Although 2020 was an economic dumpster fire of epic proportions for many, the last few years were filled with plenty of prosperity and, of course, stock market growth. After all, the S&P 500 rose by 29% in 2019, and the unemployment rate was crazy-low, dropping to its lowest level (3.5%) since 1969.

And the years before that weren’t too shabby, either.

The S&P 500 dropped 4.8% in 2018, but it grew by 21.83% in 2017 and 11.96% in 2016.

Don’t get me wrong — things were not perfect, nor will they ever be. But for the most part, the economy became a well-oiled machine. Interestingly, the prosperity of this last decade brought about a brand new movement — the FIRE movement.

“FIRE” stands for “financial independence, retire early”. The main premise of FIRE is living on a small percentage of your income during your working years so you can retire early (often as young as age 30) and live off your investments.

Sounds good, right?

The thing is, the FIRE movement has a lot of holes, and it made considerably more sense during one of the greatest bull markets in history. During a pandemic and in a time with so much economic uncertainty, the idea of the FIRE movement makes even less sense than it did before.

Here’s my advice: Save like your future depends on it (because it does), but treat each day like it’s your last.

How Does FIRE Work?

Table of Contents

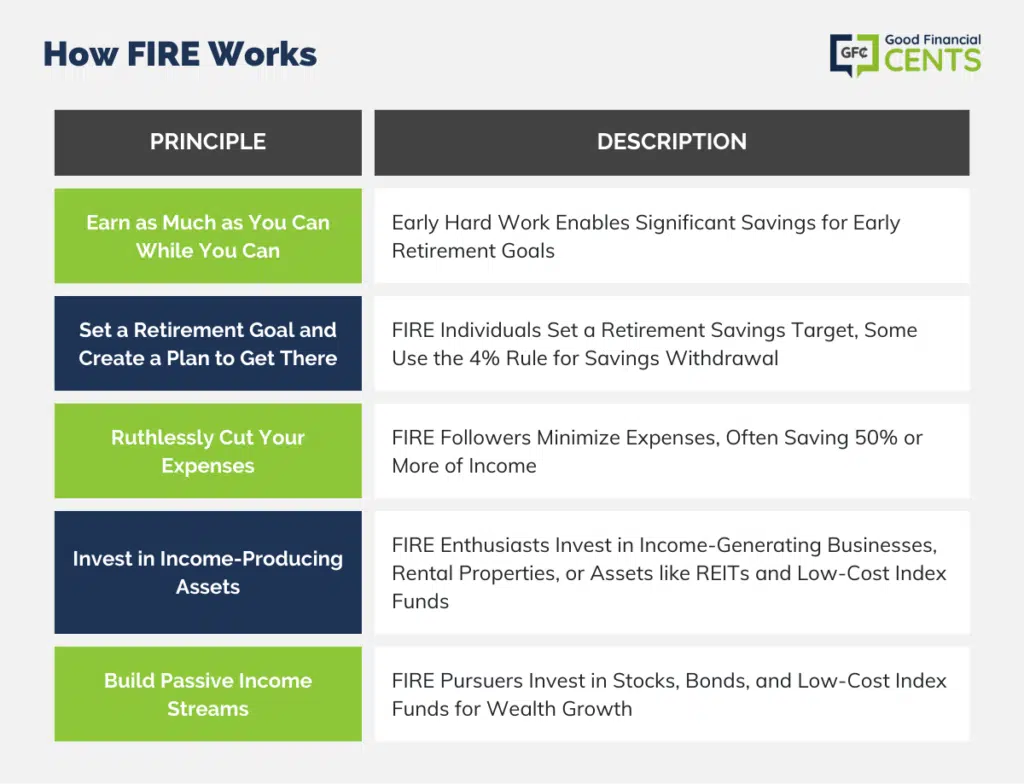

The logistics of achieving FIRE vary from person to person, but the underlying narrative is always the same. Here’s how FIRE works, or how it’s supposed to work, for the majority of its subscribers.

Earn as Much as You Can While You Can

Most people who pursue FIRE have high incomes and careers in engineering, medicine, or entrepreneurship, which is the reason they are able to save so much money. FIRE enthusiasts who want to retire early need to work hard early on so they can save significant sums of money and reach their goals faster.

Set a Retirement Goal and Create a Plan to Get There

When talking to individuals pursuing FIRE, they almost always have a “retirement savings number” they plan to reach before leaving their jobs.

This number is usually figured as 25x their annual expenses ($1.25 million if you want $50,000 in annual spending during retirement), but others use formulas like the 4% rule to determine how much they need to save. With this rule, retirees plan to make their nest eggs last by withdrawing only 4% of their portfolio each year.

Ruthlessly Cut Your Expenses

The key to retiring early usually involves cutting expenses to the bone so you can save 50% of your income, 70% of your income, and sometimes more. For the most devoted FIRE followers, that can sometimes mean living in a tiny home or a mobile home, never dining out, only buying used, or even buying nothing at all.

They also use apps like Trim to cut subscriptions, and I swear every single FIRE person I know tracks their spending on Personal Capital to stay on course.

Invest in income-producing assets. To retire early, many FIRE enthusiasts invest in businesses that produce income. You’ll also find a subset of the FIRE movement that invest entirely in rental properties to fund their retirement, although some might buy REITs or invest with a platform like Realty Mogul instead.

Build Passive Income Streams

Most who pursue FIRE also invest in stocks and bonds, but normally in low-cost index funds. Index funds let them grow wealth based on average market returns with some of the lowest expense ratios possible and without worrying about buying or selling stocks at the right time.

Some who pursue FIRE also swear by robo-advisors like Betterment and Robinhood, which help them grow wealth with some investment help and low account management fees.

Once you’ve cut expenses, invested heavily, and reached your “retirement number,” the rest of your FIRE journey is all about the “RE” side of the equation. With plenty of passive income, you get the chance to spend your time pursuing hobbies and passions you never could before.

This final piece is a critical component of FIRE. The entire point of the movement is buying time to spend your life doing what you want instead of being beholden to an employer.

With FIRE, you work hard for a decade or so, save all of that money, and then spend the rest of your years on hobbies and relaxation. At least, that’s what the goal is supposed to be.

Caveats of the FIRE Movement

The thing is, I’ve found that FIRE enthusiasts don’t always practice what they preach. And even when they do, they don’t always recognize the fact that not everyone is set up to achieve the same results.

The pandemic has also created even more holes in the FIRE story that anyone can achieve early retirement if they try hard enough. After all, it’s a lot easier to invest for retirement in a year when the S&P surges by 29% vs pretty much any other year on record.

Here are some of the lesser-known caveats of FIRE that hardly anyone mentions.

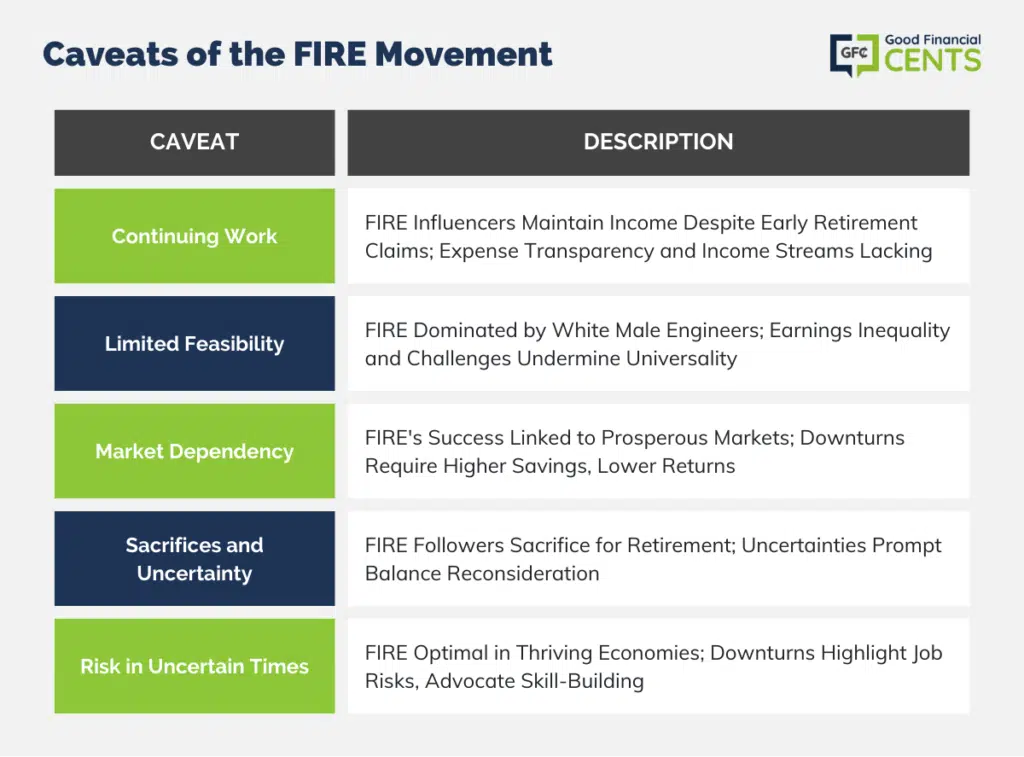

#1: Most Need to Continue Working

Most FIRE bloggers, podcast hosts, and media personalities are less than transparent when it comes to making their numbers work. They insist on saying their family spends just $25,000 per year or some other arbitrary number, but they don’t break down their expenses or explain how that’s possible when the average family is spending a third of that on healthcare alone.

The not-so-hidden secret of the FIRE movement is the fact that most people who talk or write about FIRE are still working and earning an income. A lot of them earn plenty due to sponsorships and affiliate partnerships, and this is income the average family pursuing FIRE won’t have access to.

Ask yourself: Do you want to continue working, or do you really want to retire early? If you plan on working part-time in a more enjoyable job, that can help you reach your FIRE number faster.

#2: FIRE Is NOT Attainable by Everyone

The FIRE movement is largely made up of white men who work as engineers, and that isn’t an exaggeration! Of course, you can retire early if you’re earning a median annual wage of $94,500, according to the Bureau of Labor Statistics. Obviously, some families have two high earners in the household as well, which gets them there a whole lot faster.

The reality is that, according to plenty of research, white men are still earning more when compared to women and anyone (male or female) who isn’t white. Not only that, but an unexpected injury or disability might halt a high-paying career. Further, not everyone comes from a home with supportive parents who give them any sort of leg up.

Ask yourself: Could you retire early if something happened with your health or you were unable to work? If you’re worried about supporting yourself or a sudden hardship making it more difficult to achieve FIRE, then rethink this option. It might be a good idea to also look into disability insurance.

#3: Achieving FIRE on a Short Timeline Only Works in Good Times

Remember how I said the S&P 500 grew by 29% in 2019? That normally doesn’t happen. The reality is the FIRE movement was born during a decade of enormous growth and prosperity. It’s possible that has given many of its proponents a skewed idea of what long-term investing returns are like.

Ask yourself: It’s easier to reach FIRE during a bull market, but will you reach your retirement number if you average 5% or 6% returns? If not, then you’ll likely need to save significantly more to reach your early retirement goals.

#4: FIRE Enthusiasts Have to Give up a Lot, and It May Not Be Worth It

The FIRE movement has a cult-like element to it, and it’s one that is very off-putting if you don’t want to tow the line. FIRE enthusiasts frown upon spending money on anything that isn’t entirely necessary, whether that’s dining out on weekends or buying a new car.

A lot of them live on a small percentage of their incomes, sacrificing vacations and hobbies for years or even decades on end. Although the payoff might be worth it when you finally retire, we all know that nothing in life is guaranteed.

What happens if you give up everything to reach FIRE but you never get to enjoy it? Like it or not, people die young all the time. It seems like there should be a balance between enjoying life now and saving so you can enjoy life later, too.

Ask yourself: Do you want to give up most of life’s pleasures for an early retirement you may never see? There’s nothing wrong with sacrificing in the short term so you can live how you want later in life, but don’t forget to enjoy the little things along the way.

#5: Leaving a Good Job Is Significantly Riskier in a Down Economy

Finally, the FIRE movement makes the most sense in an economy where the unemployment rate is still at 3.5%. You could leave your job and try early retirement without putting everything on the line. If it didn’t work out, you could just get another J-O-B, right?

But the pandemic taught us that the good times don’t always last. Unemployment rates are going back down, but they were surging in March and April when COVID-19 had businesses shut down from coast to coast.

It might take years or decades to get unemployment back down to 3.5%, or it may never happen again. Either way, it’s not always easy to just get another job — especially right now.

Ask yourself: Can you really walk away from a profitable and stable career? If you’re worried about completely stepping away, it can make sense to work on skills that could lead to some type of part-time work during early retirement. Options could include 1099 work in your old field, consulting, or even one or two side hustles you can do in your spare time.

The Bottom Line

The FIRE movement might be less relevant in the midst of a pandemic, but there are plenty of good lessons to be found within its tenets. Spending less and living within your means is always smart, and you will reach your financial goals faster if you can save and invest the difference.

Just don’t get so caught up in it that you forget to enjoy your life. Experiences that cost money can make life worth living, and splurging for some creature comforts is not the end of the world.

Here’s my advice: Save like your future depends on it (because it does), but treat each day like it’s your last. Do something you enjoy, hug and love your family, and stop and smell the roses while you still can.