The idea behind FIRE is if you can earn more money, live on less, and save and invest the rest, you can cut years — or even decades — off of your working career. Of course, the FIRE movement has its problems.

Not everyone can save 50% or more of their income to work toward FIRE. And most who retire early continue working in some capacity to avoid running out of money early.

Also, achieving FIRE is considerably easier during times of economic prosperity — no matter what anyone says, it would’ve been a lot harder to get excited about FIRE in 2008 when the Dow dropped by 33.84%!

I’ve learned that there are benefits to cutting expenses, saving money, and investing more. Some advantages to FIRE don’t even have anything to do with money at all.

Achieving FIRE and retiring early sounds good in theory, but it’s actually very hard to execute in a real-world sense. But here’s why you should try anyway.

Table of Contents

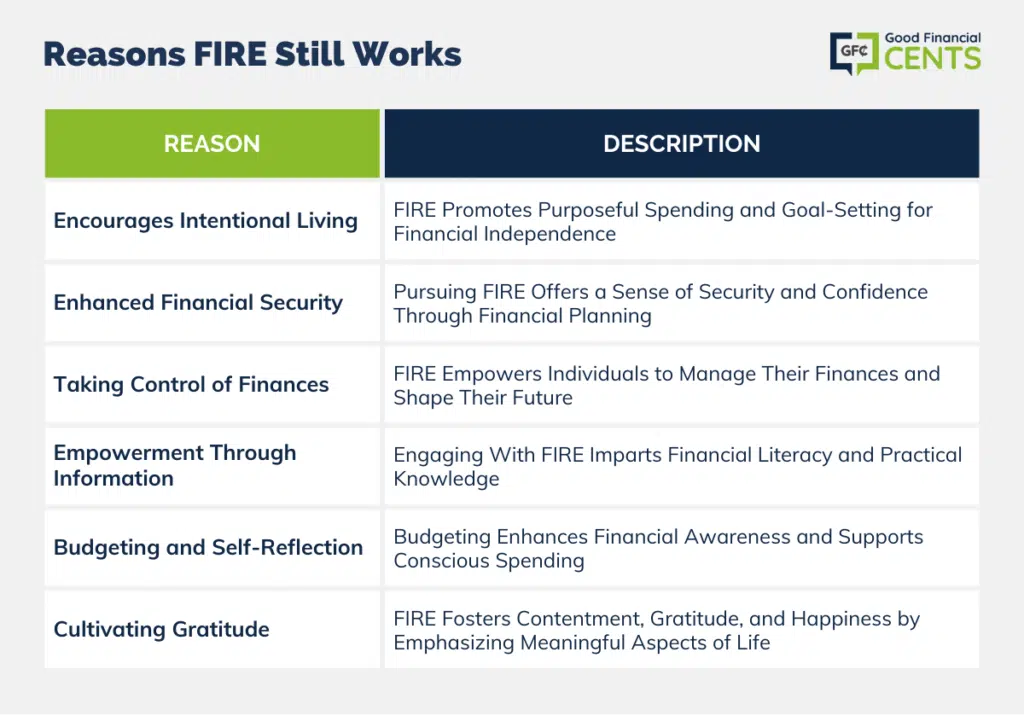

6 Reasons FIRE Still Works

But, you know what? I would argue that anyone who can should at least try to pursue FIRE anyway. As I’ve become more interested in financial independence, I’ve learned that there are side benefits to cutting expenses and learning to save money and invest more.

Some advantages to FIRE don’t even have anything to do with money at all.

If you’re on the fence about FIRE, here are some of the reasons you might want to change your way of thinking and get on board.

1. Encourages Living With Intention

After reading Michael Hyatt’s book, Living Forward, its concept of “drifting” stuck with me. Drifting occurs any time you’re going through the motions in life, but living without any concrete plans or goals.

Maybe you’re going to work every day, taking care of your kids, and keeping up with bills. But in these day-to-day tasks, you’re not actively achieving anything in particular.

You’re just waking up and getting by.

With the FIRE movement though, you learn to live with intentionality because you’re forced to focus on your spending, and the specific goals necessary to reach financial independence.

As you pursue FIRE, you can’t simply drift through life in hopes that the numbers work out in your favor. To have enough money to retire early, you need a plan. You have no choice but to set goals, and the act of doing so forces you to get real about how you’re living and what you really want in life.

Are you saving to buy a house? Are you saving to pay for college? Are you saving to retire early? Whatever your goals are, FIRE forces you to reverse engineer your long-term plan so it’s actionable and intentional today.

2. Feels More Financially Secure

Here’s another potential side benefit of pursuing FIRE — you get the opportunity to feel more secure and sleep better at night. This is something I personally experienced when I started becoming FIRE-minded, but it’s also backed up by research.

In fact, a 2021 survey from Schwab showed that 63% of people with a written financial plan said they felt financially stable, compared to only 28% of those without a financial plan. Further, 56% of people with a financial plan said they felt “very confident” about reaching their financial goals.

If you’ve ever felt helpless about your finances before, then this probably makes total sense. Having a plan provides some comfort — even if you are far away from your goal. At least you’re working toward something, and that provides peace of mind.

3. Forces You to Take Control

I don’t always agree with everything Dave Ramsey says, but I do love some of his best quotes. One example is:

“You must gain control over your money or the lack of it will forever control you.”

— Dave Ramsey

The point I’m making is that, if you don’t ask yourself important, uncomfortable questions, you might never get control of your finances — or your life.

Think about it this way. If you’re drifting through life and spending money without really saving for a goal, you’re at the mercy of your job and outside factors that affect your income and savings.

But if you learn to take control of your spending, you’ll also learn to take control of your future finances in ways you probably never realized before.

When most people start pursuing FIRE, they realize right away that the biggest part that’s in their control is their spending. The other side of that coin is, of course, how much you’re able to save.

A recent survey from the Federal Reserve Bank of St. Louis shows the average American set aside 5% to 8% of their income in savings. In contrast, those who pursue FIRE, frequently save 50% to 70% of their incomes toward their goals.

When you find a way to save a large percentage of your income, this means you’ve taken control of the reins. You have goals and you have a purpose, and your money is no longer controlling your future. You are.

4. Empowers You With Information

According to a joint study from PwC US and the Global Financial Literacy Excellence Center (GFLEC) at George Washington University, only 24% of millennials demonstrate basic financial literacy. And, even with minimal knowledge of their own, only 27% had sought out professional financial advice.

This is one area where even studying FIRE can leave you dramatically ahead. After all, pursuing FIRE or even reading about it forces empower you with information about saving and investing for the long haul.

For example, through FIRE you’ll randomly learn personal finance lessons like the 4% rule for retirement and how to create a budget. These are cornerstone concepts of the FIRE movement.

You’re also forced to think about your income and your financial situation in a brand new way. This includes questions, like “How much are you actually earning?” and “How much interest are you paying toward debt every month?”

As a financial advisor, I can tell you for sure that a lot of people don’t know the answer to any of these questions because they’ve never thought about it before. You wind up learning so much that can help you along the way toward your goal.

5. Learn How to Budget and Question Yourself

I remember back in the day when my wife and I first started getting serious about budgeting. We’d sit down to look over our bills and were shocked by some of our ongoing expenses and subscriptions.

These budgeting “meetings” made a big difference in how we worked together to achieve our financial goals. When we sat down to look over our expenses, our income, and where we were headed, we found ways to spend less without affecting our quality of life.

Now, I hate budgeting, but I do think it’s an important part of pursuing FIRE — especially at first. After all, you can’t really work toward major financial goals if you have no idea where your money is going every month.

And, the thing is, you can’t really argue anything when you start budgeting and tracking your expenses. You get the chance to see where your money went, in black and white, and you get the opportunity to act accordingly.

This may sound like a huge buzzkill, but I’ve found that taking control and budgeting is actually really empowering.

Crazily enough, not enough people have any idea how they spend the income they work so hard to earn. In fact, a recent survey from the budgeting app Mint found that 65% of respondents had no idea how much they spent last month.

When you ask someone pursuing FIRE how much they save each month, these people know. In fact, they often know their savings amount down to the penny.

6. FIRE Helps You Be Grateful

Finally, there’s one more major benefit of FIRE that goes largely ignored. I’m going to call it the “contentment factor”. It’s the ability to be content with what you have.

Everything involved with FIRE — tracking your spending, cutting things you don’t care about, creating long-term goals — can really put your life in perspective for you. It also makes you realize you might have more power over your life than you realized. That’s a pretty amazing lesson.

And of course, learning contentment leads to learning how to feel grateful. How amazing is it that, in this broken world we live in, you can earn a living, care for your family, and set aside something for the future?

How amazing is it that you have the chance to work hard and retire early, and then spend decades doing whatever it is you love?

This brings me to a quote I love from Oprah:

“Be thankful for what you have; you’ll end up having more. If you concentrate on what you don’t have, you will never, ever have enough.” ―

Oprah Winfrey

This is what I love about FIRE; it really encourages you to be grateful and teaches you to be content with what you have. After all, there is no way you could ever save 50% or even 30% of your income without these lessons.

Pursuing FIRE teaches you that you don’t need the hottest pair of sneakers and that you might not need that cable television package you pay for each month. It teaches you that a huge car payment isn’t worth it and that any “friend” who judges your car probably isn’t a good one.

Learning about FIRE makes you ask yourself all of these questions, and sometimes, that’s all it takes to realize how good you have it.

Garth Brooks once said, “You aren’t wealthy until you have something money can’t buy.”

And perhaps that’s the greatest benefit of pursuing FIRE. You learn that happiness and true contentment come from within. And that, my friends, is priceless.

Final Thoughts on 6 Reasons to Try the FIRE Movement

The FIRE movement suggests earning more, spending less, and saving for early retirement. Challenges exist, yet pursuing FIRE offers valuable lessons.

Benefits include intentional living, enhanced financial security, taking control of finances, improved financial literacy, effective budgeting, and fostering gratitude.

Pursuing FIRE can lead to contentment and realizing the value of non-monetary aspects of life. Despite difficulties, attempting FIRE imparts valuable insights and attitudes toward financial and personal well-being, promoting mindful living and a sense of fulfillment that transcends monetary measures.