As a financial planner, I get a lot of concerned questions from my clients regarding their investments.

One recently asked me:

What exactly happens if the brokerage firm I’m custodied with goes out of business?

This is a great question because many people don’t know their investments have protection in the first place, or they’re misinformed about what the protection actually covers.

Keep reading and I’ll help you understand what coverage your investments get from the SIPC, or Securities Investor Protection Corporation. You’ll find out exactly what the SIPC does (and does not do) for investors.

What is the Securities Investor Protection Corporation (SIPC)?

Table of Contents

- What is the Securities Investor Protection Corporation (SIPC)?

- The SIPC Is Not Like the FDIC

- Who Offers SIPC Protection?

- What The SIPC Doesn’t Cover

- How to File an SIPC Claim

- How SIPC Claims Are Paid

- Steps to File a Claim with SIPC

- Excess of SIPC Coverage

- How to Stay Safe from Investment Fraud

- Final Thoughts on What Is the SIPC and How Does It Protect Your Investments

The SIPC is a nonprofit corporation created by Congress in 1970. Their job is to return securities—like stocks and bonds, as well as cash—up to a certain amount to investors when their brokerage firm closes and owes them money.

As of March 2023, the SIPC says they’ve helped an estimated 773,000 investors recover over $141.8 billion in lost assets.

Not all investments are eligible for SIPC protection. These include investments like commodity futures and fixed annuity contracts that are not registered with the Securities and Exchange Commission (SEC).

The SIPC Is Not Like the FDIC

The SIPC is often compared to the FDIC (Federal Deposit Insurance Corporation) bank insurance—but they’re not related in any way.

The SIPC helps investors when their money is stolen or put at risk if their brokerage goes out of business—but they don’t insure invested funds. In other words, the SIPC doesn’t bail investors out of bad investments.

Unlike FDIC, which is a government agency, SIPC is funded by member firms.

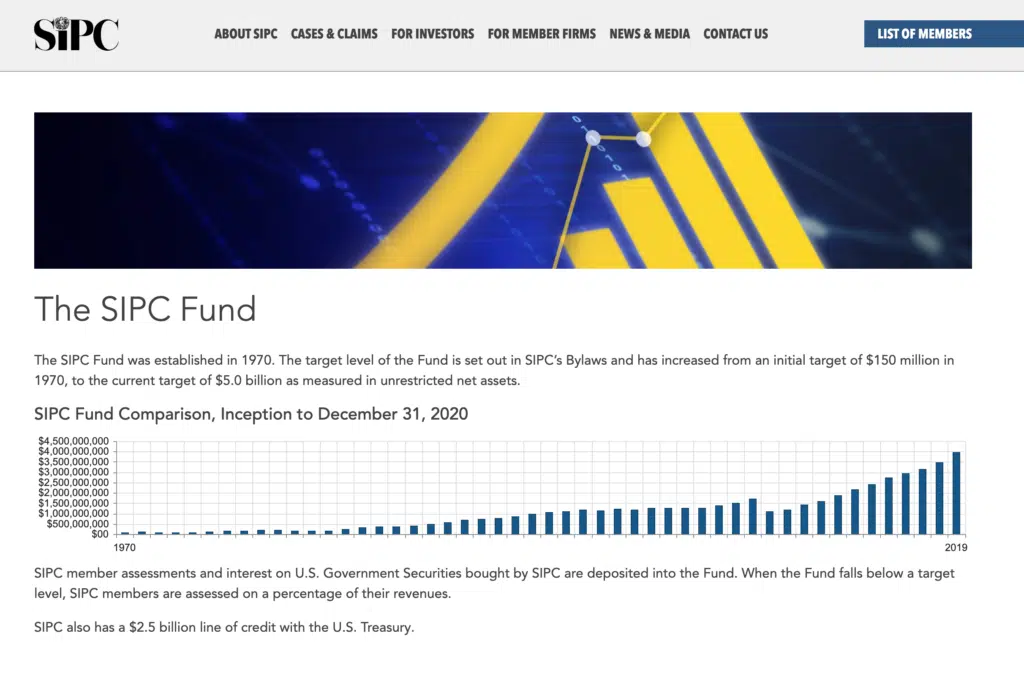

And currently, SIPC has only $3.9 billion in assets vs. $128.2 billion for FDIC (as of March 2023). Seems like this wouldn’t go very far if the holdings of a couple of big brokerages just up and disappeared.

But SIPC’s doesn’t have to be this big.

Broker/Dealers function differently from banks. Banks are in the business of investing your deposits – lending out your savings to other customers, who might renege on those loans. Brokerages only have to hold your securities, nothing else.

Even with the Lehman Brothers incident, for example, the SIPC already issued a statement saying all the assets under the brokerage umbrella would be taken care of. It never hurts to double-check to make sure your firm is covered under SIPC.

Who Offers SIPC Protection?

The SIPC is funded by member brokers and you’ve probably seen the SIPC logo on brokerage websites and literature. To find out if your brokerage firm is an SIPC member visit sipc.org and search the member database.

Or you can call the SIPC Membership Department at (202) 372-8300.

What The SIPC Doesn’t Cover

The SIPC will not cover every loss. It does have restrictions. Those include:

- SIPC limits coverage to SEC-registered securities. So foreign currency, precious metals, and commodity futures contracts aren’t protected.

- Bad timing. SIPC will replace your shares, not dollar values. So if you own 500 shares of General Electric worth $15,000 and your brokerage firm fails, SIPC will replace your 500 shares, but only at the current value.

- Some outstanding margin loans. If your broker fails while you have a margin loan outstanding, SIPC will try to transfer the debt and collateral to another broker. But if no other firm takes on the loan, you’ll be on the hook to pay it off to your broker or ultimately to its creditors

Keep this in mind, as you’ll want to act as quickly as possible should something happen to you.

How to File an SIPC Claim

So, what happens if your money disappears from an SIPC member broker?

You’ll typically receive an SIPC claim form from the court-appointed trustee who’s in charge of liquidating the firm’s assets. By the way, there are strict time limits for filing claims, so be sure to adhere to any deadlines you receive.

If your broker is in trouble it’s possible your account could be transferred to another brokerage firm before you even know there’s a problem.

In the event of a transfer, it’s still recommended you file an SIPC claim form. This can protect your rights in the event of reporting errors that could occur during the transfer of your money.

How SIPC Claims Are Paid

The goal of the SIPC is to replace the actual securities you lost. Since they have to purchase those securities in the open market, your investments may have increased or decreased in value by the time the SIPC returns them to you.

If there isn’t enough money in liquidated customer brokerage accounts to satisfy all claims, the SIPC has a huge reserve fund that kicks in to make up the difference.

SIPC Maximum Coverage:

The maximum amount that the SIPC will pay out of reserve per customer is $500,000. This includes a $250,000 maximum for cash claims.

Once a claim is received, most customers can expect to get their funds back within one to three months. If fraud is involved and the firm’s financial records are deemed to be inaccurate, it may take longer to sort out the bad books.

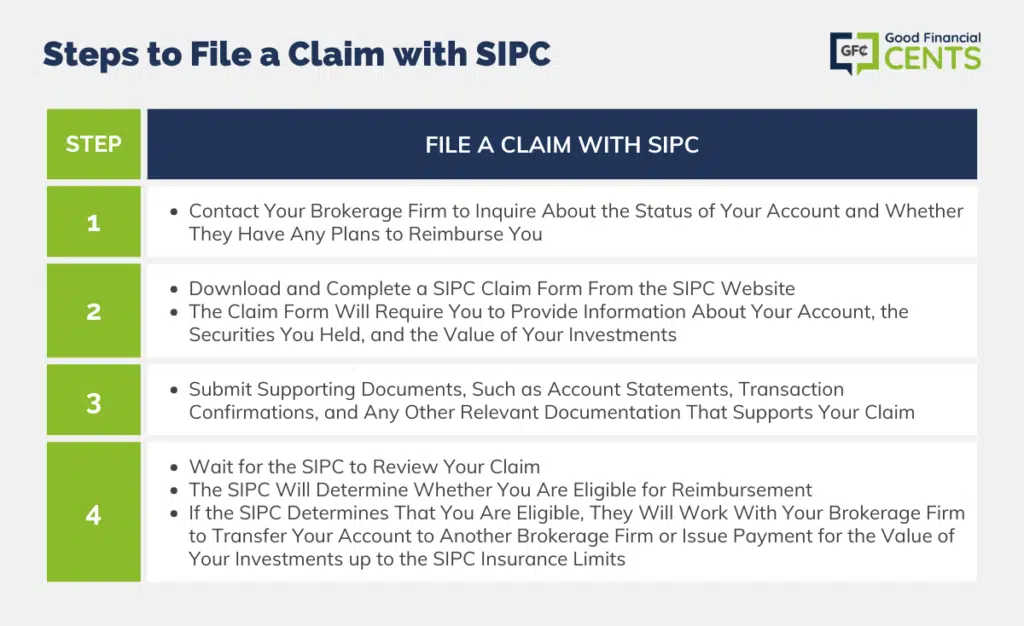

Steps to File a Claim with SIPC

If your brokerage firm fails and you believe you are entitled to compensation, you can file a claim with the SIPC.

Here are the steps to file a claim with the SIPC:

Excess of SIPC Coverage

There are some strict limits on how much coverage SIPC provides. Because the SIPC coverage is capped at $500,000, a lot of the larger brokerage firms have “excess of SIPC” insurance.

These insurance plans will pay for any client losses above what they would receive in a liquidation proceeding, which includes the payments from SIPC.

These insurance plans only pay out when the distributions from a brokerage firm’s liquidation are not high enough to pay for a client’s claim.

Claims for Excess of SIPC insurance claims are EXTREMELY rare. In fact, there are only been 2 times when the excess of SIPC insurance policies has been invoked.

How to Stay Safe from Investment Fraud

It’s good to know that the SIPC has returned investments to 99% of the investors eligible for its protection.

But, of course, I’d prefer you never get into a situation where you need SIPC protection! Here are several resources where you can learn how to stay safe from shady brokers and investment fraud:

- Securities and Exchange Commission – sec.gov and investor.gov

- FINRA (Financial Industry Regulatory Authority) – finra.org

- National Fraud Information Center – fraud.org

- Investor Protection Trust – investorprotection.org

- Securities Industry and Financial Markets Association – sifma.org

Final Thoughts on What Is the SIPC and How Does It Protect Your Investments

The SIPC offers crucial investment protection, returning securities and cash to investors when their brokerage faces closure. While not an FDIC equivalent, it covers losses due to firm insolvency. Funding comes from member brokers, aiding over 773,000 investors in recovering $141.8 billion.

Eligibility hinges on SEC-registered securities; commodities and metals aren’t covered. Claims require quick action and must replace shares, not dollar values. A strict $500,000 maximum applies per customer, supported by a reserve fund.

Larger firms often possess “excess of SIPC” insurance to cover losses beyond SIPC limits. Remember, awareness of fraud prevention measures remains essential.