any spare after doing this, to save and spend on non-essential goods/services.

To work out your disposable income, simply subtract your monthly expenditure from your monthly income.

Once you know how much your disposable income is, you will need to work out how much the monthly repayments to all your non-priority debts cost you. Now compare this with your disposable income – if it’s big enough to cover your debt repayments, you should be fine.

However, if it isn’t big enough, it’s important that you rectify this problem as soon as possible. You can start by letting your creditors know you are experiencing problems, and seeking professional debt advice to find the most appropriate solution to your problems.

2. Cut Back on Non-essential Spending

Once you have worked out your budget, and can see whether or not your disposable income is enough to cover the cost of your unsecured debts, you could focus on cutting back on non-essential spending to free up a little bit of extra money each month.

Here are a few tips on how to do this:

a. Create a List of Everything You Spend and Highlight the Items You Don’t Actually Need

Make a list of everything you spend in a month – including spending on non-essentials such as chocolate, magazines, CDs, etc. Once you have done this, go through the list and highlight the items you don’t actually need.

Once you have highlighted those items, you should add up how much you spent on them. This is money you didn’t actually need to spend, and could have been used for other purposes, which brings us to the next point…

b. Remove These Items From Your Budget

Try and remove as many of these non-essential items from your monthly budget as you can. The money you can free up by doing this can be used for other purposes, which, again, brings us on to our next – and final – point…

3. Use Any Spare Money to Overpay Your Debts

The ‘extra’ money that you’re not spending on non-essential goods/services can be used to overpay your debts each month – to pay more than you need to.

Overpaying your debts can be an excellent way to improve your debt management skills. By overpaying your debts, you will reduce the amount of money you owe at a faster rate, and it should reduce the amount of time you are in debt as well as the total amount you’ll pay in interest… providing you don’t take on any more debt.

Credit: t3hWIT

Bottom Line: Enhancing Debt Management Skills

Improving debt management is essential in our fluctuating economy. By understanding and budgeting your finances, you gain control over your money. Tracking income and expenditures gives a clear picture of financial health, highlighting areas for cutbacks on non-essentials.

With the additional savings, prioritizing overpayments on debts can fast-track financial freedom, reducing both debt tenure and interest. Effective debt management not only ensures financial stability but paves the way for a secure future.