Table of Contents

- About Public

- Is Public Legit?

- How Do You Make Money With Public?

- Public Account Types

- How Public Works

- How Does Public Make Money if They Don’t Charge Fees?

- Public Features

- How to Sign Up for a Public Account

- Is Public Safe to Use for Beginners?

- Why You Should Open an Account With Public

- Final Thoughts – Public Review – The Perfect Broker for New Investors?

About Public

Is Public Legit?

How Do You Make Money With Public?

Public Account Types

Public Premium

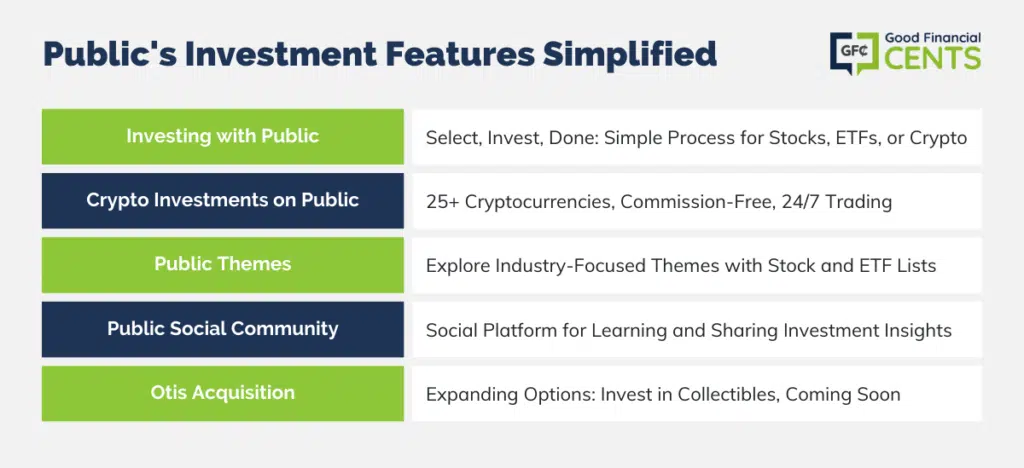

How Public Works

Cryptocurrency

Public Themes

The Public Social Community

Otis

How Does Public Make Money if They Don’t Charge Fees?

Public Features

Tax Reporting and Exporting

Account Protection

Public Promotions

How to Sign Up for a Public Account

Funding:

Is Public Safe to Use for Beginners?

Why You Should Open an Account With Public

But at this point in the game, Public is designed for new and intermediate investors. And for that group, Public is an excellent choice.

Final Thoughts – Public Review – The Perfect Broker for New Investors?

Public stands out as an enticing option for budding investors, offering commission-free trades, no initial investment requirement, and a broad spectrum of investment options, including over 25 cryptocurrencies.

Additionally, the platform’s social community fosters an environment of learning and idea exchange, greatly benefiting novices and intermediate investors.

The recent inclusion of alternative assets, such as rare collectibles and art, adds another layer of diversity to investment choices.

However, it’s essential to note its limitations, including a lack of services like mutual funds, options, and margin trading. For those new to investing, Public presents a commendable starting point.

How We Review Brokers and Investment Companies:

Good Financial Cents conducts a thorough review of U.S. brokers, focusing on assets under management and notable industry trends.

Our primary objective is to offer a balanced and informative assessment, assisting individuals in making informed decisions about their investment choices. We believe in maintaining a transparent editorial process.

To achieve this, we gather data from providers through detailed questionnaires and take the time to observe provider demonstrations.

This hands-on approach, combined with our independent research, forms the basis of our evaluation process. After considering various factors, we assign a star rating, ranging from one to five, to each broker.

For a deeper understanding of the criteria we use to rate brokers and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Public.com Investing App Review

Product Name: Public.com

Product Description: Public.com is a social investing platform that allows users to invest in stocks and ETFs commission-free, as well as follow investment strategies of other notable investors. The platform also provides financial education, community engagement, and a rewards program for users to earn points for completing certain activities or referring new members.

Summary of Public.com Investing App

Public.com offers a social investing platform that allows users to discover and invest in companies, ETFs, IPOs, and cryptocurrencies with fractional shares. It also provides users with personalized news feeds and real-time stock ticker updates to help them stay informed about the markets. The platform also offers community forums to connect with other investors and ask questions or share insights.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

Cons