Whether you choose real estate or index funds as your primary investment, each has an outstanding track record of building wealth.

But is one better than the other, if maybe only by a little bit?

This topic was inspired by this question from a reader:

“My question: Real estate or long-term index fund investing?

– Patrick

I know the answer is probably both, but I’ve been a person who invests in stocks (mainly ETFs and index funds). However, on my social feed, I’m getting more and more people pushing rental real estate investing as a better way to wealth than stocks.

I do have a rental because it was my previous primary home before becoming a rental. So, while I know rentals, I worry that I’d make a mistake buying a property for more than it’s worth, having a prolonged period of no renters, or a large capital expenditure that might occur later down the road.

But so many people are into it that I feel like I’m left out. I’m grinding right now and think I’ll have $45k to put towards a rental at the end of the year so that’s why I am thinking about a rental.

But if my numbers are right and I can get the market to return 9%, then yes, in 30 years, when I plan to retire, that $45k becomes $597,000. I guess you can argue that if you buy a home, it could appreciate to $400k and cash flow a significant amount of money. Any insight?”

This is an age-old question, and maybe it has no one answer. As a spoiler alert, I think the answer will be different for each investor.

Let’s try to break down the reasons why this is such a tough choice. But before we do, I want to let you know I’m not a heavily experienced real estate investor.

My answers are based on my own limited experience, and I’ll be coming at the topic from a financial angle.

Why Invest in Real Estate?

Table of Contents

Real estate has proven to be one of the biggest wealth generators in history. It is estimated that up to 90% of millionaires obtain their wealth primarily by investing in real estate.

What makes real estate such a special investment?

1. Long-Term Capital Appreciation

The median price of a home in 1970 was around $23,000. But by the end of 2021, that figure has risen to $408,000. That’s an incredible 1,770% increase in 50 years. Few investments can match that performance.

2. Rental Income

Properly structured real estate investment can generate regular income in addition to long-term capital appreciation. While the income may only cover the monthly payment of the property after purchase, returns will become increasingly positive as rents increase. And once the mortgage on the property has been paid, most of the rental income will be profit to the owner.

3. Generous Tax Breaks

At least with investment property, depreciation expense can be claimed to reduce any tax liability. The benefit of depreciation is that it’s a “paper expense”—you can use it to lower your income, even though there is no out-of-pocket cost involved.

But there may be an even bigger tax break when you sell the property. Investments for more than one year get the benefit of lower long-term capital gains tax rates. For example, while ordinary income and short-term capital gains are taxed at rates ranging between 10% and 37%, long-term capital gains tax rates are limited to between 0% and 20%.

4. Leverage

Real estate is one investment where a small investor can make a big play with a small amount of money. You can purchase an investment property with 20% down and finance the rest from the bank. With an owner-occupied property, the down payment may be no more than 3%. Because of the high level of leverage, the long-term returns on real estate will be even higher than would be the case if you paid the full price in cash for the property.

5. Real Estate Is a Tangible Asset

Some investors prefer holding physical assets to paper and electronic investments, like stocks and bonds. Real estate is the ultimate tangible asset because it represents ownership of the land itself.

6. It Can Be Directly Managed

When you invest in an index fund or even in stocks and bonds, you’re turning control of your money over to the fund manager or company management. But when you invest in individual property, you control the entire process.

The Risks of Investing in Real Estate

Despite the easy and painless path the get-rich-quick-in-real-estate crowd claims it to be, real estate has real risks—and they’re not minor.

Here are some examples:

Overpaying for a property. This is more likely during hot markets when multiple offers boost property values. But if you buy in at or near the top of the market, you may not recover your investment for a long time. This is made worse by leverage. Since most of the funds used to purchase real estate are borrowed, and that creates a fixed obligation, what’s really at stake is your equity.

Unexpected structural problems. Even if a property passes a home inspection with flying colors, it can still have structural problems. Two or three years after the purchase, the furnace could melt down, the roof may need replacing, or you can learn the property has substantial termite damage.

Rising interest rates. These affect all investments, including stocks. Rising rates have a bigger impact on real estate because of the leverage factor. If rates rise significantly, your property value may go flat or even decline.

A deteriorating rental market. This can happen because the major employer in the area closes down a large facility or because a huge new apartment complex goes up nearby. Either situation can cause tenants to become scarce, forcing you to lower your rent.

Legal problems. Because someone will be occupying your investment real estate, there’s always the potential for legal problems. Sure, you can have insurance to cover a lawsuit. But it will still cost you in time and aggravation. There’s also the possibility that a bad tenant could use the legal system to prevent eviction.

My Own Experience Investing in Real Estate

At the beginning of this article, I wrote that I’m not a heavily experienced real estate investor, but I do have one episode to relate to. I did try buying a rental property once, and it didn’t go well. You can read all about that experience in my article, 7 Lessons I Learned From Failing at Real Estate Investing.

Joseph Hogue wrote a guest post on this site, 7 Rules I Learned After Going Broke in Real Estate Investing, so I know I’m not the only one who had a bad experience. Joseph still invests in real estate, but the article lists several rules you need to be aware of if you’re going to make it work.

At the same time, I don’t use my own experience to discourage you from investing in real estate. It is possible to make money, and plenty of people do. But you do need to be aware of exactly how it works and what the potential pitfalls are.

There’s one more piece of personal advice I’d like to give: You don’t need physical property to invest in real estate. There are different ways to invest in real estate, and you may want to consider one as an alternative to owning property outright.

Fundrise

One popular alternative is real estate crowdfunding. My choice for real estate crowdfunding is Fundrise, where I’ve earned solid returns without ever owning property directly. One of the advantages of Fundrise is that anyone can invest on the platform with very little cash. It’s an opportunity to diversify your portfolio into real estate with an investment that’s never more than you’re comfortable making.

I’ve been investing for 4 years now and have been happy with the returns. But I’m even happier with the amount of time it takes me, which is basically nothing.

Here’s a video I recapped on my 3-year returns with Fundrise:

Private Real Estate Notes

In a different direction, I also invest in private real estate notes. It’s a more advanced strategy, and I don’t recommend it to everyone. That’s because it involves purchasing nonperforming mortgages, a.k.a. bad loans.

The basic idea is that you buy a nonperforming mortgage at a deep discount. Since the mortgage is fully secured by property, there’s an excellent chance you’ll ultimately collect the full amount of the loan.

But if there’s insufficient equity in the home, you can take a loss. That’s why I don’t recommend a strategy for everyone.

But if you have a high-risk tolerance and an appetite for big profits, it may be a gamble worth taking.

Why Invest in Index Funds?

There are multiple reasons why stocks—and, by extension, index funds—are one of the three major investments, along with bonds and real estate.

1. There Are a Variety of Funds to Invest In

You can invest in U.S. and foreign markets and even in individual industry sectors, like technology, healthcare, or energy. You can even invest in index funds that hold other investments, like bonds or even real estate.

2. Invest for Income, Growth, or Both

Some funds specialize in growth stocks, while others focus on dividends. For example, the Invesco QQQ invests in the NASDAQ 100 index and has a long history of outperforming the S&P 500 index. But if you prefer dividend income, the Schwab U.S. Dividend Equity ETF (SCHD) has a dividend yield of 3%.

3. Investment Diversification

When you invest in an index fund, you’re indirectly investing in shares of hundreds or thousands of companies. If any one of them fails, you barely notice the impact. This is the exact opposite of the situation with real estate. If a single property investment goes sour, you could be out of business.

4. Your Portfolio Is Very Liquid

You shouldn’t be trading investment positions on a regular basis, but it’s good to know you could liquidate a position or two if you need to. Index funds can be traded on a daily basis.

5. There’s No Legal Liability

Since you’re investing in public corporations, any liability you might have is limited to your investment. A plaintiff or group of plaintiffs can’t come after you personally.

6. Index Funds Are Truly Passive Investments

You invest your money, then wait for the returns to play out. In the meantime, there’s no property to maintain, no tenants to deal with, and no need for periodic renovations.

7. Index Funds Fit Neatly Into Retirement Plans

Index funds are probably the most common investments found in retirement plans. This is for all the reasons listed above. Unlike real estate, index funds are a clean investment. They can be held in a brokerage account, used to build a diversified portfolio, bought and sold as necessary, and require no direct management.

While it is possible to hold physical real estate in an IRA account, that requires special handling. That includes setting up a self-directed IRA account (SDIRA), which is not only complicated but involves a matrix of compliance issues that could cause the IRS to invalidate your plan completely.

The Risks of Investing in Index Funds

Stocks and the index funds that invest in them have become the primary investment vehicle over the past few decades. But like real estate, they’re not without risks.

Some examples include:

The market could crash. This is probably the biggest fear of anyone who invests in the stock market. It’s not entirely unjustified, either. We’ve experienced a couple of crashes in just the past couple of years. Though it was short, the Dot-Com crash was deep, particularly in the NASDAQ stocks, which dropped by about 80%.

The market can go into a prolonged bear market. Though market crashes may be scarier on the surface, a long bear market has the potential to do even more damage. What makes it worse is that so many of today’s investors have never experienced that type of market and how much damage it can do.

Inflation could hurt long-term returns. There’s really good news and bad news on this front. The good news is that stocks have outperformed inflation over the long term. While inflation has averaged about 3% over the past several decades, stock returns have been close to 10%.

But the bad news is that inflation can depress stock prices over the short run. Inflation causes prices to rise, which cuts business profitability. It also puts upward pressure on interest rates, adding to the negative effect on stock prices. The long-term effect of inflation could hurt stock returns for several years.

Real Estate Returns vs Index Funds Returns

All the above advantages and disadvantages aside, return on investment is the single biggest factor in determining the desirability of an asset. And as it turns out, the returns on both real estate and index funds are very positive.

We can get an idea of the returns on real estate by looking at two different examples.

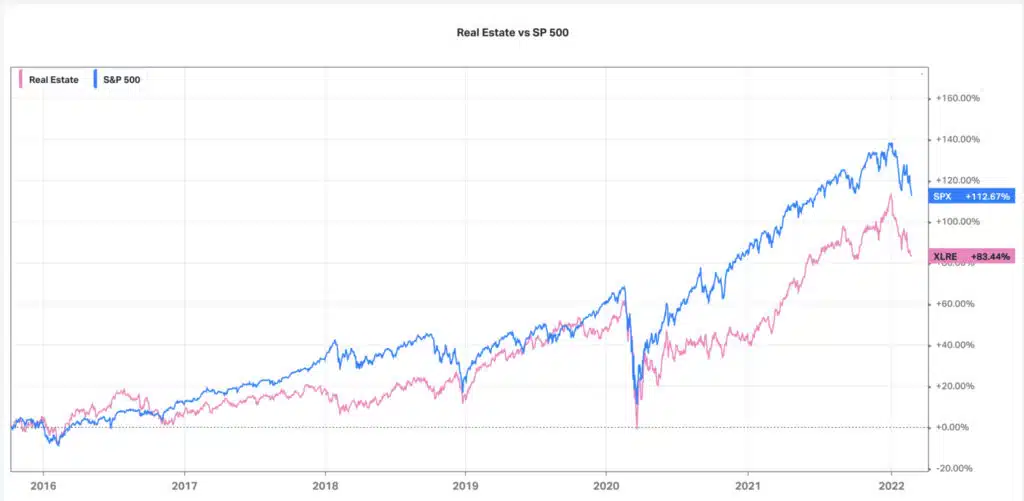

First, let’s look at the 10-year returns of the SP 500 index vs the U.S. Real Estate Index (chart courtesy of Koyfin.com):

Looking at this chart, the S&P 500 is the clear winner with a cumulative return of 112.67% compared to U.S. Real Estate at 83.44%.

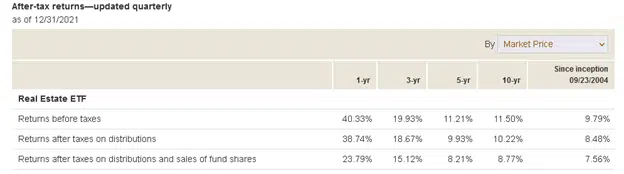

For another comparison, we can look at the ETFs of both indexes. First, let’s look at the Vanguard Real Estate ETF (VNQ). The results from that fund are as follows:

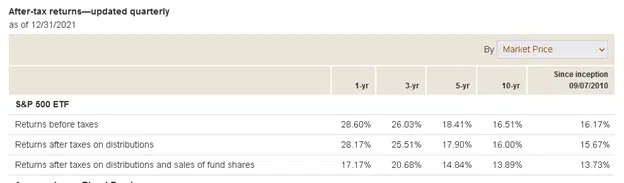

Now, let’s look at the average returns on stock-based index funds. We’ll use the Vanguard S&P 500 ETF (VOO):

When you look at the “Returns before taxes” in the first column (1 year) from each of the two screenshots above, real estate comes up as the clear winner. In 2021, it easily outdistanced stocks from 40.33% to 20.60%.

That certainly made real estate investment the choice in 2021, but what about the longer-term trend?

That clearly favors stocks. They easily outperformed real estate during the three-year and five-year terms and, most importantly, for 10 years. In fact, stocks outperformed real estate by a full five percentage points each year for 10 years, from 16.51% to 11.50%.

Unfortunately, the comparison of returns between real estate and index funds is hardly a pure play. First, there are different ways to own real estate. An owner-occupied home is only the most obvious, but there is also rental real estate, which can be either residential or commercial.

Leverage also plays a role since a property with a higher percentage of financing is likely to provide higher long-term returns than one paid for in cash.

The same is true of index funds. Since there are so many different ones to choose from, there are also a variety of returns. For example, the long-term returns on a growth fund are generally higher than they are for an income fund.

Real Estate or Index Funds – Which Is the Better Way to Build Long-Term Wealth?

Now let me get back to answering Patrick’s question more directly: Are real estate or index funds the better investment?

Based on my analysis above, the combination of higher returns over the past 10 years, greater liquidity, ability to diversify, and suitability for retirement plans clearly favors index funds over real estate.

But when it comes to investing, it’s never quite that simple. If Patrick or one of his clients (he’s a CPA) prefers the control and direct ownership real estate provides and is willing to invest over several decades, real estate could be the better investment.

But for anyone who doesn’t want to get their hands dirty with an investment, index funds are the better choice.

Personally, I favor index funds. But at the same time, I’m well aware of the importance of diversification. In a best-of-all-worlds scenario, you want to have both index funds and real estate. After all, there are certain market conditions where stocks perform better and others where real estate is the better play. If you hold both, you’ll benefit from either outcome.

But since both investment classes are so popular—and for so many obvious reasons—and are a regular part of the American wealth-building scene, you really can’t go wrong with either.

Think of it as one of those rare opportunities where you’re presented with a choice of two equally profitable investments.

Patrick, I hope I’ve answered your question or at least given you some concrete criteria to use in judging one investment against the other.

If you have a question you’d like to submit, fee free to use our Contact submission page. If you do submit a question, understand the information you provide will be included in an upcoming post. But we won’t use your full name unless you give us permission to.

I’ve been a real estate investor and S&P 500 index investor for over 30 years. I owned a mortgage company for over 30 years and did private lending at high interest rates. I’ve owned hundreds of high interest rate loan mortgages and hundreds of rentals both commercial and residential. I’ve owned the rentals in both big cities and the suburbs. I’ve done everything with real estate except develop. I’ve bought many properties at foreclosure sales and bought many properties to rehab and sell. I was one of the largest investors in property tax liens in my state and had mastered that investment so completely that I had attorneys call me for advice. I made some huge profits doing this but also failures. After looking back at my 30 year career in real estate, I would never do it again nor would I recommend anyone to do it. I was also hands on and spent many years doing drywall work, painting, carpentry and cleanup, all in an effort to maximize my profit. I did become rich but would have done much better if I had just put the money into an S&P 500 index fund, such as Fidelity or Vanguard and let it ride. I have extensive spreadsheets detailing the returns of every mortgage and property I invested in going back 30 years and compared that to the return I would have made just investing that money in the S&P 500. Not only would I have made more money in the S&P 500, I would have made more than double what I made in real estate. Now this doesn’t include the labor hours I put it because I never paid myself for that. I expected the return to be about equal but was surprised to see the return of the S&P 500 was double. I also took into consideration income taxes so my comparison was fair. The other reason I wanted to do the comparison is because after decades of doing real estate deals, I became very tired of having to pay attorney fees for litigation. This would include quiet title actions on the tax sale properties and all the eviction proceedings. I then began to represent myself in district court for the rental evictions. Every advantage is given to the tenant and this was also disappointing. Another factor is later years was how every City I was doing business with hated landlords. The cities were doing everything they could to discourage landlords so they would sell the rentals to principal homeowners. Home owners take better care of their properties than tenants and there is much less police contact. The fees these cities would charge were outrageous but the message they were sending was clear, get out.

There was also a good story done on Donald Trump, one of the most famous real estate investors in the country comparing his net worth with all his real estate deals all over the world, the casinos he owned, golf courses and very high end real estate with what he would have been worth had he just invested his money in the S&P 500. The analysis started in the year his father, Fred Trump passed away and each one of his children inherited 20 million. Had he just invested that 20 million into the S&P 500, his net worth would be considerably higher than it is now. That is something very powerful to think about. Moral of that story was that Donald Trump is rich because he was born rich. Not criticizing him, just stating the facts.

In conclusion, in my opinion and based on my extensive history in real estate, just invest your money in the S&P 500 index and forget about real estate. You don’t need the headaches.

My original analysis was based on learning what kind of return I made on real estate versus the return of the S&P 500. Based on the headaches of the real estate business I thought it wouldn’t be worth the headaches for an extra 3%. It certainly wasn’t worth the head aches for a return in the S&P 500 that was double my return in real estate.

Also did an analysis on Mark Cuban. Read an article on him where he was discouraging people from investing in the S&P 500. He thought people should be running their own business’s and making contacts. My thoughts were that not everyone is capable of doing that nor would everyone want to. Anyone can invest in the S&P 500 and the current fees charged by Fidelity and Vanguard to do so almost make a free investment. Your only paying around $20 a year for every $10,000 invested so I consider that free.

I went back and figured out when Mark Cuban first made his fortune. He did make millions selling a company when he was very young and then made almost a billion selling another company. That was decades ago. The article about his stated how he was on shark tank and always has 50 deals going on at the same time. He also owns the Dallas Mavericks NBA basketball team. I looked at what he was worth around 25 years ago and what he was worth now and had he invested his money 25 years ago into the S&P 500 and did absolutely nothing, he would be worth considerably more that he is worth now. It was even close. He also made a lot of money on the so called worth of the Dallas Mavericks from what he originally paid for them. Even with that inflated figure, the S&P 500 killed his returns on all his deals he has been doing for the past 25 years. His article was absolutely wrong.

Based on my experience and the 2 cases mentioned above. Invest in the S&P 500 over any real estate deals. What makes the S&P 500 so hard to beat is it’s diversity and compounding effect. Compound interest is the 8th. wonder of the world.

Now you might know people who think the opposite of me but if Donald Trump and Mark Cuban can’t beat the S&P 500 with their investment money, who can?

If somebody gives you different examples, they will be the exception rather than the norm. They will be the 1 tenth of 1% instead of the 99.99 %.

Once shared my argument with an older lady who made millions in what she called real estate. Seems her family owned an apple orchard for decades and oil was discovered on the land. Made millions on the oil not the real estate. Without the oil, would have been just another apple orchard.

Would be happy to communicate with anybody about my experiences.