When the markets are in turmoil and inflation is increasing, investors become very concerned about their money. Interest rates are creeping up but the national average on savings accounts is still around 0.5%.

Where is an investor supposed to park their money and make a decent return without a ton of risk? One surprising answer is the U.S. government. Let me explain.

Through TreasuryDirect.gov investors can purchase I bonds. Series I bonds are currently yielding 7.12% and they’re low risk. But that rate is set to increase on July 1st to 9.62%. It doesn’t get much better than that at this point, especially when you look at how little high yield savings accounts and CDs are offering right now. No wonder I bonds have gotten a lot sexier lately.

The “I” in I bonds stands for “inflation-linked”. Series I bonds are government savings bonds whose return increases with inflation made exactly for these times as an additional bonus.

They’re easy to purchase and you can even buy one by the time you get done reading this article.

By the end of this article on Series I Bonds you’ll:

- You’ll know whether a Series I Bond might be right for you

- How to buy a Series I Bond (step by step)

- Some important restrictions or catches of buying an I Bond

Table of Contents

Should You Buy I Bonds For Your Portfolio?

These two questions will help you figure out if an I bond might be right for you:

- Do you have extra cash above and beyond what you need in your emergency fund?

- Is it possible that you might still need this extra cash say next year, in two years, or perhaps even five years?

For example, if you’re saving up for a house, a wedding, or a teen that’ll be going to college soon, or maybe your retirement in the near future then YES, a Series I Bond is something you should consider to inflation-proof your extra cash at the moment. You can also consider I Bonds if you’re looking for better banking alternatives in 2022.

How Safe Are Series I Bonds?

As I mentioned earlier, I Bonds are U.S. government savings bonds that help protect you during inflationary times on the most basic level. Think of it as a loan that you give to the US government alone, whose interest rate is adjusted upward or downward based on where inflation is because I Bonds are backed by the US government. They are low-risk, safe investments that pay a high return.

What About Default Risk?

With Series I Bonds, investors may be concerned about “credit risk”. The U.S. government will not default on your I Bond or refuse to pay back your money when you redeem it a year later, this safety has, however, historically come at a price.

Typically in times of low inflation, I Bonds will pay lower returns compared to other types of bonds such as municipal bonds or high-yield bonds.

It wasn’t until recently that the yield on Series I Bonds caught the interest of investors paying a salty 7.12%. But when the Fed increased interest rates the CPI also adjusted so now I Bonds will be paying 9.62%.

Non-Marketable Securities

Series I Bonds have a 30-year term and can only be purchased directly from the US Treasury. This means they’re non-marketable (not available in the secondary market).

You can’t purchase these at your local brokerage firm or in your retirement account. They are also not available on your favorite online broker or even investment apps.

So no Fidelity, Vanguard, Betterment, M1 Finance, or Robinhood.

Now some folks will say that this is a disadvantage and it is an extra step, but this extra step takes literally five minutes. But five minutes to make a 9.62% return is totally worth it!

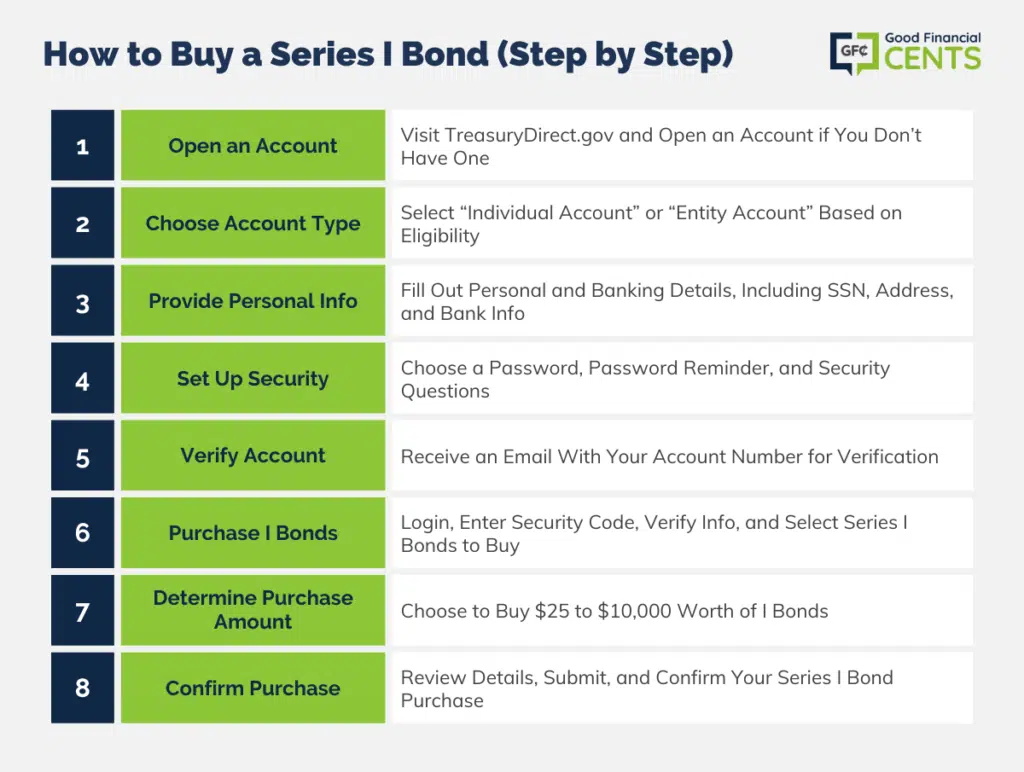

How to Buy a Series I Bond (Step by Step)

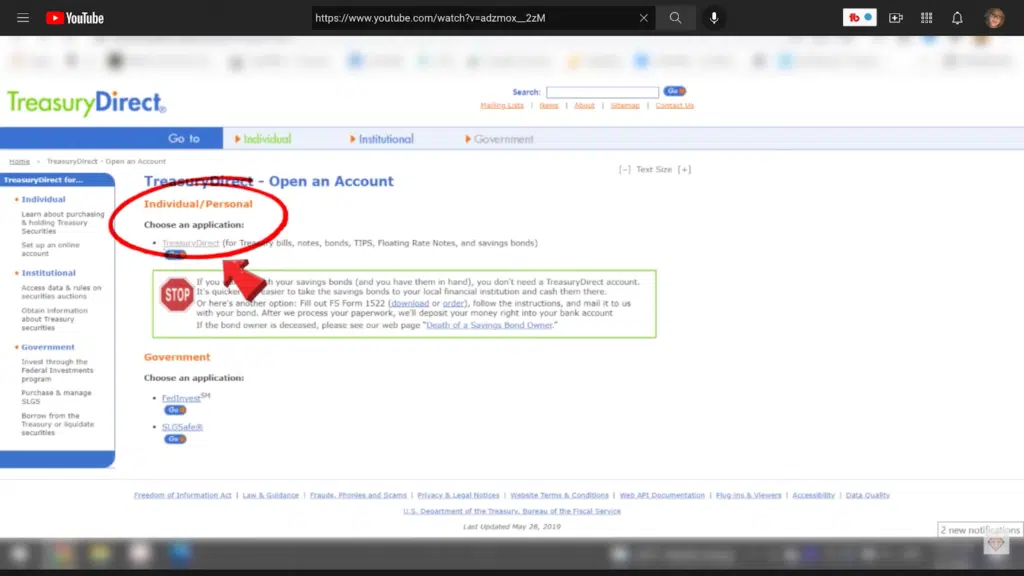

What you need to do first is to go to the US Treasury website, TreasuryDirect.gov, and open an account, assuming you don’t have one already.

Then click on “TreasuryDirect” under the Individual/Personal tab.

What’s going to pop up next is this page showing you the three-step process for setting up an account.

Step 1: Choose the Type of Account

There are several different types of accounts you can open to purchase Series I Bonds. Most investors will select the “Individual Account” option. In addition to that option, you can also select “Entity Account” if you meet those requirements.

Types of Entity Accounts for Business or Organization:

- Corporation

- Partnership

- Limited Liability Company (LLC)

- Professional Limited Liability Company (PLLC)

- Sole Proprietorship

Types of Entity Accounts for Estates or Trusts:

- Deceased Estate

- Living Estate

- Trust

Step 2: Personal Information and Banking

Step two will require you to input your personal and banking information.

You’ll have to fill out some basic personal and banking information. You’ll need to provide your name, social security number or tax ID number, driver’s license information address, at least one phone number, email, and bank account information, everything that is marked where the red asterisk is required.

This bank account should be the one you’re using to fund your I Bond purchase.

Now read through this section, check this box to certify your social security or tax ID number then click submit.

This will take you to the next screen where you should double-check all your personal information and banking details. Scroll down and submit if correct, or go back and edit.

If there are any mistakes, once you click submit, this will be the screen you see next, choose an image and an image caption. And after this, choose your password, password reminder, and three security questions.

Step 3: Make Your Treasury Account Secure

Step three is setting up your password, password reminder, and security questions. Scroll down and click on “Apply now”.

After selecting the type of account you are opening, click submit on the next screen.

Once you’ve completed this final step, you’ll see something like this on your screen.

Step 4: Verify Your Account

At this point, check your email. You’ll get something similar to this with your account number on it. Your treasury account should be set up successfully. Now let’s buy your Series I Bond.

Verify Your Account Number Here

Step 5: Buy Your Series I Bond

Go back to the TreasuryDirect.gov homepage and click on login. This will take you to another login page. Click on login again.

Enter your account number. Next is a screen that asks for a one-time security code. You’ll find this one-time security code at the same email address where you received your login account number.

Once you enter it, check the box that says something along the lines of ‘remember me’ on this computer, assuming you’re on a trusted, safe, personal computer.

Check your image and image caption to make sure everything is correct. Then input your password via this keyboard. Then scroll down and click submit.

You are now ready to buy your first Series I Bond. Click on “buy direct”, and then on the next page, click on Series I Bonds and then submit. Now, all you need to do is figure out how much you want to buy. The minimum is $25 and the maximum is $10,000.

For those of you who want to invest more than $10,000, there is a legitimate way to do this. We’ll cover this a little later. You can buy your Series I Bond as a single purchase on a specific date or as a regularly scheduled purchases. For example, weekly or monthly, or on specific dates like the day after your paycheck hits your bank account.

If you opt for a single purchase you’ll see a confirmation page soon afterward. Remember to hit submit after you’ve checked everything and boom! That’s your first purchase at a 9.62% yield.

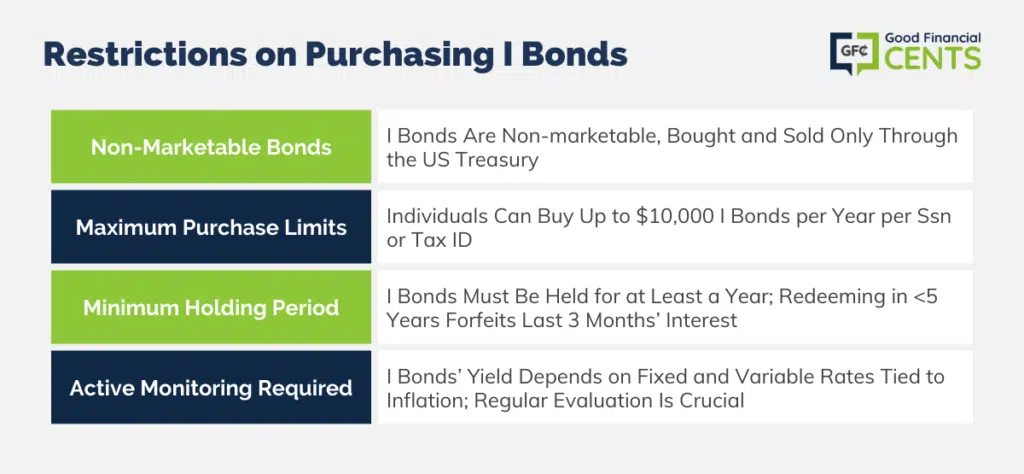

4 Restrictions on Purchasing I Bonds

There are four restrictions you’ll encounter purchasing I Bonds. The first two are fairly simple.

1. Series I Bonds Are Non-Marketable

As I’ve already mentioned, restriction or catch number one, I Bonds are non-marketable. You have to open an account with the US treasury. And when you’re ready to sell the I Bonds to redeem or get your money back, you can only do this via the US treasury. You can’t just log onto a brokerage or retirement account, like Fidelity or Vanguard, to sell your I Bonds.

2. Series I Bonds Have Maximum Purchase Limits

Restriction two is you can only buy $10,000 worth of I Bonds per year per individual or entity. So if you are sitting on $100,000 of extra cash, I Bonds are great yield-wise, but you can’t really inflation-proof your whole portfolio of excess cash with them. There are several ways to get around the $10,000 limit. Legally first you can purchase up to an additional $5,000 of Series I Bonds with your tax refund.

If you’re envisioning I Bonds in your investment portfolio for the near future, you can increase your tax withholding so that you’ll have enough from your tax refund to purchase an additional $5,000 of I Bonds. As always consult with your tax or other relevant professional advisor beforehand.

Second, you could purchase $10,000 for each of your children and gift it to them. The $10,000 annual cap on I Bond purchases is per social security or tax ID number. So if you are a family of four, you could, in theory, buy up to $40,000 of I Bonds, excluding any tax refund-related purchases. You could buy $10,000 of I Bonds for yourself, $10,000 for your spouse, and $10,000 for each of your two children.

The great thing about gifting an I Bond to your children is that the interest earned on the I Bonds is exempt from all local, state, and federal income taxes. If used for qualified higher education expenses upon redemption.

For those of you who are not using I Bonds to pay for your children’s qualified higher education expenses do note that the interest on I Bonds is exempt from local and state income taxes, but not from federal income taxes.

Having said that, you don’t have to pay taxes on interest earned every year if you choose not to. In fact, according to the US treasury, most people choose to report their interest earned on I Bonds only when they redeem them at face value.

3. Series I Bonds Have a Minimum Holding Period

Restriction number three, you have to hold Series I Bonds for at least a year. There is no way, I repeat, no way to get your money back within the first 12 months under any circumstances from the government.

Additionally, if you redeem your Series I Bonds within the first five years, you’ll lose your last three months of interest.

4. Series I Bonds Are Not to Be Forgotten

Restriction number four, Series I Bonds are not a set it and forget it financial strategy, especially when it comes to using them as a way to inflation-proof your extra cash. You need to have a pulse on the market and understand where you stand on the inflation rate. Do you think inflation will continue to increase? Or do you think it’s reached its peak?

Let’s walk through how this current 9.62% yield on I bonds is calculated. This 9.62% yield is what’s known as the composite rate on a Series I Bond.

This composite rate is made up of two primary components:

- Fixed rate, which is set at the time of purchase of your I Bond. This fixed rate stays the same for the 30-year term.

- Variable rate that’s equal to two times the semi-annual inflation rate. This variable rate changes every November and May, based on inflation at that time.

All Series I Bonds purchased between July 1st, 2022, and October 31, 2022, have a fixed rate of 0% and a semi-annual inflation rate of 4.78%. Now take the 0% and add it to the two times 4.78%. And that’s how you get to the composite rate.

When Do Series I Bonds Rates Reset?

What happens after October 31st, 2022? Well, a new semi-annual inflation rate will be set for May 2022. And depending on where inflation is, then this I Bonds composite rate will also change. If inflation goes up, you should expect your I Bonds composite rate to also go up.

Similarly, if inflation goes down, you should expect your I Bond composite rate to also go down. This is why buying I Bonds with your extra cash and parking it for a year or a few years makes sense. But it’s not a “set and forget it” financial strategy. If you’re worried about inflation, check out our 5 best hedges against it.

Investors should be regularly tracking inflation rates especially where the I Bonds yields are updated every November and May.

What About Negative Inflation?

One more thing to note is the formula the Fed uses to compute the Composite interest rate does factor in negative inflationary periods.

The formula is designed so that your Series I Bond composite rate will never fall below 0%. So you’ll never have a negative return on your interest payments.

Bottom Line – Series I Bonds To Protect Your Money

Keep in mind we consider Series I Bonds as a defensive strategy for your money. It’s not meant to significantly grow your wealth, but rather to preserve as much of your purchasing power as possible.

During inflationary times, Series I Bonds are a great consideration for cash that’s sitting on the sidelines that’s above and beyond what you need for your emergency fund. This is cash you don’t expect you’ll need for at least one year, or if you have extra money that you don’t need for a longer period of time, think 5+ years or longer.