There comes a time when minors, senior citizens, or disabled persons might need someone to manage their money. In these cases, a guardian will be appointed by the court to control guardianship of the individual’s accounts.

While you want to think that everyone who is appointed a guardian of an account is trustworthy and will manage the accounts ethically and wisely, that is not always the case.

That is why there are rules governing the control of guardian accounts. From who has access to the account, to who owns it, and how money is spent, courts monitor these accounts.

Table of Contents

Children and Guardianship Accounts

Children are not legally allowed to open a bank account or manage their own money in an account. Sometimes a parent or guardian might jointly open an account for a child to save money for college or to just help to teach the child about saving.

In this case, the parent is the actual owner of the account has control over the money, and may do what they wish with the funds.

This is different than a guardianship account. With a guardianship account, the money does belong to the child. The guardian of the account manages the money for a child but doesn’t have any ownership over that money.

The most common reason for a child to have an account with guardianship is that the parents are deceased and have left money or property for the child and someone, the guardian, needs to control that account until the child is of legal age.

Elderly or Disabled Individuals and Guardianship Accounts

Sometimes adults do not have the physical or mental capacity to manage their finances and a guardian needs to be appointed. As with children, the guardian does not gain any ownership of the person’s finances, they just manage the account.

The court chooses an appropriate guardian for someone who has been deemed unable to manage their finances.

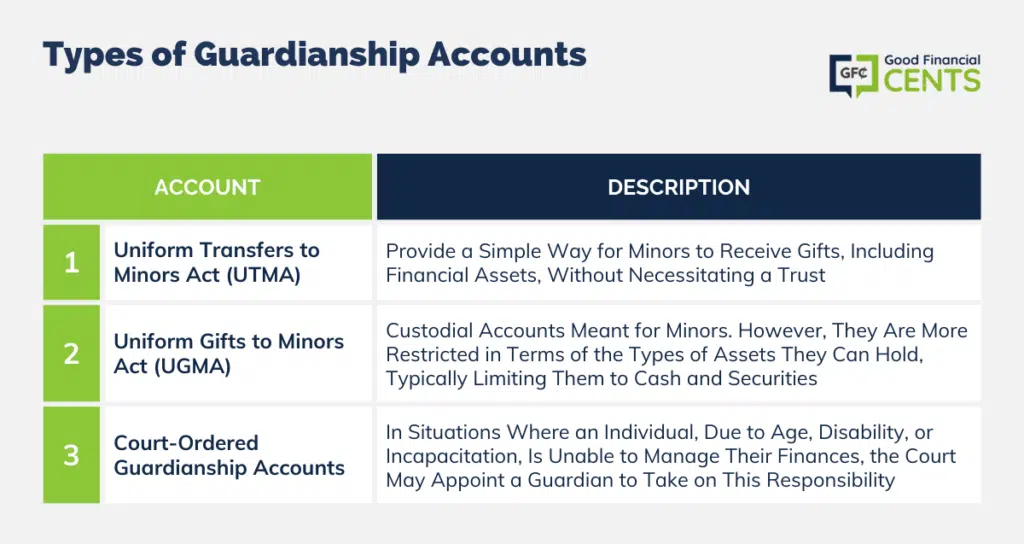

Types of Guardianship Accounts

Guardianship accounts can be broadly categorized into several types, each serving specific needs and situations.

1. Uniform Transfers to Minors Act (UTMA) Accounts

UTMA accounts provide a simple way for minors to receive gifts, including financial assets, without necessitating a trust. The custodian, who could be a parent or a legal guardian, manages the account on behalf of the minor until they reach the age of majority.

2. Uniform Gifts to Minors Act (UGMA) Accounts

UGMA accounts, like UTMA accounts, are custodial accounts meant for minors. However, they are more restricted in terms of the types of assets they can hold, typically limiting them to cash and securities.

3. Court-Ordered Guardianship Accounts

In situations where an individual, due to age, disability, or incapacitation, is unable to manage their finances, the court may appoint a guardian to take on this responsibility. This type of guardianship account is strictly regulated to protect the interests of the individual in need.

The Rules and How It All Works

As mentioned, the guardian of an account controls the funds and must report all receipts and disbursements to the court on a periodic basis. The guardian handles the account but has no ownership of the account, meaning the money or property in the account.

- All guardianship accounts have a beneficiary or a “ward”, usually a child, elderly, or disabled individual.

- The guardian of the account cannot appoint a beneficiary of the account. In other words, the guardian cannot change who the account is for and who receives the disbursements.

- In order to open a guardianship account, the guardian must show a certified copy of a court order appointing them the guardian of an individual’s account.

- If an individual can no longer serve as guardian of an account, because of death or some other reason, the court will appoint a new guardian for the account.

- Because the guardian does not own the funds in the account, the money can not be used to settle the debt of the guardian – meaning it can’t be garnished or seized.

Duties and Liabilities of Guardians

The guardian’s role is pivotal, and it comes with a set of responsibilities and potential liabilities.

1. Prudent Asset Management

The guardian is expected to manage the assets prudently, making sound investment decisions to ensure the safety of the principal while also aiming for growth.

2. Transparent Reporting

Regular, transparent reporting to the court is crucial. The guardian must detail all receipts, and disbursements, and provide updates on the status of the investments.

3. Avoiding Conflicts of Interest

Maintaining a clear boundary between personal finances and the guardianship account is paramount. The guardian must avoid any investments or decisions that could potentially benefit them at the expense of the beneficiary.

4. Ensuring the Beneficiary’s Well-being

The guardian is tasked with using the assets in the account to cater to the beneficiary’s needs, following the guidelines and stipulations laid out by the court order.

Safeguarding the Beneficiary’s Interests

The system has built-in checks and balances to ensure the ethical management of guardianship accounts.

1. Strict Court Oversight

Courts play a critical role in monitoring guardianship accounts, ensuring regular reporting, and providing oversight to protect the beneficiary’s interests.

2. Clear Ownership Boundaries

The assets in the guardianship account belong solely to the beneficiary. The guardian has control but does not have any ownership rights, ensuring that the beneficiary’s interests are paramount.

Practical Aspects of Managing Guardianship Accounts

1. Opening and Closing Accounts

To initiate a guardianship account, the guardian needs to present a certified copy of the court order that appoints them as the guardian.

If a guardian is unable to continue their duties, or if the beneficiary reaches the age defined by the court for asset transfer, the court will intervene to either close the account or appoint a new guardian.

2. Protection from the Guardian’s Debts

The assets in a guardianship account are shielded from the guardian’s personal debts, ensuring that creditors cannot seize these assets.

3. Prohibition of Unilateral Decisions

Guardians are not allowed to change the beneficiary of the account or make decisions that serve their interests at the expense of the beneficiary.

Conclusion

Guardianship accounts are essential tools that play a crucial role in safeguarding the financial interests of minors, senior citizens, and disabled individuals.

Understanding the various types of guardianship accounts, along with the responsibilities, liabilities, and protections in place, is vital.

This ensures that the accounts fulfill their intended purpose, providing financial stability, support, and peace of mind for those who need it most.

By adhering to strict rules and maintaining transparency, we can uphold the ethical management of these accounts, ensuring that the assets are used solely for the benefit of the individuals they are meant to protect.

My mother has been receiving a monthly bank transfer set up for her by her brother 4 years ago. It is a permanent arrangement he set to help with bills and other expenses. The transfer has been received without fail every month until this month, April 2023, after mom’s sister came to see her. When the transfer didn’t arrive she had it and as their brother is now incapacitated his son has been appointed guardian and must have access to mom’s bank account and records before he will release allow the transfer. Is this legal? Mom depends on the transfer to survive

Hello. My son has a CD that has a court hold for guardingship. He is 18 and we are unable to get the funds moved. The cd matured already and has since rolled over. How can I get my son’s money out?

What is the court telling you? Sounds like without a court order the money will stay in the CD.

I am one of 3 guardian’s. for minor children. They were left annuities by their deceased father. We have court order specifying the above and giving the guardian’s the ability to act

I independently.

We are having problems find a bank that will open an account and we don’t know why. Any suggestions?

If someone (one parent) applies for guardianship is the other parent contacted? Virginia

I am a Full guardian and I pay his bills – my son will build a bathroom with his money a barrier free bathroom without paying my son. Can he do that? and do I have to get a lawyer to give his car title to his grandson (not really his grandson) he can’t drive anymore so he wants to give it to my grandson.

CAN I APPLY ONLINE APPLICATION TO A GUARDIAN COURT FOR GRANT OF LEGAL GUARDIANSHIP CERTIFICATE IN THE CASE OF MENTALLY ILL BROTHER CERTIFIED WITH 70 % DISABILITY BY MEDICAL BOARD.

How do i know if there a accout open for my grandsn0

How do I get reimbursed for the guardian account – I hold onto the receipts and I live with him and take care of him. It’s easier to use my credit card when I am out because some places do not take checks or I have left the checks at home. I handling my bills and I moved in with him but I still have my house so I am paying his bills and mine.

Hi Daryel – Discuss it with the trustee who holds the account. It really depends on the trustee rules, the state where the account is held, and any rules particular to the guardianship account when it was established.

Are there rules for how the name of the guardianship account must be printed on the checks used for the account?

Hi Miggie – Yes, but the bank should be able to help you with that.

I am legal guardian to my 20-year-old son who has autism, is non-verbal and has limited cognitive abilities. I applied for SSI for him and recently received his first check. I want to open a bank account in his name for every day expenses like clothes, outings, etc where the SSI funds will be deposited and can easily be kept track of. I looked into opening a PA Able account, but the expenses that the funds can cover are restrictive. I was reading about a guardianship account, but I am not sure where or how to open one or how it will affect his SSI payments. My son does not have a photo ID, which I’m concerned can make this process more complicated. Any advice would be appreciated. I want to do this the right way. Thank you in advance.

Hi Angie – I’d sit down with a bank and see about the rules pertaining to a guardianship checking accounts. The rules can vary from state to state or even from one bank to another. Failing that you may want to talk to a lawyer. You might need some sort of formal document drawn up, if that will solve the problem.

I have a quardianship chase bank account for my friend (it’s legal) so how do I take care of his daily needs. Sometime I buy diapers on my dime or get him a hair cut. The bank won’t give me a debit card but I understand why.. How do I handle that.

Hi Daryel – As guardian you should have access to the funds. Sit down with the bank and ask them how to handle this. Maybe they won’t give you a debit card, but they might set up a reimbursement system, where you submit reports and receipts of spending.

Ok I will do that.

I was appointed guardianship over my mother. When she died I had a lawyers office do the final accounting. A bill was sent to my brother who is executive of her estate. He will not pay the bill unless he gets the final accounting and he can see what her money was used for. Why would he need this when I did the work for three years and what the money was used for was her care. She was in a nursing home for a big part of it. He received all the annuities and bak accounts which was all she had. I sold her house and the total check went into an account which he got. Well he wants to close the estate and he had to do a final accounting and I will not sign the waiver due to him not paying that bill. He says when he gets the accounting he will pay the bill but then he makes comments he won’t pay it. What is the deal. If he wanted guardianship he could have had it. It was a lot of hardwork and stress which he came to see her six times. Should I just pay the bill and forget it.

Hi Barb – It sounds like you did all the care work for your mom and your brother got all the benefits. I’d let him pay it. Attorneys have a way of making people pay. But if it’s not a large amount, you have the money to cover the bill, and you just want to get on with your life, do what you think will work best for you, not your brother.

Hello, I am over my 20yr olds guardianship and I have been granted a sum of money for his vehicle and school supplies. Will he have to be present in order for me to receive the funds eventhough he didn’t sign off on any of the bank forms? We are in Mississippi…

You’ll have to check with an attorney in Mississippi. Since he’s over the age of majority, he may need to be on board. But please check with an attorney. I don’t know what the particulars are of the guardianship arrangement.

I am the legal guardian of my elderly brother how suffered a head injury about 35 years ago. My question is can I take over the trust account and manage it myself?

Hi Raul – Another good question for an attorney! It depends on the laws in your state, which a local attorney will know. Just make sure he or she specializes in guardianship situations. Also, you said your brother has a head injury, but is he considered legally competent to make the change – assuming he created the trust?

My son now has guardian over his deceased brothers 14year old son, can he use money from the life insurance, which was in the child’s name to pay for the lawyer he had to get to be guardian

Hi Susie – That’ entirely a legal question. My guess is that since the attorney is required for the guardianship situation, he’ll be OK using the insurance money. But please consult with an attorney, preferably the one who helped establish the guardianship. The funds have to be used for the benefit of the guardian, so I think he’ll be OK. But please double check with the attorney. I’m not a lawyer and I don’t know the rules in your state.

my father and his second wife both have wills with living trusts. The will states upon the death of one spouse, gifts will be left to their children and the balance remains in the trust as a marital trust until the second spouse’s death. the wife became incompacitated due to dementia and her son got court appointed guardianship He just passed away. because a guardianship account was set up does that not break the marital trust invalid as hers changed but his didn’t?

Hi Dee – Wow, that’s a complicated situation, to say the least. You need to discuss this with an attorney who specializes in guardianship situations. There are too many potential outcomes here, as well as the possibility of litigation (not to scare you, but it’s the kind of thing that happens when money is at stake).

Hi my name is Amanda and I am my so s Guardia of his account he is 3 but needs major surgery and I don’t have the money for . Is there any way i could pay the bill out of his money ?

Hi Linda – Guardianship accounts typically let you use the money in the account for the benefit of the child. Check with the bank and see how you can go about it. You may have to provide documents proving the need for the surgery, but that’s just a guess.

My minor daughter’s father passed away years ago and a guardianship account was set up at my bank for her, listing me as a guardian. I know to withdraw money I need permission from the judge. I am purchasing a home and one of the requirements states I must show an account in my name with “excess funds”. Am I able to list this guardian account on paperwork when purchasing a home? Money will not be transferred or removed from this account. It will just be to show the amount of money sitting in the account. I will pay all home purchasing fees from my personal checking account. We are in Illinois.

Hi Chrystal – I think you’re referring to cash reserves for a mortgage – money you have to show, but not use in the purchase. You’ll have to find out if that’s acceptable to your mortgage lender. It’s not really a legal question.

I am my mother‘s are limited guardian my sons went to guardian is 24 years old I am responsible for all his money is as representative payee and Social Security account and also the trustee under the special needs trust. My ex-husband has had nothing to do with my son for 20 years he abandoned him he has no custody never had any custody is not a guardian is not in the trust whatsoever except etc. and I have just learned that he has been taking checks that are his mother has been sending my son for his birthday and cashing them or doing whatever he’s doing and if fiduciary matter and I believe that’s Firstly against the law… By the way I reminded him before he did it that he was not allowed to do that I didn’t want him to do it I didn’t know how is going to handle the money is yet except etc. he is not in a legal position to handle any financial documents of my sons or cash checks etc. etc. he’s not on any of the accounts what agencies can I contact you can’t have him arrested or whatever needs to happen please advise

Hi Jody – You can try filing a police report, but I’m not sure how they’ll handle that. You may have to speak with an attorney and find out how to proceed. The laws are different in each state.

Hello. I live in Florida. I am a healthy widow, 76 years of age, and the legal guardian of a Great Grandson, now age 13. My only child cannot handle money, and I have nobody at this time to list as a Power of Attorney on a Will. What would be my best option of having a Will set up and somebody, personally unknown to me, that could act as a Power of Attorney if needed? Any suggestions would be helpful.

Carol Johnson

Hi Carol – You really have to sit down with an attorney and make this decision. Since it will be a non-family member, it may need to be an institution. You’ll need help in making that decision. The bright side is that your great grandson is just 5 years away from adulthood, so it’s really a temporary problem. But you want to make sure you get it right, without causing long-term problems for him. That’s why you need professional advice. You may need to set up a trust rather than a guardianship account, but that’s for you and your attorney to decide.

I have legal guardianship over my nephew whom is grown but have a permentaly disability. My sister which is my nephew mother died April 19,2016 in a car accident and in her will I a was appointed gurdian over my nephew and following me was his sister. After the settlement of the lawsuit against trucking companies that hit the vechile my sister was in the lawyers us still holding my nephew 9 hundred thousand dollars claiming the father which gave up his rights to my nephew when he was born is now over his money and I nor his sister other my nephew hisself can get his money. The lawsuit case was closed in December of 2017. What can I do?

Hi Gladys – Wow, that’s entirely a legal matter that I’m not qualified to answer (nor do I have one). For that kind of money, you might want to talk to another lawyer and get a second opinion. Or even a judge if you can.

Ok thanks

Greetings, my name is Rosemary,

The process of opening a guardianship related bank account seems uncommon for a situation involving the elderly.

Is it a common service offered by most financial institutions?

My mom is still alive and with us, she simply is unable to conduct any business because of her dementia.

The courts are requesting that I obviously open a guardianship related bank account, and I am certainly willing to comply.

Any recommendations regarding what should be my proceeding steps?

Many thanks in advance,

Kindly,

Rosemary B

Hi Rosemary – It sounds like you’re already at the point of needing to do this, if the courts are making the request. You need to sit down with a bank if it’s just one account, or a lawyer if it’s several. There are other considerations where a lawyer can help such as creating a living will.

HI my son will be19 in may he wanting enrolling in air force he has ADHD disability bad has problem with handling money , saving money paying bills ,responsibility wanted to get guardian ship over his military check until he learn how manage his own money and take care of his self is that possible

Hi Ionda – I don’t think that’s possible. But you might have it direct deposited into an account that you control. You can then give him money as he needs it without turning the whole amount over to him.

Dear friend. My grandma had a guardianship account set up for my son .. she passed away , so I went and tried to have the account switched to my name because my son is 13. The bank told me I need a guardianship paper in order

To get access to the account. It’s not set up through court that she has a guardianship account for him , so how can I get access to this account and will I be able to use the funds.

Hi Meechie – That’s really a legal issue, not a financial one. Please consult with an attorney in your state to determine the best course of action.

We had a settlement with and put money away for our children. They way it was structured was so we cannot even borrow against it. We are trying to pay our children’s back school bill so they can register and are trying to figure a way to get the money. Any ideas?

Hi Dan – It sounds like you made the account so airtight that you can’t access it. Usually, you can access the funds if they’re used to pay for the kid’s expenses. But you should check with the account trustee to see what your options are. Failing that, you may have to speak with an attorney to see if the laws in your state provide any options.

MY DAUGHTER WAS KILLED A YEAR AGO IN CAR CRASH SHE DID,NT HAVE ANY DEBTS SHE DID NOT OWN ANYTHING BUT SHE DID HAVE A QUIT CLAIM DEED FROM HER DECEASED HUSBANDS MOTHER FOR THE HOME SHE LIVED IN @ THE TIME OF HER DEATH BUT SHE NEVER FILED IT SHE JUST KEPT IN SAFE PLACE FOR OVER A YEAR THEN SHE GOT KILLED BUT SHE ALWAYS TOLD ME WHERE IT WAS BUT MY ? IS CAN I HAVE THE MOTHER N LAW QUIT CLAIM TO ME AND THEN SALE AND PUT MONIES IN A TRUST FUND FOR THE 4 REMAINING CHILDREN , I CALLED THE COURT HOUSE AND THEY STILL SHOWED THE MOTHER N LAW OWNED BUT HAS NOT HAD TAXES PAID IN ALMOST 3 YEARS AND I DO NOT WANT THE STATE TO SALE FOR TAXES WHICH THEY CAN IF NOT PAID BUT MY LAWYER FRIEND OF 27 YEARS IS TELLING ME THAT I AM NOT ALLOWED TO BE OVER HER PERSONAL THINGS AND I WANT TO KNOW WHY NOT ……………………THX !!!!

Hi Tamathy – That’s a legal question that I can’t help you with. It also depends on the laws in the state where you live. It is true though that if the quit claim deed was never filed with the court house. As far as the court is concerned, the mother-in-law is still the owner.

Now since you want to sell the house and use the proceeds to provide for the children, perhaps her mother-in-law will cooperate in transferring the deed for the benefit of the kids. As well, if you offer to pay the back taxes, you may be getting her out of a jam. Since mom-in-law is still the owner, the tax lien is against her.

If you’re not satisfied with the advice that you’re lawyer friend gave, get another opinion from a different lawyer. But my guess is that you’ll have to work this out with the mother-in-law.

My 15yr daughter’s dad was killed.She has about 18,000.00 in life insurance.My question is other than a restricted bank account or surety bond,are there other options in order for her to access her money for things she needs now or up until she’s18..What would be legitimate reasons for requesting funds since they are saying you cant use it for things such as food and clothes,which is so crazy being that if her father was alive,he was obligated to help provide for her.

Hi Tera – I’d check with an attorney in your state. Laws are specific to each state so the answer might be a little bit different in each state.

I was legally appointed guardianship to raise my husband son whose mom was in a fatal car accident…at the time he was in the 3rd grade…my husband hid the fact that his mom had a large insurance policy for them that my husband was the beneficiary of..the childs biological grandmother got a family member in the courts to give her papers to oversee the money in the account that was for raising the child.because my husband faced life imprisonment…..they teamed up together and kept this a srcret from me for years..i suffered financially for13 years raising my son..he is 21 now..do i have any rights to the guardship money that was already spent for me to raise my son..p.s when he turned 18 he left my home and went to live with his biological family but he ended up in trouble over there and is now incarcerated…i feel so hurt and betrayed..what are my rights at this point

Hi Erica – You did a truly selfless thing raising your husband’s son, so please at least feel good about that. As to any rights to the money that was hidden from you, you need to contact an attorney in your state to see what the laws are and what recourse you have. Unfortunately, if they’ve already spent the money, and they have no money otherwise, there may be no money left to get.

Which institutions will allow a guardianship CD to be opened; I called Capital One today as well as Goldman Sachs and they both stated they do not offer guardianship accounts.

Hi Andrea – I’m surprise to hear that Capital One won’t. Try local banks in your area, they commonly do offer guardianship accounts. You might also try some investment brokerage accounts.

It has just come to my attention of a situation that I need some guidance on. A mother of a completely disabled person (now age 52) has opened credit cards in the disabled persons name, listing herself as guardian (which she is). The disable person is completely incapable of paying this debt of roughly $40,000 , and she (the guardian) is unable to pay this debt as well. What happens to the debt? There are two adults that will assume guardianship once she (the mother) is unable to continue the role. Will these two people become responsible for this large debt?

Hi Nancy – That’s an EXCELLENT question for an attorney – which I most definitely am not. Just an opinion here, but I don’t see how the two succeeding guardians can be held responsible for debts they didn’t create, but it is possible the debts will transfer with the disabled person. But I think a complication here is that the debts might have been taken in the name of a person who lacks the legal capacity to enter them, and that’s why an attorney is necessary.

My dad and I just received our official commission as co-guardians for his incapacitated sister. She is in an assisted living facility that she direct pays for. We need to take care of her outstanding bill asap.

We are in New York and are having a difficult time finding any bank that will open a bank account for her with us as co-guardians. She has significant funds that we need to put into this type of account. Any ideas of which banks offer guardianship accounts in New York?

Hi Christine – I don’t, but you should locate an attorney who handles guardianship cases and might be able to recommend on. You might also check with some large banks, like Chase and Citi to see what they recommend. But if your aunt has substantial assets, you might want to get an attorney involved in the process anyway. You may need to protect your own rights in the arrangements, as well as to be fully aware of your legal rights and obligations.

My question is, if the Aunt/Sister directly pays for her assisted living situation, why does she have an outstanding bill. Being guardian/co-guardian does not entitle one to the “large assets” of the Aunt/Sister, which can be tempting. The guardian/co-guardian have to follow the guardianship rules and make yearly reporting, so the court can be sure the funds are used for the benefit of the Aunt/Sister and not for the benefit of the guardian/co-guardian.

Hi Deb – We don’t know the specifics, but I’m guessing that it means that Christine and her dad must write the checks, since the aunt is not capable. But that’s just a guess.

My mother in law left our two children some money. My husband was the executor of her will. It was to be put into a bank account. I saw yesterday the guardian on the account is only in my husbands name. Why would he not have both of us as guardians on our childrens account? Am I wrong feeling this way?

Hi Jean – I certainly understand your concern, but have you asked your husband why he did it that way. Maybe the will stipulated he be the guardian. Whatever the reason, only one person can be a guardian on an account (I’ve never seen two names on a guardian account), so maybe the better question is why your husband made himself guardian on both accounts, rather than setting up each of you as guardian for one child?

I need to know why when I am legal guardian of my own son do I have to get guardianship papers to close a savings account for him his grandmother opened with his name. Unfortunately she passed in an auto accident and my husband became executor of her estate. So why isn’t different than us just being able to go and transfer his funds to another savings account.

Hi Darlene – I’m the wrong guy to ask that question! It sounds like a complication of guardianship laws in your state, and you should consult an attorney on how to proceed. That said, I fully agree that it seems like a convoluted arrangement. You’re the guardian of your son, and your husband is the estate executor, so there has to be a way to do that that won’t violate some legal provision.

my husband and I have co-guardianship over our son who is 38. my question is he was able to change his checking account without our signature and I was wondering could I close his checking account even though my name is not on account. he has been diagonised with bipolar in 2007

Hi Velma – That’s really going to depend on the laws in your state. If the guardianship is total, you may be able to close out the account. But since it’s in his name alone – this is where it gets really complicated. You can contact the bank (be prepared to present legal documents establishing the guardianship), but you may have to meet with an attorney.

Do you know if the Guardian needs to have an attorney for the life of the guardianship for tax purposes?

Hi my daughters father got into a helicopter accident and the settlement was really low of 32k. Right now I received guardianship of her money. I think is such a low sum besides that he left with a life insurance 125k that I fooze I want to know how can I get these funds liquid to help me with her up bringing after I lost everything when I lost her father?

Me and my Ex got guardianship of my niece. My Ex is a financial adviser and has always used that for an excuse to not share accounts and she could hide money. Well now she does the same thing on nieces accounts. I can only deposit money. She says because she is a financial adviser my name cant be on the account. Is this true?

Hi Sherry – That’s an outstanding question for an attorney. And given the other party’s history of hiding money and not sharing accounts, I think you need to retain one. It’s your niece, and the person in question is your Ex, so this is a legal matter. The laws in your state will have a major impact on how this plays out. Seeking opinions – including mine – won’t offer much help in this case.

One more question that I think is really important – Did your Ex become your Ex before or after guardianship was awarded to her??? (This is another reason why you need legal counsel.)

Hello, I am a 2o year old from Indiana and when I was six years old I was hit by a car and broke my femur. The person that hit me payed for my medical expenses and such, but there was money left over from it all, for grievences, I suppose, and the extra was set up in a gaurdianship account as me as the beneficiary. Due to my parents lack of credit no bank would open an account for them so our lawyer was kind enough to help my parents get through all the loop holes. I was always told when I turned 21 I would have access to these funds myself. Now that day is almost upon me and I have no clue how I am susposed to go about gaining access to it. I tried calling the lawyer but I get brushed aside and told to wait for him to call since “it’s such an old case file.” What can I do?

Well, my daughter’s father was killed and she received a large insurance settlement which was set up in an annuity. There was a lump sum placed in a guardianship account with limited access. Also, an annuity interest check was sent to me as guardian of the estate of my daughter monthly. I was told by the lawyer, before receiving any funds that I could do with the annuity interest as I please and it was not placed in the guardian account. I have not filed accounting for these funds for over 9 years and have used the money to maintain standard of living. Now I am finding out that I could be prosecuted for this and may have to pay the funds back, which would bankrupt our family. I in know way would have kept the money had I known that it was supposed to sit in an account. To say that now sounds naive but I was 25 when this all took place and this is the first time any accounting has ever been requested (and I have been filing accounting for the other account every 2 years). I am scared and feel like I was misled or the checks were not worded the way that was originally agreed. My lawyer also tells me that he now may be a potential adverse witness so I need to seek other council. Please advise.

This is such an old question, 11/8/11, but I will offer my comment for anyone else in this situation. To prove the money was spent for the benefit of the daughter, all you need to do is produce receipts for normal living expenses, i.e. rent, mortgage, taxes, insurance, utility bills, food, clothing, etc., that add up to the amount of the annuity interest. This is assuming that the daughter also lived in the house and used the utilities, food, etc. Banks keep a record of bank accounts for years, so you should be able to get copies of these records that normally show where, when, to whom, and the amount of money that was spent from that account. The only problem I foresee is if cash is used to pay bills.

Hello.. We are from Indiana. About 7 years ago our son was involved in an auto accident with his grandmother. We were not sure of how to handle things so we got an attorney. The case was settled out of court and dismissed. So the courts no longer have it on record. I have the entire case from attorney, whom at that time told us we had to put in account for our son. we thought we doing the right thing. Little did we know that we would not access to it to be able to buy him things. We wrote a letter to judge as we were instructed to do. The judge told us that there was nothing we could do but try to get another lawyer to help us. By no means are we talking about lots of money… only a little over a thousand! The attorney back at that time told us that we did not have a say in matter!! Told us to sign the papers, what bank it was to be placed in, and that if we did not do what he said that our son would not get his settlement. We are at aloss as what to do now… tried talking to this law firm but they are of absolutley NO help. Do you have any advice for us? at this time anything would be greatly appreciated!!!! thank you for your time and look forward to your response.

@Susannah I wish I could be of help, but your situation is out of my expertise. I would suggest keep calling different attorneys and hopefully you’ll find someone that is willing to help.