The ultimate goal of life insurance coverage can be as varied as the people who purchase it. For some, the purpose of a policy may be to ensure that loved ones can continue with their daily living expenses in case of the unthinkable.

For others, having a policy in place may mean that final expenses will be paid, providing peace of mind to a long-time spouse and other family members.

But whatever the reason is for obtaining life insurance coverage, there are several key factors to keep in mind before actually purchasing a policy.

They certainly include the type and the amount of coverage that you are seeking – as you will want to ensure that your survivors are adequately protected.

But making sure that the insurance company through which you buy the policy is financially stable should also be a must.

This is because if or when a claim needs to be filed, you will want to know that the company is there to make good on their promise to pay out. One such insurer that has been there for its policyholders for more than 160 years is Northwestern Mutual.

Table of Contents

History of The Northwestern Mutual Life Insurance Company

The Northwestern Mutual Life Insurance Company is a name that is well recognized in the insurance industry. Having a long history that spans more than 160 years, this company began helping its customers to both grow and protect wealth, and it continues to do so today.

This large insurance company now has over 4 million policyholders and has paid out more than $47 billion in dividends. As a mutual insurer, in 2019, the company expects to pay out $5.6 billion in total dividends to its life insurance and disability insurance policyholders.

The company has its headquarters in Milwaukee, Wisconsin, where The Northwestern Mutual Tower and Commons opened on August 21, 2017.

The Northwestern Mutual Life Insurance Company Review

Northwestern Mutual is one of the largest, financially stable life insurance companies in the US. It has total company assets of $558 billion and revenues of $35 billion as of 202. This ranks the insurer as number 22 on the Fortune 500 list.

The insurer has approximately $2.2 trillion worth of life insurance protection in force, with 5 million people insured. The company has more than 360 local offices that are located across the United States.

Get My Quote

Northwestern Mutual is proud of keeping its promises. Not only does it have a stellar reputation for paying out its policyholder claims, but the company is also heavily involved in the communities that it serves. It also believes in doing what is right.

It has a long-term focus, as well as prudent investment strategies – which is one of the reasons why it has held such a strong financial position in the industry – and has also been able to continuously help its clients to grow and protect their wealth.

The company also believes that a diverse and inclusive workforce attracts and engages the very best talent. Therefore, it hires and attracts a wide array of employees and associates, and it is affiliated with some diverse organizations and entities.

Some of its corporate commitments include the following:

- The Northwestern Mutual Foundation has given nearly $465 million to communities across the nation in the past decade.

- Northwestern Mutual has given more than $500 million to support urban education in the Downtown Milwaukee Campus.

- Employees of Northwestern Mutual volunteer more than 32,000 hours each year to community organizations.

Because of its strong financial position, along with its mission to help its clients succeed, Northwestern Mutual and its subsidiaries have achieved numerous accolades, such as:

- World’s Most Admired – The company is among the “World’s Most Admired” life insurance companies, according to Fortune magazine’s annual survey, published in 2018;

- Giving – The company is one of the largest corporate givers in Wisconsin, donating nearly $290 million to non-profits nationwide since its foundation’s inception in 1992;

- The company’s nationwide Childhood Cancer Program is helping to accelerate the search for a cure to childhood cancer and providing support to families that are affected by the disease – and to date, more than $50 million has been donated by Northwestern Mutual, and more than 500,000 hours of research have been funded;

- Top 10 Independent Broker-Dealer – Ranking for Northwestern Mutual Investment Services, LLC. Source: Financial Advisor magazine, May 2018, and Financial Planning magazine, June 2018.;

- Guidance – The financial representative training program is recognized among the country’s best by Training Magazine, helping the reps to guide their customers to a more secure future;

- Customer Satisfaction – The company also has a persistency rate of 96% for life insurance in force;

- Market Share -Northwestern Mutual is the largest direct provider of individual life insurance in the U.S. based on direct premiums written, by S&P Global Market Intelligence;

- Total Dividends – The company expects to pay an industry-leading total anticipated dividend of $7.3 billion for 2024;

- Ratings – The company has the highest financial strength ratings that are awarded to any life insurer by all four of the major rating agencies.

The Northwestern Mutual Life Insurance Company Ratings and Grades

Because of The Northwestern Mutual Life Insurance Company’s financial strength and stability, this company has been given superior ratings by all of the insurer rating agencies.

These include the following:

- A++ by A.M. Best

- AAA by Fitch Ratings

- Aaa by Moody’s

- AA+ by Standard & Poor’s

Life Insurance Products Offered By Northwestern Mutual

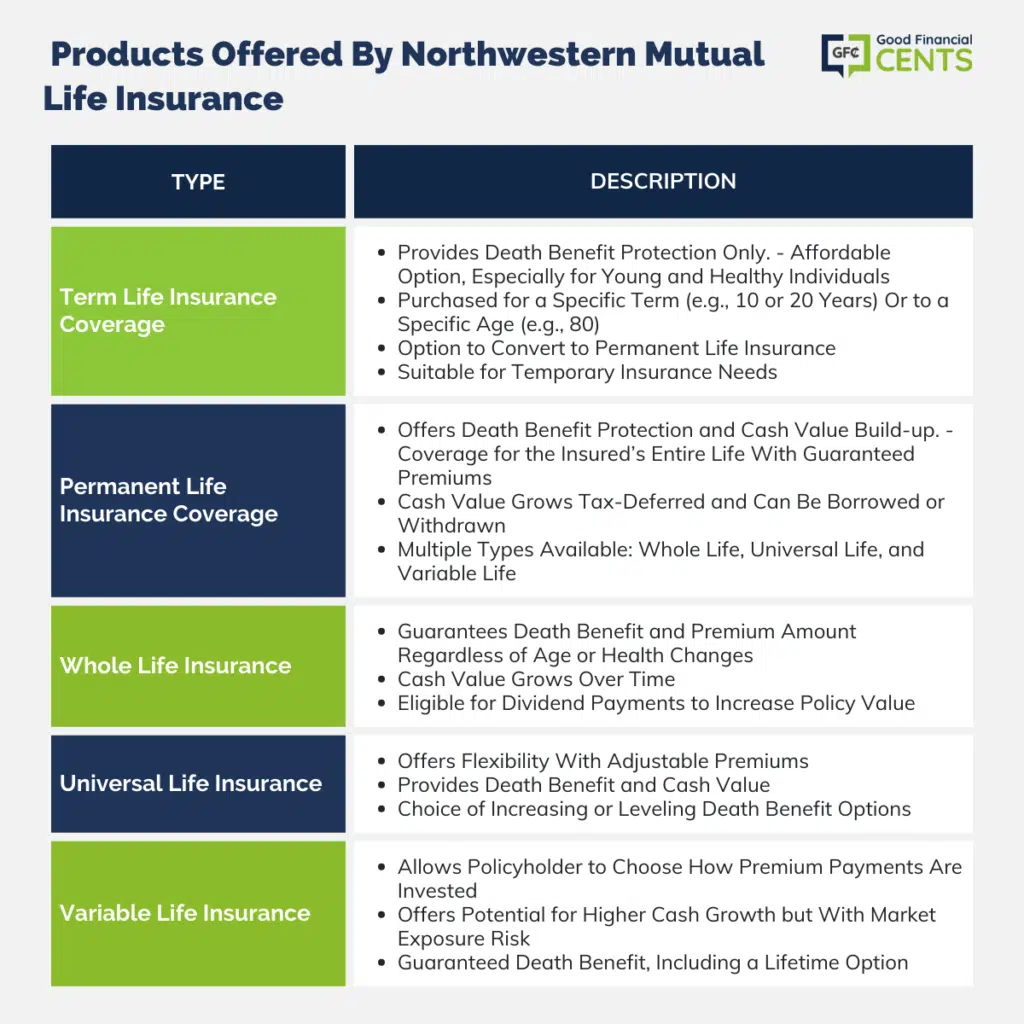

The Northwestern Mutual Life Insurance Company offers many different types of life insurance coverage. These include both term and permanent protection. Talking to an advisor can help you determine what policy type suits your needs.

Get My Quote

The types of policies offered by Northwestern Mutual include the following options:

Term Life Insurance Coverage

With term life insurance, a policyholder will be covered with death benefit protection only. This is why term insurance is often considered to be the most basic form of life insurance coverage.

Because of this, however, term insurance can be quite affordable – especially for those who are young and in good health at the time of the application and are seeking larger amounts of coverage, such as a million-dollar life insurance policy.

Term life insurance, as its name suggests, can be purchased for a certain amount of time, or “term.”

The Northwestern Mutual Life Insurance Company offers several different term life products with varying premium and death benefit structures to suit your needs and budget. These policies provide coverage for specific periods of time, for example, 10 or 20 years, or to a specific age, such as 80.

There may also be the option of converting the policy over into a permanent life insurance policy. This can allow the insured to have coverage that lasts for the remainder of his or her lifetime, provided that the premium is paid.

A term insurance policy may be a good choice for someone who is seeking lower premiums, as well as when the insurance need is temporary – such as when they want to ensure that a mortgage balance will be paid off.

Permanent Life Insurance Coverage

Permanent life insurance offers death benefit protection and cash value build-up. With this type of coverage, an insured can have life insurance for the remainder of his or her life – guaranteed, as long as the premium continues to be paid. There is also the ability to build up savings via the cash value.

Cash value grows tax-deferred. This means that there are no taxes due on this growth unless or until it is withdrawn.

The Northwestern Mutual Life Insurance Company offers several different types of permanent life insurance coverage, including:

Whole Life Insurance

Whole life insurance provides a death benefit that is guaranteed, as well as a premium amount that is locked in, too. This is the case, regardless of the insured’s increasing age, and even if the insured contracts an adverse health condition in the future.

The cash value of a whole life insurance policy grows over time as premiums are paid.

Because Northwestern Mutual is a mutual company, the whole life insurance policies that are offered are also eligible for dividend payments. These dividends may be used to increase the policy’s value when declared.

Universal Life Insurance

Universal life insurance also offers a death benefit and a cash value. Here, the policy is more flexible than whole life because the premium may be adjusted – based on certain guidelines.

Northwestern Mutual offers the choice of either increasing or leveling death benefit options on its universal life insurance policies.

Variable Life Insurance

With variable life insurance, the policyholder can choose how the premium payments are invested.

While there is the ability to attain much growth in the cash component of a variable life insurance policy, there can also be more risk due to the market exposure. These policies can offer guaranteed death benefit coverage – including a lifetime option.

Other Products Offered

In addition to life insurance coverage, The Northwestern Mutual Life Insurance Company also offers other products and services, as well. These include:

- Disability insurance

- Annuities

- Mutual funds

- Individual securities

- Advisory programs

- Personal trust services

- Brokerage services

- Fixed income management

- Cash management

- Discretionary investment management

Annuities Offered by Northwestern Mutual

Just about everyone has heard the word “annuity,” but not many people understand exactly what they are and why they should have one in their investment portfolio. How does an annuity work?

The concept of an annuity is simple, it’s a contract between you and an insurance company that gives you a place to put money for retirement. Once you’ve reached that stage, the annuity is a guarantee of income after you’ve retired.

The advantage of annuities is that they grow tax-deferred until they start paying out. You can contribute to an annuity in payments over time, or you can do it all at one time if you have the money saved.

Northwestern Mutual is the second-largest provider of deferred annuities in the United States which means that they must be doing something right.

According to their website, their annuities are “backed by a history of financial strength,” which is extremely important when you’re looking for a place to invest your retirement funds. It’s important to note that The Northwestern Mutual Life Insurance Company has an A++ rating from A.M. Best.

Advertiser Disclosure: Northwestern Mutual is an affiliate partner, meaning GoodFinancialCents may receive compensation when you click on links to their products. That relationship in no way impacts our review process or the opinions voiced in our content, which are held to the highest editorial standard.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability. Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: Northwestern Mutual Product Description: Northwestern Mutual is a long-standing financial services company known for its life insurance offerings and wealth management solutions. Founded in 1857, it has built a reputation for stability, financial strength, and client-focused services. Over the years, it has expanded its portfolio to include a wide range of insurance and investment products. Summary of Northwestern Mutual With a legacy spanning over a century, Northwestern Mutual is one of the most recognized names in the American financial landscape. Primarily known for its robust life insurance products, the company provides a suite of services ranging from disability insurance to financial planning and retirement solutions. As a mutual company, Northwestern Mutual operates for the benefit of its policyholders, often returning dividends to participating policyholders. Its commitment to financial strength has often been reflected in top ratings from major rating agencies. Moreover, the company’s network of financial advisors across the nation allows for personalized consultation and planning. Pros Cons

Northwestern Mutual Review

Overall