You certainly can! The IRS actually allows for multiple IRA accounts. This could be multiple Roth IRAs or multiple Traditional IRAs. There are benefits and disadvantages of owning multiple IRAs that you should be aware of before making a decision.

Table of Contents

- Why You Need to Save For Retirement

- What Is an IRA (Individual Retirement Account)?

- How Many IRA Accounts Does the IRS Allow?

- Personal Example of Owning Multiple IRAs

- The Benefits of Owning Multiple IRA Accounts

- Disadvantages of Owning Multiple IRAs (Roth or Traditional)

- Reduce Your Multiple IRA Accounts to a Manageable Level

- Bottom Line: Multiple IRA Accounts: Traditional and Roth Possibilities

Why You Need to Save For Retirement

According to a recent study, nearly 50% of Americans have nothing saved for retirement. Nothing. Nada. Zip. Zilch.

This is a huge problem because social security only replaces about 40% of your pre-retirement income, and you’re expected to live 20-30 years in retirement.

That leaves a 60-70% income gap that needs to be filled, and the only way to do that is by saving on your own.

While 401k’s are also an option (if your employer offers one) and can be a great way to save, they come with limitations. Compared to Roth IRA’s, 401k’s:

- Have fewer investment options – Most 401k plans only offer mutual funds or ETFs (Exchange Traded Funds). Compared to Roth IRAs where you have more options such as individual stocks, real estate, and even cryptocurrency.

- Subject to vesting schedules – Your employer may require you to work for a certain number of years before you’re fully vested in the company 401k plan.

Types of vesting schedules include cliff vesting (you’re fully vested after a certain number of years) and graded vesting (you’re partially vested after a certain number of years).

What Is an IRA (Individual Retirement Account)?

An Individual Retirement Account is a personal savings plan that offers tax advantages to help you save for retirement. There are two types of IRAs: Traditional and Roth.

With a Traditional IRA, you make contributions with money you may be able to deduct from your taxes now. Your earnings then grow tax-deferred until you make withdrawals in retirement, at which point they are taxed as ordinary income.

With a Roth IRA, you make contributions with after-tax dollars. Your earnings then grow tax-free, and you can make tax-free withdrawals in retirement.

Choosing which IRA is right for you depends on your circumstances and should be discussed with a financial advisor.

How Many IRA Accounts Does the IRS Allow?

The IRS actually allows for multiple IRA accounts. There is no limit to the number of IRA accounts you can have, but there are contribution limits. For 2024, the contribution limit for IRAs is $7,000. If you’re 50 or older, you can make catch-up contributions of an additional $1,000 for a total of $8,000.

The 2024 IRA income limits are (this applies to both Roth and Traditional IRAs):

- $161,000 if you’re filing as a single taxpayer

- $240,000 if you’re filing jointly as a married couple

- $161,000 if you’re filing as a head of household

RELATED:

Personal Example of Owning Multiple IRAs

When I started my career as a financial advisor, I was a W-2 employee and had access to a 401k with a nice match. I wasn’t making a sizeable income, but I was living way below my means and managed to invest money in the 401k and also a Roth IRA.

After working there for five years, I left and continue to fund my Roth IRA. Instead of leaving my 401k with my old job, I chose to initiate a 401k rollover.

At this time, I also became self-employed, and I was able to set up a business retirement plan, otherwise known as an employer-sponsored retirement plan. My options included:

- Simple IRA – This is a retirement plan for small businesses with 100 or fewer employees. Employers must contribute either a fixed percentage of each employee’s pay (2% to 3%) or make a matching contribution of employee contributions, up to 3%.

- SEP IRA (Simplified Employee Pension) – This is a retirement plan that can be established by any size business. The employer contributes money to each eligible employee’s SEP-IRA based on a percentage of salary or compensation, up to 25%.

- Solo 401k – This is a retirement plan for self-employed individuals and their spouses. The employer (you) can contribute 100% of your compensation, up to $23,000 in 2024 ($30,500 if you’re 50 or older).

- Traditional 401k – This is a retirement plan sponsored by an employer. Contributions are made pre-tax and grow tax-deferred. Withdrawals in retirement are taxed as ordinary income.

I could take advantage of any of the above as well as a traditional IRA or Roth IRA.

I opted for the SEP-IRA because it was the simplest and most flexible option for my business. I could contribute 25% of my annual income up to the contribution limit of $69,000 for 2024.

And since I didn’t have any employees at the time, I didn’t have to contribute money on behalf of anyone else.

So, at one time, I owned three IRAs! A Roth IRA, a Traditional IRA (rollover), and a SEP IRA.

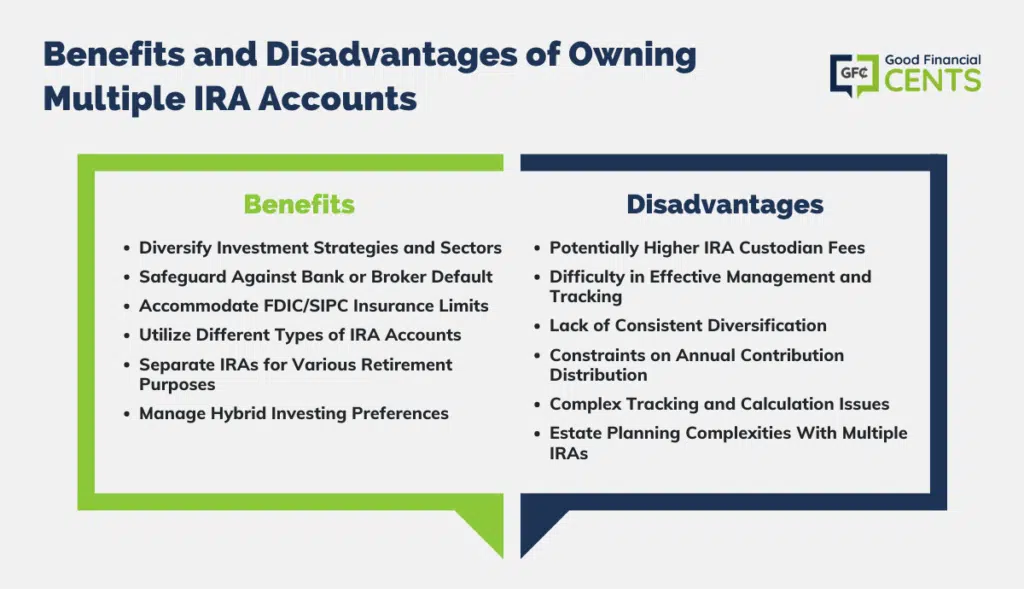

The Benefits of Owning Multiple IRA Accounts

There are times when having multiple IRA accounts can be a clear benefit.

Here are some examples:

1. SIPC or FDIC Insurance Limits

If you are a fixed-income investor (think bonds or preferred stock) and prefer the safety of banks, there is a $250,000 FDIC insurance limit for bank accounts.

If your IRA balances are higher than this, you may need to maintain an IRA at two or more banks. The same is true of SIPC insurance.

The limit is $500,000 in cash and securities per account, which includes $250,000 in cash. If your IRA balance exceeds $500,000, you might have more than one account.

2. You Feel Safer Not Having All of Your “Eggs in One Basket”

Apart from either FDIC or SIPC insurance, you might just feel safer having your retirement assets spread across two or three accounts, rather than in a single account.

Even though your funds are insured, the thought of bank or broker default can be unnerving in connection with something as important as your retirement savings.

3. Diversification Into Very Specific Investment Accounts

There may be certain investment vehicles that specialize in certain investment strategies.

For example, you may have one that’s a low-cost trading account, another that’s a family of funds, and still, a third that invests in specific sectors, such as real estate or natural resources.

4. Different Types of IRA Accounts

As mentioned earlier, you may have a traditional IRA and a Roth IRA. And if you’re self-employed, you might also have a SEP IRA. It largely depends upon personal circumstances.

5. Different IRAs for Different Retirement Purposes

As you get closer to retirement, you may decide that you want different IRAs that each serve a certain purpose. For example, you can have one IRA account that functions primarily as a source of regular income.

A second account could be dedicated to growth investments so that your retirement portfolio never runs dry.

Still, a third IRA could function as a large emergency fund so that you’ll have an account to tap when a large expense comes up, such as an uncovered medical expense, the replacement of a car, helping your adult children, or even major work to be done on your home.

6. Managed Account vs Self-Directed Account

A lot of people are hybrid investors – they prefer to have most of their money professionally managed but still want to dabble in do-it-yourself investing.

Such an investor might have most of their money in a managed account, such as Betterment or M1 Finance, or with a DIY account set up through TD Ameritrade. It’s nice to have choices!

Disadvantages of Owning Multiple IRAs (Roth or Traditional)

Despite the advantages that can be had from having multiple IRA accounts, it is possible to have too much of a good thing.

Here is where having several IRA accounts could hurt your situation:

1. IRA Custodian Fees

If you have five IRA accounts, and each has an annual fee of $100, you’re at $500 per year in fees rather than $100 per year with a single account. That’s an extra $400 a year. Over 20 or 30 years that starts to add up and eat away at your investment returns.

2. Difficult to Manage

Unless you invest money on something like a full-time basis, it can be very difficult to effectively manage multiple IRA accounts.

The problem will be even worse if you also have multiple taxable investment accounts. You may find yourself doing particularly well with some accounts but very poorly on others and maybe losing money on some.

3. Lack of Consistent Diversification

It can be tough enough to create and maintain a reliable investment allocation in one account. But if you’re trying to juggle four or five, it can be a certified nightmare.

Think about how difficult that becomes when you’re trying to rebalance your accounts. Most likely, the combination of all of your IRA accounts looks more like a little bit of this and a little bit of that rather than a well-balanced investment portfolio.

4. Only So Much You Can Contribute Each Year

If you have five IRA accounts, you can still contribute no more than $6,000 each year. How do you handle that? Do you fund one account each year? Or do you divide the contribution by five and put $1,100 in each account?

5. Tracking Issues

If you have multiple IRA accounts, it may be difficult to know at any point in time exactly how much money you have saved for retirement. Will you know if you are on track with your retirement savings? Every time you want to find out, you’re going to have to do a calculation.

And what happens if the market takes a big hit? How will you know how extensive the damage is to all of your accounts collectively? In addition to being a math problem, that kind of complication can make it difficult to make rational investment decisions.

6. You May End up With an Estate Planning Nightmare

If you do decide to open multiple IRAs, make sure you keep good records and consult with a tax advisor to make sure you’re taking advantage of all the available tax benefits and not on the hook for unrealized tax liabilities.

You also need to be aware that RMDs (required minimum distributions) will need to be managed across all retirement accounts and financial institutions.

So what’s the answer?

Reduce Your Multiple IRA Accounts to a Manageable Level

It can make sense to have a limited number of multiple IRA accounts for specific reasons. A married couple in which each spouse has a traditional IRA and a Roth IRA would certainly justify the couple having four IRA accounts.

And you can certainly make the case for having a managed account and a truly self-directed account.

But if the reason why you have multiple IRA accounts is more because of passive accumulation (taking advantage of promotions or 401(k) rollovers), you’ve probably created a web of complications for yourself that has no real benefit.

Cut your IRA accounts down to no more than two or three per spouse, and only for the best reasons. Then, consolidate the others into the most important accounts.

That will enable you to save on fees, get better control of your investments, properly diversify your retirement portfolio, and have a better handle on tracking your progress toward your retirement goals.

Bottom Line: Multiple IRA Accounts: Traditional and Roth Possibilities

Having multiple IRA accounts offers both advantages and disadvantages that require careful consideration. While the IRS allows for multiple IRAs, each individual’s financial situation and goals play a crucial role in determining the optimal number of accounts.

The benefits encompass diversification, insurance coverage, and specialized investments, while disadvantages include potential fees, management complexity, and tracking challenges.

Striking a balance between benefits and drawbacks is essential. Limiting the number of IRA accounts, focusing on meaningful reasons, and consolidating where necessary can lead to more effective retirement planning.

It’s crucial to align choices with long-term objectives, ensuring a well-structured and secure retirement strategy.

This is how I feel about some of the clients I see with so many retirement accounts! 😉 Personally, I think simple is better.

Most definitely!