Umpqua Bank may be relatively unknown throughout most of the U.S., but that could change as their mobile and online products grow in popularity.

Currently the largest bank based in Oregon, Umpqua boasts locations up and down the West coast in states like Nevada, California, and Washington.

This bank is well known for its affordable banking products, particularly its savings and checking accounts with low fees (or no fees).

Umpqua offers other banking products for individuals and businesses, as well as mortgage loans and even boat loans and car loans.

If you’re in the market for a new bank or you need to borrow money for any reason, it makes sense to explore what Umpqua has to offer and compare its value proposition with other online banks.

Table of Contents

What Does Umpqua Bank Offer?

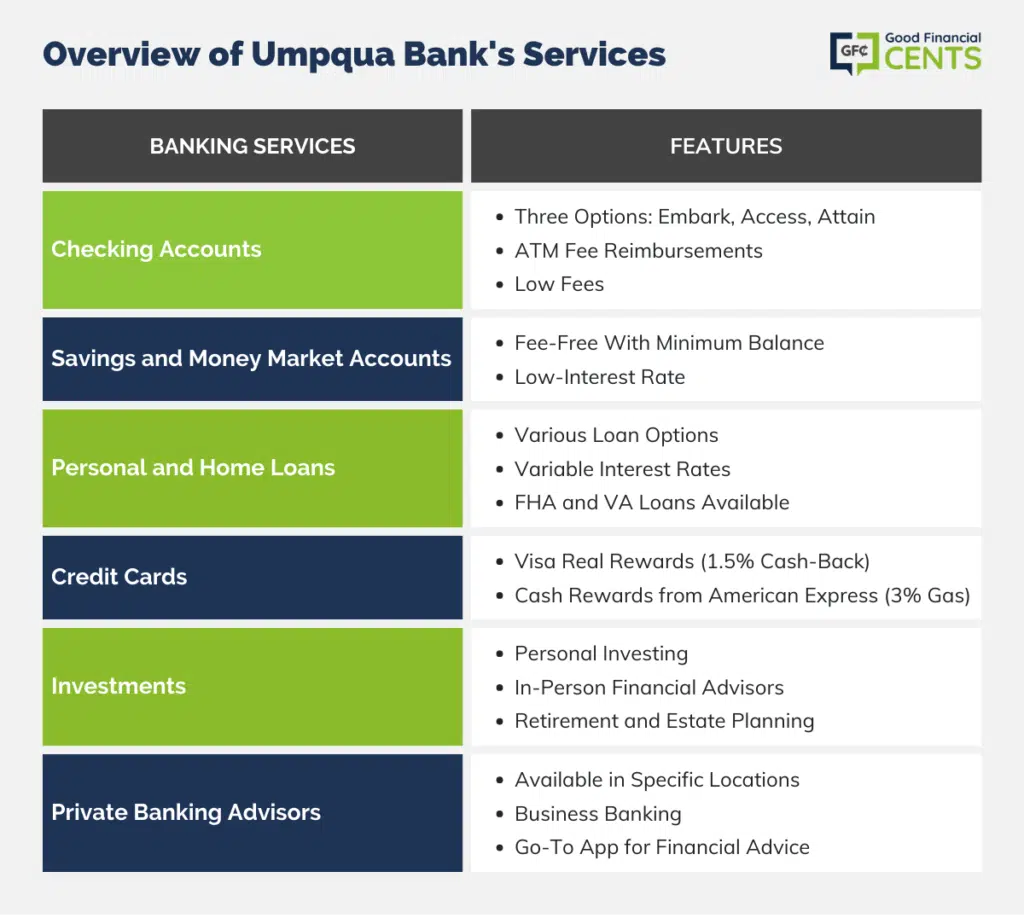

On the personal side of the banking equation, Umpqua Bank offers checking accounts, savings accounts, personal loans, home loans, credit cards, investment accounts, and private banking.

They also promise a personal banking experience based on your unique needs and access to mobile banking products that make banking anywhere easy.

Here are some of the main details on their most popular banking products:

Checking Accounts

You can choose from three checking accounts with Umpqua Bank

Each offer reimburses ATM fees at various levels each month, and the two lower-level checking options only require $25 as an initial deposit.

Embark Checking comes with no monthly maintenance fees, while Access and Attain Checking come with $5 and $20 monthly fees that can be waived if you meet their requirements.

Savings Accounts

Umpqua offers savings accounts and money market accounts that can be fee-free provided you meet minimum daily balance requirements.

These accounts earn interest and come with an ATM card.

Their savings accounts only pay an average of .01% right now, however, so there are better high-interest savings accounts out there.

Personal and Home Loans

Umpqua Bank also offers an array of ways to borrow unsecured funds or borrow against the equity in your home.

With Umpqua, you can take out an unsecured personal loan, apply for a home loan or home equity line of credit (HELOC), auto loan, or a boat loan.

Interest rates and terms for these loans can vary depending on your creditworthiness, income, and other factors.

Their HELOC, for example, comes with a variable APR that starts at 5% and no origination fee.

Within their mortgage offerings, you can apply for a fixed-rate mortgage, an adjustable-rate mortgage, a construction or renovation loan, or a jumbo loan.

As of January 2024, rates for a 15-year home loan are offered starting at 5.875% APR.

Also, note that Umpqua Bank offers FHA loans and VA loans to those who qualify.

Home Loan Qualifications

Umpqua Bank follows many of the industry standards when reviewing home loan applications.

A credit score is, of course, one of the most critical mortgage qualifications.

Borrowers with a credit score above 670 should have a high chance of approval, and the lender will likely offer their best mortgage rates to those with excellent credit scores.

Credit Score Classification

| CREDIT SCORE | QUALITY | EASE OF APPROVAL |

|---|---|---|

| 760+ | Excellent | Easy |

| 700-759 | Good | Somewhat Easy |

| 621-699 | Fair | Moderate |

| 620 and Below | Poor | Somewhat Difficult |

| N/a | No Credit Score | Difficult |

Umpqua Bank accepts closing cost contributions and gift funds for all loans and only imposes income-earning limits on those applying for USDA Rural Housing and state bond programs.

Most loans require a 20 percent down payment, although Umpqua Bank offers low down payment options for every loan type, aside from custom construction programs.

The lender also accepts the industry standard for FHA loans, which is a 3.5 percent down payment and an average 680 FICO credit score.

Credit Cards

While Umpqua Bank is virtually unheard of in the credit card world, it offers several credit cards with unique benefits.

Their Visa Real Rewards card lets you earn 1.5% cash-back without an annual fee and a $25 signup bonus after your first purchase.

The Cash Rewards from American Express offered through Umpqua doles out 3% on your first $6,000 spent at gas stations each year, 2% back on grocery purchases, and 1% back on other purchases.

Make sure to compare all credit card options from Umpqua Bank and other card issuers before deciding which one is right for you.

Investments

Umpqua Bank also offers personal investing to customers who live in Oregon, California, Nevada, and Washington.

You can meet with an advisor in person provided your area has its own Umpqua Bank branch.

Umpqua financial advisors can help you figure out the best ways to save for retirement, pay for college, manage risk, give charitably, and plan your estate wisely.

Private Bank Advisors are also available in the following cities and regions with Umpqua Bank branches: Spokane, Portland, Puget Sound, Bay Area, Sacramento, and San Diego.

Business Banking

On the business side of the equation, Umpqua Bank offers the same selection of products — checking accounts, savings accounts, loans and lines of credit, credit cards, and cash management tools.

They also offer commercial banking products that can help you find working capital, invest in real estate, or find financing for equipment leasing and other goals.

Go-To

Umpqua Bank wants to be your go-to for financial advice, revolutionizing online banking with its rollout of Go-To. With the Go-To app, you get access to your own financial expert, who you choose and build a relationship with.

Rather than calling a customer service line and connecting with a different stranger every time, you can get real-time advice from your go-to specialist. Whether you’re changing your account type, canceling a card in a hurry, or looking for advice on your next big purchase, Go To helps.

The Bottom Line – Umpqua Bank Review

If you’re looking for an online bank, you should explore opening an account with Umpqua.

The fact that many of their accounts can be free if you meet deposit requirements is enticing, and it’s also helpful you can open several accounts with just $25 or $100 to start.

Also, make sure to compare other high-interest savings accounts and checking account offers before you choose a bank.

Compare interest rates, fees, and other perks before you select an account, and you’ll end up ahead in the end.

How We Review Banking or Financial Institutions

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability. Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation. Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Umpqua Bank Review

Product Name: Umpqua Bank

Product Description: Umpqua Bank is a good choice for those looking for a wide range of banking services and a personalized customer experience. They offer a variety of checking and savings accounts, loans, mortgages, and credit cards. The online and mobile banking options are convenient, making it easy to manage your finances on-the-go. However, Umpqua Bank has limited branch locations, which may be an inconvenience for some customers. Additionally, they have higher fees compared to other banks, so it's important to review your options and understand the costs before opening an account.

Summary of Umpqua Bank

Umpqua Bank offers a wide range of banking services including checking and savings accounts, personal and business loans, mortgages, credit cards, and online and mobile banking.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Wide range of banking services

- Convenient online and mobile banking options

- Personalized customer service

- Strong financial stability

Cons

- Limited branch locations

- Higher fees compared to other banks

- Limited investment services

- Poor mobile app user experience.