Not interested in setting a traditional New Year’s resolution, like losing weight or eating healthier? You’re not alone.

A majority of Americans are abandoning resolutions of years past, and instead, are focusing on more practical goals in today’s unpredictable world. One survey for Affirm found 62% of Americans are saving money for the future in 2024, while 54% want to budget better and 49% want to repay debt.

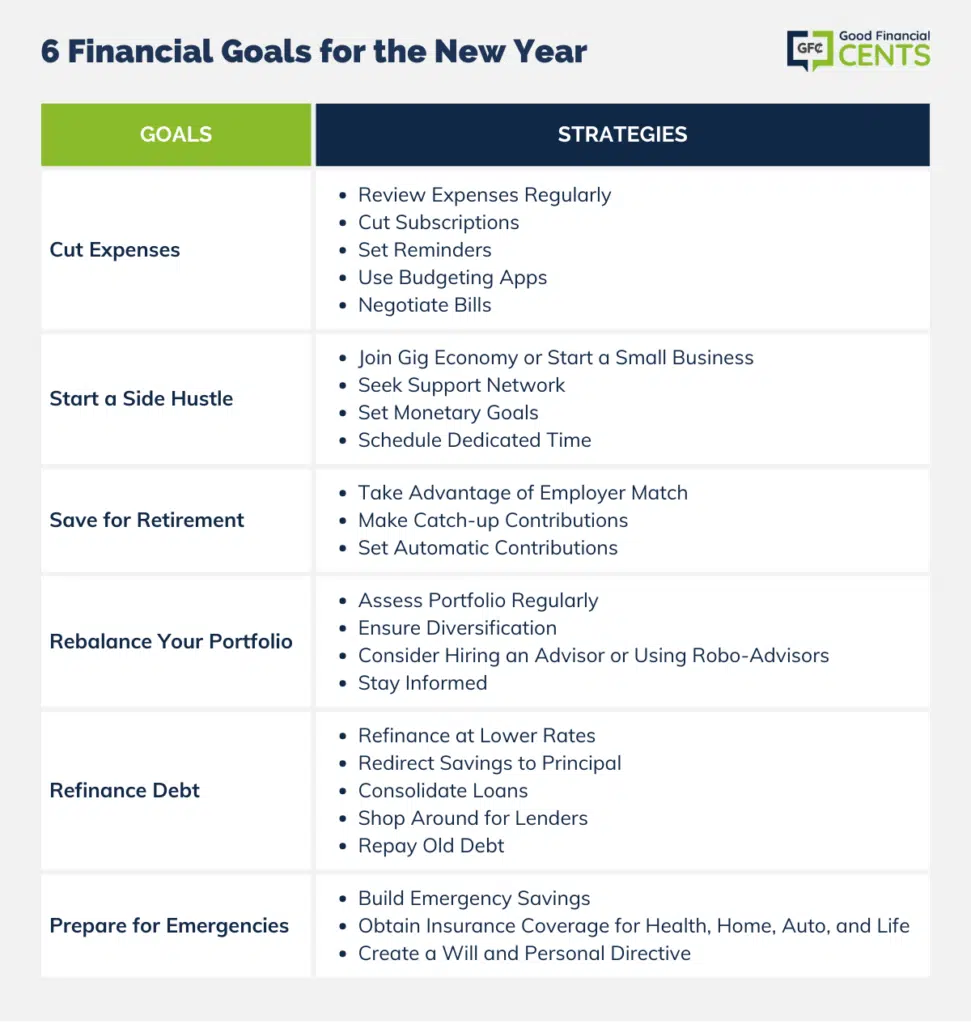

What money goals do you want to set this year? Here are some top goals to prioritize that have a big impact on your financial picture moving forward.

Table of Contents

1. Cut Expenses

A survey by McKinsey and Company found that four out of 10 Americans don’t expect their finances to rebound from the impact of COVID-19 until late 2022 or 2023. More people are looking at how to get by with less, and where to cut expenses.

Reducing your expenses has obvious benefits. To have more money for tackling bigger financial goals, you’ll either need to earn more income or spend less money. Getting into the habit of regularly reviewing your expenses, and reducing spending, can help you stay on track.

Reducing expenses isn’t always easy. Whether it’s peer pressure, wanting to treat yourself, or paying for emergencies — expenses arise, and they can throw you off course. Here’s what you can do to make sure you stick to your goal:

- Cut Subscriptions: Get selective with your subscriptions, like entertainment streaming services (looking at you, Hulu, Disney+, and Netflix). Reduce subscriptions to 1-2 options per service type.

- Set a Reminder: Put a reminder on your calendar for a set time every month where you’ll review your spending. This includes expenses, like subscriptions, groceries, and automatic refill orders, through sites, like Amazon Prime and Chewy. Adjust your budget, if necessary.

- Get an App: Try budgeting tools, like Mint or You Need a Budget, which help you organize and track your custom budgets, send excessive spending alerts, and monitor subscription costs for more savings.

- Negotiate Bills: Review bills, like your car insurance or cell phone service. Contact your providers to see if they can offer discounts or rate reductions on your contract. If not, shop around with their competitors.

2. Start a Side Hustle

An Upwork and Freelancer’s Union survey estimated that approximately 57 million Americans freelanced either full- or part-time. Side hustles are the new norm. Whether it means taking advantage of the gig economy or starting your own small business, a side gig can bring in extra cash to transform your financial reality.

The extra money from starting a side hustle can help you attain otherwise out-of-reach financial goals. The added cash boost can go toward savings, big-ticket purchases, new investments, or repaying existing debt.

Starting a side hustle can be daunting. Here are some ways to help you stay motivated throughout the process:

- Find a Support Network: Reach out to peers and mentors who’ve tried a similar side hustle, and stay in contact with them for accountability. They can also be a huge resource when brainstorming ways to navigate any challenges ahead.

- Have a Monetary Goal in Mind: Decide how much money you want to earn from your side hustle (and what you’ll do with it). This can help you persist even when you’re tired or discouraged.

- Schedule Time in Advance: Whether you’re planning to drive for Uber or launch an online store, set aside time to focus on it. It’s also helpful to keep this schedule consistent; for example, every Monday morning before your 9-to-5 job, or for two hours every evening.

3. Save for Retirement

Half of American families have little or no money saved for retirement, a trend that worsened after the Great Recession, according to the Economic Policy Institute. Because many retirement savings techniques rely on the power of compound interest it’s smart to get started early. Plus, contributing to your retirement savings can provide a tax benefit.

If you’re looking to give your retirement savings some love this year, here are some strategies to get started now and continue for the rest of the year:

- Take Advantage of Any Employer Match: Many employers provide matching retirement savings as a workplace benefit. Max out this employer match as your first priority when it comes to saving for retirement. If not, you’re just leaving money on the table.

- Make Catch-up Contributions: If you’re age 50 or over and haven’t consistently contributed to your IRA or 401(k), you might be eligible to make additional contributions to give your savings added momentum.

- Set Automatic Contributions: If you’ve found it hard to prioritize retirement savings in the past, setting up automatic contributions now can take a lot of the willpower out of the process. You should be able to do this through your bank, or even through your employer if you have a workplace plan.

4. Rebalance Your Portfolio Regularly

In March 2020, Dow Jones plunged 26%, proving a personal finance axiom: the stock market is unpredictable. Although some investors prefer to time the market — gambling on its ever-changing highs and lows — others take the buy-and-hold approach.

Even if you’re buying for the long term, you’ll want to regularly assess your portfolio to adapt to marketplace changes. Ensuring your investment mix is diversified can help you hedge against swings in the market.

Not sure how to guide your finances through the ups and downs throughout the year? Here’s how you can stay consistent.

Hire an advisor: Taking a more active investment approach requires time commitment and confidence in your depth of knowledge. If you need help in this regard, consider getting an investment advisor. If you’re just getting started, online or robo-advisors, such as Wealthsimple or Robinhood, are good places to start.

Stay informed: Managing your investments means staying on top of market trends. Consider adding a stock ticker to your phone’s lock screen, and subscribing to investment newsletters and stock alerts.

5. Refinance Debt

With interest rates at a near record low, it makes sense that refinancing debt is a New Year’s goal for many people. Refinancing can help you repay any existing debt faster.

If you refinance at a lower rate than your original loans, you’ll pay less in interest over the life of the loan. You can redirect these savings toward your loan’s principal to get out of debt faster. You can refinance most types of debt, from your mortgage to student loans.

Not only can refinancing shave time off the life of your loans, but if you consolidate at the same time it could simplify your finances. When you consolidate, you use the funds from your new loan to repay your existing debt. With the old debt paid off, you focus on making the one payment for your new loan each month.

Refinancing doesn’t have to feel daunting. Here’s how to get started:

- Shop Around: Compare refinancing rates and terms from a handful of lenders.

- Consider fees: Some of your old debt could have a prepayment penalty. Factor this into the cost of refinancing — particularly, when it comes to refinancing your mortgage. You might find the penalties might negate the potential savings from refinancing.

- Repay Your Old Debt: Make sure your old debt is completely paid and that you’ve received documentation stating such. If you’re repaying credit cards or lines of credit, make sure to close these accounts after repaying them so you’re not tempted to incur more debt.

6. Prepare for Emergencies

No matter how well you plan, emergencies are always bound to happen in life. Many American households don’t have enough cash on hand to replace even one month of lost income. If this is a concern for you, prioritizing your emergency planning could be a smart goal to achieve this year.

Having the appropriate amount of emergency savings and insurance coverage can protect you and your family should a worst-case scenario occur. It can prevent you from going into debt, because of unexpected expenses and protect the future you’ve worked for.

What should you prioritize when it comes to preparing for the unexpected?

- Emergency Savings: Your individual circumstances will dictate how large your emergency savings fund should be. Ideally, you’ll want enough savings to cover your expenses for about three months. Keep this money in an account with easy access, such as a high-interest savings account.

- Insurance: When it comes to insurance, you’ll want to make sure you’re covered for health, home, auto, and life insurance. If you feel underinsured in any of these areas, find an insurer that offers a discount for purchasing multiple policies to reduce costs. Here’s a helpful list of top life insurance options.

- Create a Will: Having a will and personal directive in place is essential for adults of all ages, even if you don’t have dependents or many assets. Creating a will helps settle your estate after you die — which can include your assets and your debt. A will can also determine decisions regarding your finances and health, if you become unable to do so yourself.

Final Thoughts on 6 Financial Goals for the New Year

In the face of shifting priorities, many Americans are turning away from conventional New Year’s resolutions and embracing more pragmatic financial goals for 2024. A recent survey found that a majority of individuals are directing their attention towards securing their financial future (62%), improving their budgeting skills (54%), and reducing their debt burden (49%). These objectives have a substantial impact on one’s financial well-being in the ever-changing economic landscape.

The goals encompass a range of strategies, from cutting expenses and starting side hustles to saving for retirement and rebalancing investment portfolios. Additionally, refinancing debt and preparing for unforeseen emergencies are becoming increasingly vital components of financial planning. By prioritizing these objectives, individuals aim to navigate the evolving financial terrain with greater resilience and stability.