Social Security disability benefits can help you keep a roof over your head and food on the table when you become disabled due to an injury, an illness, or a severe medical condition.

That said, applying for these benefits can be a cumbersome process, mostly due to the various steps involved, the complicated paperwork required, and the potential for in-person hearings.

Also, be aware that you have to be “insured” to qualify for Social Security disability benefits for yourself or eligible family members.

According to the U.S. Social Security Administration, this means “that you worked long enough – and recently enough – and paid Social Security taxes on your earnings.”

We’ll walk you through each step of the process, and tell you what to expect during each stage of your Social Security disability application.

If you believe you might qualify for assistance through the Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) programs, read on to learn more about the process and the steps you’ll need to take.

Who Are Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) Programs Made For?

When you’re stuck navigating a disability or a chronic illness that prevents you from working a full-time job, planning for the future can seem pointless.

Not only that, but keeping up with bills and household expenses can truly be impossible when you are no longer able to bring in a guaranteed income.

The uncertainty of not knowing when you’ll be paid can make life increasingly difficult, which is why the Social Security and Supplemental Security Income disability programs exist in the first place.

According to a 2020 report from the Aspen Institute — The True Cost of Caregiving — the costs involved in taking care of adults and children with disabilities are often exorbitant and out of reach.

The report notes that disabled adults make up approximately 12% of the nation’s working-age population, yet account for more than 50% of those living in long-term poverty.

Adults living with a disability are three times more likely to have trouble keeping up with bills and twice as likely to skip important medical care as a result.

The financial impacts also apply to caregivers in the home, which could be parents, siblings, or other relatives.

The report notes that “family caregivers who work part-time or full-time jobs are more likely to take time off from work due to unreliable or limited affordable access to professional care, leading to foregone household earnings.”

Further, approximately 28% of family caregivers provide care to both an adult and a child, which makes it even more difficult to stay on top of bills and other household expenses.

According to the Social Security Administration, the Social Security and Supplemental Security Income disability programs provide the bulk of assistance to disabled people, which can help take the pressure off of their caregivers as well.

While each program works differently, they are both administered by the Social Security Administration and available only to those who meet specific medical criteria.

Social Security Disability or SSI: Which Medical Conditions Qualify?

The complexity of the application process, along with the hoops one must jump through to be approved, can make it difficult for those who need these benefits most to qualify for assistance through the Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) programs.

This often means those in the worst need of assistance are often stretched too thin to fight when their application is unjustly denied.

Before you apply for Social Security Disability or SSI, it makes sense to find out whether your condition is commonly considered disabling, and whether you have a shot at securing benefits for yourself and your family.

The Social Security Administration lists a number of illnesses and conditions that are applicable to individuals aged 18 and over and to children under the age of 18 when appropriate.

Having one of these conditions will usually lead to approval for SSDI/SSI benefits after one completes the application process — including all paperwork, medical exams, and hearings.

The following medical conditions are considered severe and a good basis for a disability application, according to the Social Security Administration. However, not everyone who suffers from one of these conditions will qualify.

Also, be aware that eligible conditions are updated on a regular basis. This means that some of the conditions on this list may no longer apply, and that new conditions can be added over time.

Listing of Impairments – Adult Listings

| CATEGORY | TYPE |

|---|---|

| Musculoskeletal | Degenerative Disc Disease Arthritis Carpal Tunnel Syndrome (CTS) Joint Pain Back Pain Neck Pain |

| Cardiovascular | Heart Failure Heart Disease Heart Arrhythmias |

| Congenital Disorders | Down’s Syndrome |

Digestive System | Gastrointestinal Hemorrhage Hepatic (Liver) Dysfunction Inflammatory Bowel Disease Short Bowel Syndrome Malnutrition |

| Endocrine Gland Disorders | Pituitary Gland Disorders Thyroid Gland Disorders Parathyroid Gland Disorders Adrenal Gland Disorders Diabetes Mellitus Other Pancreatic Gland Disorders |

| Genitourinary Disorders | Pituitary Gland Disorders Thyroid Gland Disorders Parathyroid Gland Disorders Adrenal Gland Disorders Diabetes Mellitus Other Pancreatic Gland Disorders |

| Hematological Disorders | Hemolytic Anemias Disorders of Thrombosis and Hemostasis Disorders of Bone Marrow Failure |

| Immune System | Inflammatory Arthritis Lupus |

| Mental Disorders | Schizophrenic, Delusional (Paranoid), Schizoaffective, and Other Psychotic Disorders Depression Post-traumatic Stress Disorder (PTSD) Bipolar Disorder Personality Disorder Anxiety Disorder |

| Neurological | Seizure Disorders Epilepsy Multiple Sclerosis Autism Spectrum Disorder |

| Respiratory System | Chronic Obstructive Pulmonary Disease (COPD) Asthma |

| Skin Disorders | Ichthyosis Bullous Diseases Chronic Infections of the Skin or Mucous Membranes Dermatitis Hidradenitis Suppurativa Genetic Photosensitivity Disorders Burns |

| Special Senses and Speech | Visual Disorders Statutory Blindness Hearing Loss Vertigo Ménière’s Disease |

If you’re thinking of applying for Social Security disability benefits, having any one of these conditions can help your case.

However, the complex nature of each of these conditions makes it possible for someone to be denied SSDI/SSI based on individual factors or incomplete analysis.

The way your condition could affect your work may also play a role in whether or not you qualify for benefits, as will the viewpoint of your assigned judge or case reviewer.

In order to qualify for Social Security disability benefits or SSI, you’ll need a full evaluation from a medical professional or existing medical records that prove your condition.

You’ll also need to have worked in a job or career that provides Social Security disability benefits.

Most of the time, Social Security disability benefits will continue until you’re able to return to work on a regular basis. Certain programs also offer transition programs that extend benefits as you ease back into the workplace.

For children under the age of 18, the Social Security Administration has another listing of illnesses and conditions used to help determine disability benefits. As with adults, having one of these conditions will usually lead to approval for SSDI/SSI benefits.

Children under age 18 will usually be considered disabled if he or she “has a medically determinable physical or mental impairment or combination of impairments that causes marked and severe functional limitations, and that can be expected to cause death or that has lasted or can be expected to last for a continuous period of not less than 12 months,” as stated by the SSA website.

The following medical conditions are considered severe and can be evaluated to determine SSDI/SSI benefits.

Listing of Impairments – Childhood Listings

| CATEGORY | TYPE |

|---|---|

| Growth Impairment | Low Birth Weight Failure to Thrive |

| Musculoskeletal | Major Dysfunction of a Joint(s) (Due to Any Cause) Reconstructive Surgery or Surgical Arthrodesis of a Major Weight-Bearing Joint Disorders of the Spine Amputation (Due to Any Cause) Fracture of the Femur, Tibia, Pelvis, or One or More of the Tarsal Bones Fracture of an Upper Extremity Soft Tissue Injury (e.g., Burns) |

| Special Sense and Speech | Loss of Visual Acuity Contraction of the Visual Field in the Better Eye Loss of Visual Efficiency Hearing Loss Not Treated With Cochlear Implantation Hearing Loss Treated With Cochlear Implantation |

| Respiratory System | Chronic Pulmonary Insufficiency Asthma Cystic Fibrosis Lung Transplant Growth Failure Due to Any Respiratory Disorder |

| Cardiovascular System | Chronic Heart Failure Recurrent Arrhythmias Congenital Heart Disease Heart Transplant Rheumatic Heart Disease |

| Digestive System | Gastrointestinal Hemorrhaging Chronic Liver Disease Inflammatory Bowel Disease (IBD) Short Bowel Syndrome (SBS) Growth Failure Liver Transplantation Need for Supplemental Daily Enteral Feeding |

| Genitourinary Disorders | Chronic Kidney Disease, With Chronic Hemodialysis or Peritoneal Dialysis Chronic Kidney Disease, With Kidney Transplant Chronic Kidney Disease, With Impairment of Kidney Function Nephrotic Syndrome Congenital Genitourinary Disorder Growth Failure Due to Any Chronic Renal Disease Congenital Complications of Chronic Kidney Disease |

| Hematological Disorders | Hemolytic Anemias Disorders of Thrombosis and Hemostasis Disorders of Bone Marrow Failure Hematological Disorders |

| Skin Disorders | Ichthyosis Bullous Disease Chronic Infections of the Skin or Mucous Membranes Dermatitis Hidradenitis Suppurativa Genetic Photosensitivity Disorders Burns |

| Endocrine Disorders | Any Type of Diabetes Mellitus in a Child Who Requires Daily Insulin |

| Congenital Disorders | Non-mosaic Down Syndrome A Catastrophic Congenital Disorder |

| Neurological | Major Motor Seizure Disorder Nonconvulsive Epilepsy Brain Tumors Motor Dysfunction Cerebral Palsy Meningomyelocele Autism Spectrum Disorder and Other Pervasive Developmental Disorders Communication Impairment |

| Mental Disorders | Schizophrenic, Delusional (Paranoid), Schizoaffective, and Other Psychotic Disorders Mood Disorders Intellectual Disability Anxiety Disorders Somatoform, Eating, and Tic Disorders Personality Disorders Psychoactive Substance Dependence Disorders Attention Deficit Hyperactivity Disorder Developmental and Emotional Disorders |

| Cancer (Malignant Neoplastic Diseases) | Malignant Solid Tumors Lymphomaleukemia Thyroid Gland Retinoblastoma Nervous System Neuroblastoma Malignant Melanoma |

| Immune System Disorders | Systemic Lupus Erythematosus Systemic Vasculitis Systemic Sclerosis (Scleroderma) Polymyositis or Dermatomyositis Undifferentiated and Mixed Connective Tissue Disease Immune Deficiency Disorders Human Immunodeficiency Virus (HIV) Infection Inflammatory Arthritis Sjögren’s Syndrome |

Social Security Disability Benefits: The Application Process

The application process for Social Security disability benefits can take anywhere from a few months to several years to complete.

This is partly because of the many steps involved, but also because of the many layers of government bureaucracy involved in the final decision.

There are several different steps involved in applying for Social Security disability, although you may not have to complete all of them to qualify. The following outline explains each step of the process, along with what to expect along the way.

- Initial Application: This step involves filling out the initial paperwork for your Social Security disability claim, along with submitting required documentation such as medical records, X-rays, or letters of recommendation.

In many cases, this paperwork will be requested directly from your medical provider by the DDS. - Reconsideration: The reconsideration process begins after your initial application for SSI is denied. At this stage, your case will be seen by a different SSI reviewer for analysis.

- Administrative Hearing: If you’re denied at reconsideration, you have the right to appeal for an administrative hearing. At this point, your case will be reviewed by a judge who will grant a final decision.

- Appeals Council: If your case is denied at an administrative hearing, you have 60 days to appeal to an appeals council. The appeals council will decide where your case goes from here, or if it is denied altogether.

If you’re applying for Social Security benefits on your own, each of these steps can seem overwhelming. The process becomes easier to digest if you’re able to break down each step and consider its implications on its own.

Step 1: Initial Application

Filing an initial application for any of these benefits can feel like a full-time job. You’ll need to accurately describe your condition on detailed government forms, submit doctor’s records, and complete a variety of questionnaires that will help the Social Security Administration build a case for or against, your eligibility.

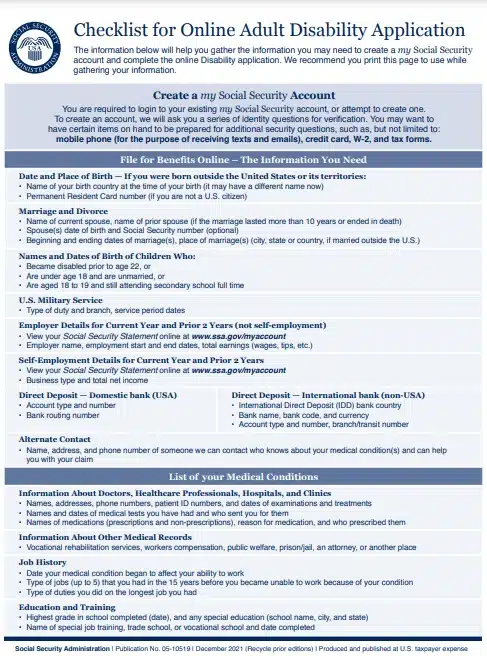

Fortunately, the U.S. Social Security Administration offers its own Adult Disability Checklist that can help you gather the necessary information to apply.

While many attorneys that represent SSDI/SSI cases offer to help once you’re denied, you may actually be better off getting an SSDI/SSI lawyer or attorney as you submit your initial application.

An honest attorney’s guidance may prove helpful as you navigate the complex world of requirements, and at the very least, they can help you fill out forms, gather evidence, and submit your first round of paperwork.

If you complete the initial application for SSDI/SSI on your own, you’ll need to make sure you provide every detail and form they ask for and in an efficient and timely manner.

Failing to submit all required forms for your application could result in a delay or denial of your case.

Step 2: Reconsideration

Reconsideration is only a factor if your initial application for SSI benefits is denied. Once you receive a denial, you have 60 days to appeal by asking for a reconsideration of your case.

At this point, your claim is sent to a different reviewer, where it will be analyzed again.

According to the Social Security Administration, only 22% of applicants received approval for their Social Security benefits after their initial application at the last count.

That leaves the other 78% to accept their denial or apply for reconsideration. The percentage of applicants who were approved after reconsideration varied from 2% to 9% from 2008 to 2017.

Many people hire a lawyer or attorney to assist them at this stage of their claim. It’s important to note, however, that some states allow you to skip the reconsideration stage and proceed directly to the next step of the process, the administrative hearing.

States that don’t have a reconsideration stage include Alaska, Alabama, Colorado, Louisiana, Michigan, Missouri, New Hampshire, New York, Pennsylvania, and some regions of California.

Step 3: Administrative Hearing

If your reconsideration is unsuccessful, or if you live in a state where reconsideration isn’t offered, you’ll need to move to the next step of the process: the administrative hearing.

During this stage of your SSI application, you’ll have 60 days to appeal the last decision made in your case.

At this stage, your claim is assigned to an administrative law judge who will analyze your case independently and rule on your eligibility. Most of the time, these cases will be held within 75 miles of your home so you can attend in person.

Having an SSI attorney on your side could prove helpful at this stage of the process, although many SSI applicants choose to represent themselves.

To prepare, you should gather any additional information for your case that has come to light since you filed your initial application for Social Security disability benefits.

This information should include any new doctors you have seen, new hospitals visited, or medical treatments or tests that have been administered.

You’ll also want a list of current medications you’re taking, along with any changes in your medical history that have taken place.

Other supporting documents, such as forms, medical reports, and written statements, should be gathered before your administrative hearing date arrives.

During your administrative hearing, you’ll have the opportunity to state your case to the judge, who will make the final decision.

Since many more claims find success and approval at this stage compared to reconsideration, the administrative hearing is considered a crucial component of your application for Social Security disability benefits.

At this point, you’ll need to have a full understanding of your medical condition or disability and be able to articulate how it prevents you from working and supporting yourself.

Still, the Social Security Administration reports that approximately 64% of disability claims are ultimately denied.

Step 4: Appeals Council

If you’re among the majority of applicants who are ultimately denied Social Security disability benefits thus far, you’ll have another 60 days to file an appeal with the Appeals Council.

At this stage, an appeals council will review your administrative hearing to determine if the judge assigned to your case followed the Social Security Administration’s rules and regulations in order to reach his or her conclusion.

One of three different outcomes can be expected once your case is in the hands of an appeal council. First, the decision may be reversed, granting you the Social Security disability benefits you applied for.

Second, your case may be sent back to the judge who analyzed your case during your administrative hearing. Or third, the denial for your case will stand.

If you choose, you have the right to appeal your case all the way up to the Federal Court.

The Bottom Line on Social Security Benefits

Applying for Social Security benefits can seem daunting if you’re unfamiliar with the process.

The complex web of paperwork, required medical visits, and the appeals process can make a living with a disability or chronic condition infinitely harder at a time when you’re least able to cope.

The best thing you can do to ensure your case goes smoothly is to stay as organized as you can.

Keep careful records of your medical condition and continue seeing a doctor regularly so the Social Security Administration will have an ongoing record of your requests for care.

Once you begin your application for Social Security disability benefits, complete each form and step of the process completely and accurately. If needed, you can also hire an attorney who specializes in SSDI/SSI claims to assist with your case.