Selecting the right legal representation can significantly impact the outcome of your legal matters. Understanding what constitutes a qualified lawyer and the importance of choosing apt legal representation are the first steps in a journey that requires diligence and informed decision-making.

Table of Contents

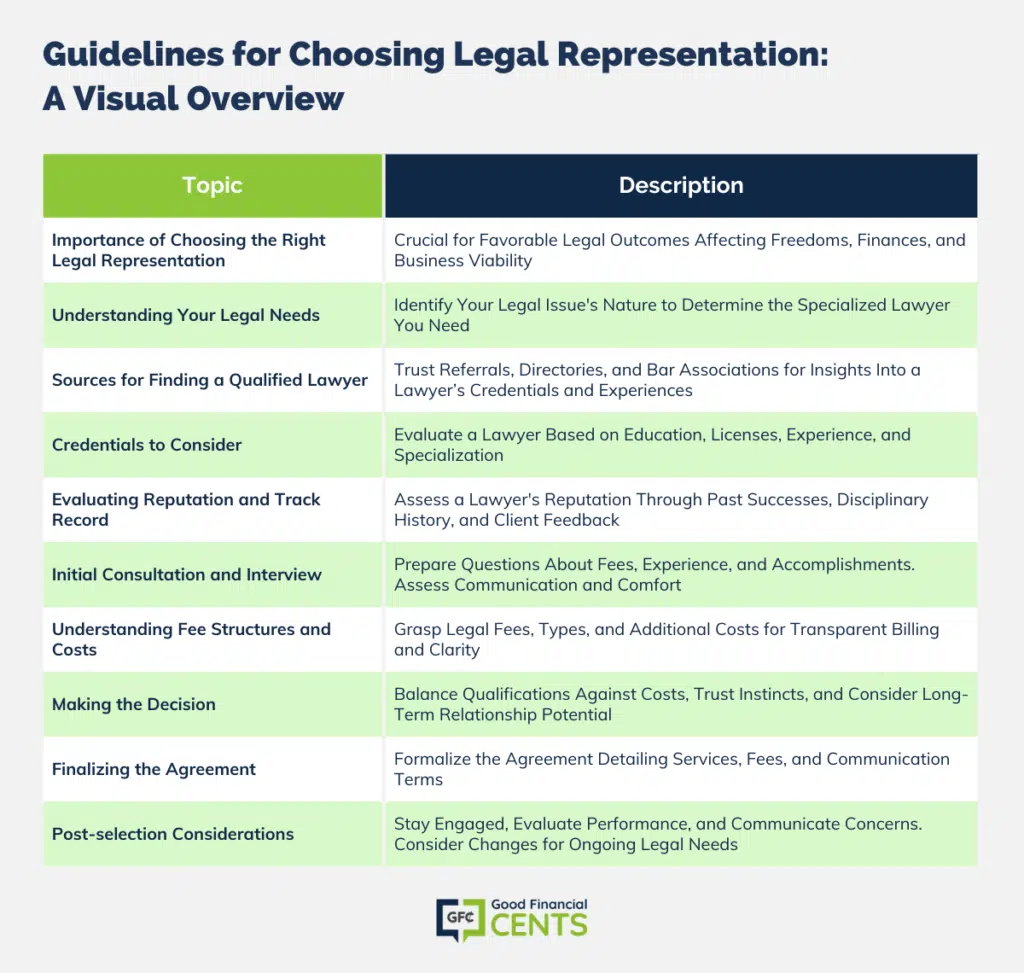

- Importance of Choosing the Right Legal Representation

- Understanding Your Legal Needs

- Sources for Finding a Qualified Lawyer

- Credentials to Consider

- Evaluating Reputation and Track Record

- Initial Consultation and Interview

- Understanding Fee Structures and Costs

- Making the Decision

- Finalizing the Agreement

- Post-selection Considerations

- Bottom Line: Selecting the Right Lawyer

Importance of Choosing the Right Legal Representation

The stakes in legal disputes or issues can be incredibly high, with outcomes affecting personal freedoms, financial health, or business viability. Having the right lawyer can mean the difference between a favorable outcome and an undesirable one. Therefore, it is paramount to make a selection based on thorough research and clear understanding.

Understanding Your Legal Needs

Different Types of Legal Issues

The legal landscape is vast, with practitioners specializing in fields as varied as family law, criminal defense, corporate law, and intellectual property, to name a few. Understanding the nature of your legal issue is the first step in determining the type of lawyer you need—one who specializes in and has a proven track record in the relevant area of law.

Identifying Specific Requirements for Your Case

Every legal case is unique, with its specific demands and nuances. It is crucial to articulate what you need in a lawyer, whether it’s courtroom experience, negotiation skills, or expertise in a particular legal matter. Clearly defining these requirements will streamline the process of finding the right lawyer for your case.

Sources for Finding a Qualified Lawyer

Referrals from Family, Friends, and Professionals

Word-of-mouth referrals are invaluable. Trusted family members, friends, or professionals like accountants or existing lawyers in other specialties can provide personal insights and experiences with lawyers, which can be a starting point in your search.

Legal Directories and Bar Associations

Legal directories and local or state bar associations can offer lists of lawyers by practice area. These resources also provide information on a lawyer’s standing with the bar, helping you verify their credentials and licensure.

Credentials to Consider

- Educational Background: A lawyer’s educational background can provide insight into their foundational legal knowledge. While prestigious law schools may be impressive, the school’s reputation alone shouldn’t be the deciding factor. Consider the lawyer’s continuous education and contributions to their field.

- Licenses to Practice: It is essential to ensure that the lawyer you are considering is licensed to practice in the jurisdiction where your case is or will be underway. This information is typically verifiable through state bar association websites.

- Professional Experience and Specialization: The number of years a lawyer has been practicing and their specialization areas can speak volumes about their proficiency. Lawyers who specialize may have a deeper understanding of the legal issues you’re facing and more nuanced insight into the laws that pertain to your case.

Evaluating Reputation and Track Record

Past Case Successes

Inquire about the lawyer’s past case successes that are similar to yours. While past performance is not a guarantee of future results, a history of favorable outcomes in cases like yours can be a good indicator of competence and expertise.

Disciplinary History

Checking for any disciplinary history is a non-negotiable step. Disciplinary actions can raise red flags about a lawyer’s ethical standards and professional conduct. This information is often accessible through state bar associations.

Client Feedback and Lawyer Ratings

Client testimonials and independent lawyer ratings can provide an external perspective on a lawyer’s performance and client satisfaction. While individual experiences can vary, patterns of positive or negative feedback can be telling.

Initial Consultation and Interview

Preparing a List of Questions

Before meeting with a potential lawyer, prepare a list of questions that cover everything from their experience with your type of case to their communication style. This will help you gather the information you need to make an informed decision.

Some questions regarding basic fees could include:

- What is the cost of the initial consultation?

- What is the basic list of fees?

- Will they provide a written list of fees?

- How many people will be working on your case/services, and what are their fees?

Some questions to ask about each lawyer might include:

- Can you see their resume?

- Have they achieved any accomplishments or received awards?

- How many years of experience do they have?

- What is their particular area of expertise?

Assessing Communication and Comfort Level

The initial consultation is not only for the lawyer to learn about your case but also for you to gauge how well you communicate with each other. A good lawyer should be able to explain complex legal issues in understandable terms and make you feel comfortable discussing personal matters.

Discussing Availability and Caseload

A lawyer’s availability can significantly affect your case. Ensure that they have the time to dedicate to your case and that their caseload does not impede their ability to provide you with the necessary attention.

Understanding Fee Structures and Costs

Types of Legal Fees

Understanding the fee structure is critical to avoid surprises later on. Lawyers typically charge by the hour, a flat fee, or on a contingency basis. Discuss the best option for your situation and ensure you understand how these fees work.

Additional Costs

Be aware that additional costs may occur beyond legal fees, including filing fees and administrative costs. Ensure that your lawyer provides a detailed explanation of these potential expenses upfront.

Transparency and Billing Practices

Transparency in billing practices is a sign of a trustworthy lawyer. They should provide a clear billing statement that outlines the services provided and the charges incurred. Regular billing and detailed invoices can also help track costs throughout your legal matter.

Making the Decision

Weighing Qualifications vs. Costs

Ultimately, you will have to balance a lawyer’s qualifications against their cost. It is essential to weigh what you can realistically afford against the level of expertise and service you require.

Trusting Your Instincts

Never underestimate the power of your instincts when meeting with potential lawyers. If something feels off, or if the communication doesn’t feel right, consider looking for another lawyer. You must trust the person who will represent you and your interests.

Considering Long-Term Relationship Potential

When selecting a lawyer, consider the potential for a long-term relationship, especially if you have ongoing legal needs. A lawyer who understands your history and legal background can be more effective in representing you over time.

Finalizing the Agreement

Engagement Letter or Contract

Once you’ve chosen a lawyer, an engagement letter or contract will formalize the agreement. This document should detail the scope of services, fee structure, and the terms of the engagement.

Outline of Services to be Provided

The agreement should clearly outline what services the lawyer will provide. This clarity ensures that both parties have the same expectations and understand the extent of the representation.

Clarity on Communication and Updates

Establish how often you will receive updates on your case and through what means of communication. Regular updates can keep you informed and provide peace of mind throughout the legal process.

Post-selection Considerations

Monitoring Case Progress

Even after you’ve chosen a lawyer, it’s important to stay engaged and monitor the progress of your case. Regular check-ins can help ensure that things are moving forward as planned.

Providing Input and Gathering Updates

Your input is valuable, and a good lawyer will appreciate your involvement. Gather updates periodically to stay informed and contribute where appropriate.

Evaluating Lawyer Performance and Making Changes if Necessary

If you are unsatisfied with your lawyer’s performance, it is within your rights to consider making changes. Ensure that any concerns are communicated to your lawyer first, as issues may be resolved through direct communication.

Bottom Line: Selecting the Right Lawyer

Choosing the right legal partner is a critical process that can significantly influence the outcome of your legal matters. From understanding your legal needs to evaluating lawyer performance, every step requires careful consideration and informed decision-making.

The impact of having the right legal partner cannot be overstated. A qualified lawyer will guide you through the complexities of the legal system and advocate for your best interests.

Being proactive and informed in your decision-making will serve you well in selecting a qualified lawyer. Take the time to thoroughly vet potential candidates, understand fee structures, and evaluate compatibility. Your legal journey depends on the strength of your legal representation, so choose wisely.

my ex-wife is dead and I owe back pay in child support. Her parents are now the guardians of my 2 kids and their lawyer is saying he they are gonna file for me to pay back pay in child support. can they do that and do I half to pay them back pay in child support?

Hi Chris – It will all depend on what the court says, but it’s very possible, since your children are the ultimate beneficiaries.

Choosing the right lawyer is critical because you want to make sure that they have your best interest when making a judgement or decision

This is a really good subject to address because it is VERY hard to find great attorneys. I’ve hired many in my career, roughly ten for various purposes, and then worked with hundreds in my former law enforcement career.

Of all of those, only a few were outstanding and I refer everyone I can to them. The others were terrible and caused more stress then help. On a few occasions I’ve fired attorneys and done a better job using Nolo products (which is not something I’d recommend).

Here are some additional suggestions to the already great one provided.

1. When you find a good one that you can trust, treat them like gold, and refer everyone you can to them. When you form a great relationship where private un-billed cell phone calls on the weekends are welcomed, you’ve succeeded, and don’t be shy about rewarding those few with referrals.

2. Most important. Do NOT get involved with an attorney that bills by the hour until you’ve established a trusting relationship like what I described above. Most, not all, do everything they can to rack up the billable hours, and little to quickly solve your problem.

3. Ask this very difficult question. “What motive do you have as an attorney to quickly and efficiently solve my problem?” Most can’t answer that question very well if their billing structure is to maximize billable hours.

You and the attorney have competing goals. If you’ve hired a lawyer, often you want it to be as quick and painless as possible, whereas their goal is often to make it as long and painful as possible, to increase fees. When you get a good answer to that question, you’ve got a winner.