Over the last year and a half, investors have been learning firsthand the importance of diversification. When the stock market is going up consistently, diversification isn’t usually “front of mind” for investors. That is because, for that period of time at least, inadequate diversification is benefitting you.

The problems start when the prices of stocks begin to go in the other direction. When stocks, crypto, or real estate begin to decline, a lack of diversification becomes apparent quickly.

So, if you are one of these people who has experienced significant losses based on a lack of diversification, you are not alone.

Most people have an investment portfolio that consists of stocks, bonds, and maybe real estate. However, there are many other asset classes that should be considered too.

Alternative assets refer to non-traditional investments, such as artwork, farmland, and even precious metals. While these investments were looked at as “boring” in years past, they are now booming in popularity as people diversify their money outside of stocks.

To put it in perspective, according to the Chartered Alternative Investment Analyst Association, art as an investment is a $1.7 trillion asset class.

In this article, we will specifically look at diversifying your portfolio through investments in artwork.

Table of Contents

Artwork Investing 101

First of all, before we discuss adding art to your portfolio, it’s important to understand how artwork investing works. It’s a lot different compared to stocks and bonds.

The main thing you have to understand with artwork is that the value is subjective. This means largely based on opinion. Determining the value of a piece of art is not a clear-cut process.

With a stock, you simply look at revenue, profits, and growth to determine a fair market value.

Important: Investing in Artwork

Artwork, on the other hand, does not generate revenue or profits while you own it.

The only way to make money with artwork is by selling for more than what you paid for it. It’s not a yield-bearing asset, meaning it doesn’t pay you any rent checks or dividends while you hold onto it. Appreciation, or growth, in the art market, takes a long time.

Be prepared for this to be a 5 to 20+ year investment in some cases.

Types of Art You Can Invest in

There are many different types of art that can be sold, including:

Types of Art You Can Invest In

| TYPE OF ART | DESCRIPTION | PROS | CONS |

|---|---|---|---|

| Paintings | Original or Limited Edition Artworks Created Using Paint | High Potential for Value Appreciation | Can Be Expensive to Acquire and Maintain |

| Sculptures | Three-Dimensional Artworks Created Using Various Materials Like Stone, Metal, Wood, or Clay | Can be displayed indoors or outdoors | Often Requires Specialized Expertise for Handling and Maintenance |

| Photography | Original or Limited Edition Photographic Prints | Can Be Displayed Indoors or Outdoors | Limited Potential for Value Appreciation Compared to Other Forms of Art |

| Prints | Reproductions of Original Artworks, Often in Limited Editions | More Affordable Than Original Artworks | Less Potential for Value Appreciation Than Original Artworks |

| Mixed Media | Artworks Created Using a Combination of Different Materials and Techniques | Can Be Unique and Visually Striking | Can Be Difficult to Determine Value Due to the Variety of Materials Used |

| Digital Art | Artworks Created Using Digital Tools and Techniques | Can Be Easily Reproduced and Shared | Still an emerging market, and potential for value appreciation is uncertain |

| Street Art | Artworks Created in Public Spaces, Often Using Unconventional Materials Like Spray Paint or Stencils | Can Be Visually Striking and Have Cultural Significance | Can Be Difficult to Acquire or Own Legally |

| Ceramics | Artworks created Using Clay and Fired in a Kiln | Can be functional as Well as decorative | Limited potential for value appreciation compared to Other forms of Art |

Art can be sold through a variety of channels, including galleries, art fairs, online marketplaces, and directly from the artist. The value of art is often determined by factors such as the artist’s reputation, the rarity or uniqueness of the piece, and the demand for the artist’s work.

How Much Should You Invest in Art?

Now that you have a better understanding of artwork investing as a whole let’s discuss adding art to your investment portfolio.

Alternative investments should make up a percentage allocation of your overall portfolio. Within that allocation, artwork could be one of the alternative investments you choose to invest in.

Most experts recommend allocating 15% to 30% of your portfolio into alternative investments. Others suggest as low as 2%. The perfect mix is probably somewhere in the middle.

Let’s say, for example, you have a $100,000 net worth and decide to put 15% into alternatives. That would be $15,000. However, you shouldn’t put “all your eggs in one basket” and put it all into artwork.

It would be wise to diversify your alternative investments, too. That could mean putting $5,000 into artwork, $5,000 into farmland, and maybe $5,000 into cryptocurrencies.

Keep in mind that artwork should make up a percentage allocation of your alternative investments. In turn, your alternative allocations make up a percentage slice of your total investment portfolio. It’s never wise to go “all in” on any investment or asset class.

Where to Invest in Artwork

In the past, your options for investing in artwork were quite limited. In most cases, you had to go out and buy an entire painting yourself. Another way was to purchase through art houses.

Here’s a list of some popular art houses that make it easy for anyone to start investing in artwork:

1. Sotheby’s – An international auction house with locations all over the world.

2. Christie’s – Another large auction house that sells everything from old masterpieces to modern works of art.

3. Paddle8 – An online marketplace selling museum-quality artworks by top designers and contemporary artists.

4. Artsy– A website offering works by thousands of emerging and established artists around the world, organized into collections curated by experts.

5. 21c Museum Hotels – A series of boutique hotels that feature cutting-edge 21st-century artwork, rotating exhibitions, and tours through their collections.

Today, this is completely different, thanks to fin-tech or “financial technology.” There are a few cutting-edge investing platforms that offer artwork investments through individual shares or fund investments.

Instead of buying an entire painting yourself, you own shares of one with other investors.

Here are the most popular methods for investing in artwork today:

1. Masterworks – The first platform that made buying shares of artwork possible. Get started with a minimum of just $500 and buy shares of fine art in $18 to $25 increments.

2. Yieldstreet – While you can’t buy shares of individual art here, they do offer investment funds that have exposure to artwork. The most popular is the Prism Fund, which invests in artwork as well as a number of other asset classes. The minimum investment is $2,500.

3. Public – Recently, the brokerage platform Public acquired the alternative investment platform Otis. Now, you can access all of these investments within Public. This means you can buy shares of artwork, sneakers, and even NFTs.

4. Auction House – Lastly, if you decide to buy a painting outright, you could seek out an auction house. The three most popular ones are Sotheby’s, Christie’s and Phillips.

Pros and Cons Investing in Art

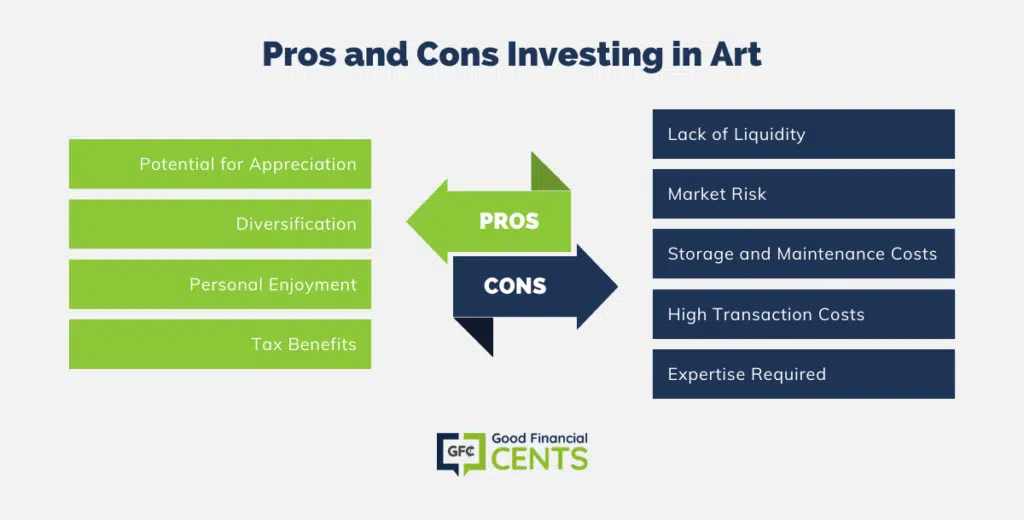

Pros of investing in art:

1. Potential for appreciation: The value of art can increase over time, particularly if the artist becomes more well-known or the piece becomes rarer.

2. Diversification: Investing in art can add diversity to your portfolio and help reduce risk by not being tied to the stock market or other traditional investments.

3. Personal enjoyment: Many people enjoy collecting and owning art for personal enjoyment, which can be a rewarding aspect of investing in art.

4. Tax benefits: In some cases, investing in art can offer tax benefits, such as the ability to take a deduction for charitable donations of art or to defer capital gains tax through a 1031 exchange.

Cons of investing in art:

1. Lack of liquidity: It can be difficult to sell art quickly, and the value of art can be hard to determine. This lack of liquidity can make it difficult to access your money if you need it.

2. Market risk: The value of art can fluctuate due to changes in the art market or the artist’s reputation.

3. Storage and maintenance costs: If you own physical artwork, you may have to pay for storage and insurance to protect your investment.

4. High transaction costs: Buying and selling art can involve significant transaction costs, such as commission fees for galleries or auction houses.

5. Expertise required: Investing in art requires a certain level of knowledge and expertise to identify and value different pieces. It can be helpful to consult with a financial professional or art expert before making any investment decisions.

Bottom Line – Investing in Artwork

Artwork has been reserved for high-net-worth investors in society for centuries. That is no longer the case today thanks to massive innovations in financial technology.

Before investing in artwork yourself, it’s important to understand the long-term nature of this asset class, as well as how returns are generated for investors.

If you want to learn more about this asset class, check out my blog, Artwork Investor, which is all about the ins and outs of buying art as an investment.

With inflation expected to be persistent in months ahead, investors may need to diversify sooner rather than later. Artwork is just one of the many possibilities for building a more durable portfolio through alternatives.