This is the question commonly associated with cryptocurrency, and not an unreasonable one to ask. After all, unlike commodities, crypto has no physical substance. And since it isn’t issued by banks or central governments, there’s no institutional entity upholding its value.

We could ask the same question about any other asset class, or even national currency. And the answer would be the same: cryptos – like other assets – derive their value from the price people are willing to pay for it.

Lately, people have been willing to pay a lot for the more popular cryptos. But even if they are, how much value does it really have given that cryptocurrency has only been around for about a dozen years?

If you’re planning to invest in cryptocurrency soon, and especially if you’re already doing it, the answer to this question needs serious consideration. After all, if you’re investing, it’s important to know what it is you’re actually investing in.

Table of Contents

- Why Traditional Currencies Have Value

- Enter Sovereign National Currencies

- What Makes Crypto Different From Traditional Currency?

- What Crypto Already Has in Common With Traditional Currencies

- Why Is Bitcoin More Valuable Than Other Cryptos?

- Who Regulates Crypto?

- What Are Crypto Exchanges?

- Where to Invest in Crypto

- Final Thoughts on Why Is Crypto Valuable

The answer to that question isn’t always obvious when it comes to cryptocurrency.

Why Traditional Currencies Have Value

Traditional currencies, like the US dollar, euros, yen, and the British pound, have value for largely the same reasons other assets do. But when it comes to national currencies, the value is more formalized.

Historically, people and businesses have engaged in transactions using barter. It’s the process of exchanging one item of value for another. For example, a farmer might have exchanged bushels of wheat for an agreed-upon number of horseshoes from a blacksmith.

Even during the era of barter, certain commodities arose as mediums of exchange. These included, most commonly, gold, silver, and copper. They were valued because of their rarity and portability and could readily be used in everyday transactions. And because they held their value, precious metals also served as a store of value, much like a bank account does today.

Barter worked well for thousands of years, but it worked in less sophisticated economies, where most people earned their living producing goods. But as global economies began to industrialize, and most people became employees, barter was less practical.

That brought about the rise of paper money. For the first century or so of the Industrial Revolution, it was used concurrently with gold and silver. Having no intrinsic value itself, paper money was usually issued in denominations of a specific amount of gold or silver.

Enter Sovereign National Currencies

As the 20th century unfolded, and demand for government services – and money – increased dramatically, countries gradually shifted over to national currencies. One by one, governments in the major countries declared government-issued money to be sovereign currency. That is, it was declared the only legal currency within the nation’s borders.

For that to happen, national currencies required general public acceptance. But since those currencies circulated for decades before becoming sole legal tender, that acceptance was already firmly in place.

Today, people and businesses transact in national currencies without giving it much thought. The major limitation of national currencies is that there are dozens of them around the world. While each currency works well enough within its own borders, payment of foreign debts and obligations is a bit of a complication.

That issue has been resolved by the status of the US dollar as the international reserve currency. Because the US has the world’s largest economy, and the largest and most liquid financial markets, the dollar has been the primary international reserve currency for nearly 100 years.

Other major currencies also fill this role, but the US dollar accounts for 60% of all international reserves. A handful of other major currencies make up the rest. As a result, most countries settle their foreign obligations in US dollars.

What Makes Crypto Different From Traditional Currency?

It’s probably best to say that crypto is in the early stages of becoming a currency. Though it is accepted for payment with certain transactions, it isn’t accepted at grocery stores, gas stations, or by government tax authorities. At the moment, crypto enjoys only limited status as a medium of exchange.

But that level of acceptance is ultimately what gives crypto its value. Though it has been functioning primarily as a speculation in the last few years, activity has been based largely on the promise that it will eventually become a standard form of exchange, possibly even replacing national currencies.

At this point in time, at least, it’s not known if that will happen, nor is it 100% certain governments will allow it. After all, the ability of a government to issue its own currency is one of the basic foundations of its power. That’s not an advantage that will be given up easily.

What Crypto Already Has in Common With Traditional Currencies

If cryptocurrency gains widespread acceptance – especially in international transactions – it may ultimately evolve into something like a global currency, hence its potential value.

This transition would hardly be unprecedented in human history. After all, we started with barter, moved to a hybrid system of paper money and precious metals, then to paper money only, and now primarily electronic money. It may even be that the current reliance on electronic money has paved the way for widespread acceptance of cryptocurrency.

Crypto has a head start in that direction. It already has some of the basic properties of money, including:

- It’s completely portable, working very similar to electronic money.

- It can be accepted for transactions.

- Each has a recognized value, though that’s currently subject to wide fluctuations.

- It’s available in limited quantities and cannot be counterfeited.

As an example of the last point, Bitcoin was created with a set limit of no more than 21 million coins. Over 90% of those coins have already been mined into existence, setting up an eventual scarcity.

Why Is Bitcoin More Valuable Than Other Cryptos?

There are thousands of cryptocurrencies available, and many more are being introduced every year. Yet Bitcoin continues to be the front runner, and by a large margin.

Bitcoin currently has a total market value of $970.2 billion. Ethereum is a distant second, with $521.7 billion – though it is growing fast. Among the many other thousands of competing cryptos, none have reached the $100 billion mark.

We’ve already touched on the subject of Bitcoin’s pending scarcity, but there’s more.

Founded in 2009, Bitcoin was the first – and for a long time, only – cryptocurrency. The crypto was gaining acceptance and value while others were struggling to get out of the starting gate.

Simply put, the average person has the greatest familiarity with Bitcoin. It’s not an exaggeration to say that the terms “cryptocurrency” and “Bitcoin” are practically synonymous. That highlights the public acceptance factor.

In general, crypto is continuing to advance. But Bitcoin is leading the herd forward. Its recognition has become so universal that it’s now common to see its price quoted by major financial media, right alongside stocks, bonds, and commodities.

Most investment scenarios focus on either Bitcoin or Ethereum, but mostly Bitcoin. The crypto continues to rise (in knee-jerk fashion), largely because an increasing number of people believe that it will. Meanwhile, the vast majority of its competitors are completely ignored.

In the end, the world may choose one crypto over the rest. Though the outcome is completely uncertain right now, you’d have to pick Bitcoin as the likely winner.

Who Regulates Crypto?

In two words, no one. That reality is part of what gives crypto its value as a currency but is also the source of the risks associated with it.

Since crypto is not issued by institutions, it’s not regulated by government agencies or any other organizations.

That said, the blockchain where crypto is stored is monitored and logged on a regular basis. Each user has a private and public key that makes transactions possible. So, while there is no regulation from government authorities, there is a specific order to how it works. That largely makes regulation unnecessary.

What Are Crypto Exchanges?

Cryptocurrency exchanges are essentially online marketplaces for digital assets. That includes mostly crypto, but also non-fungible tokens (NFTs), which are basically unique digital art that’s rapidly growing in acceptance and value. Some crypto exchanges provide other investments, but they’re few and far between.

The online factor with crypto exchanges is central. They operate entirely on the Internet, with no physical locations. The exchanges facilitate buying, storing, and selling cryptocurrency. But it’s now common for some to offer other financial services, like high interest on crypto balances, cash back debit cards, and even short-term loans.

Cryptocurrency exchanges are practically a requirement for crypto investors. Very few brokers – and no banks – make a market in crypto. But given the rise of crypto in the past few years, it’s very likely that those limitations will change, and mainstream financial institutions will begin offering crypto investing.

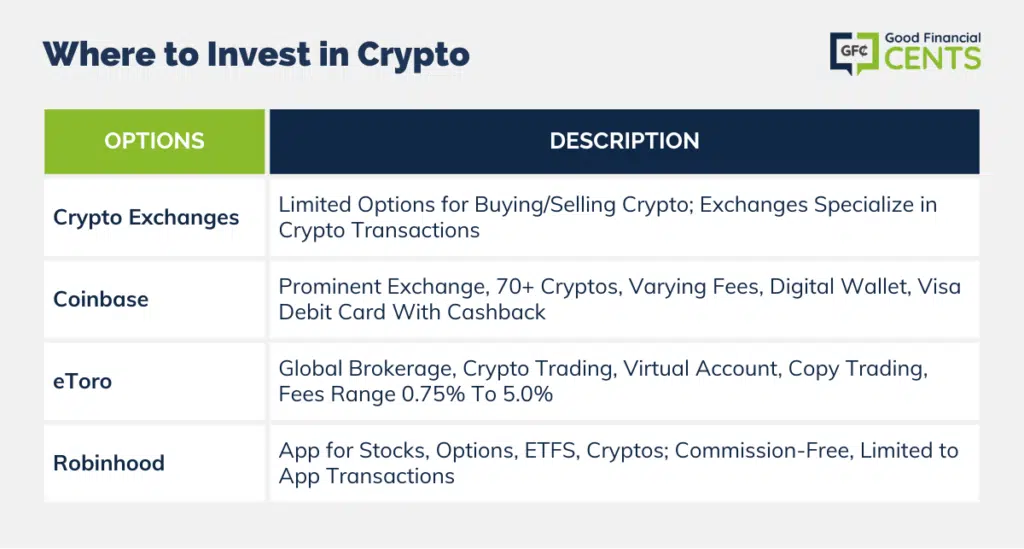

Where to Invest in Crypto

Relatively speaking, there are only a few places where you can buy and sell cryptocurrency freely. For example, banks don’t provide or accept crypto, and most investment brokers don’t offer it as an option.

That’s likely to change in the future, as crypto continues to gain acceptance. But for now, the best option for buying, holding, and selling crypto are crypto exchanges. These work much the way traditional investment brokers do, but they specialize in cryptos.

Below are three popular crypto exchanges. Not only are they widely used by crypto investors, but you’ll be pleasantly surprised to see that many also offer valuable additional benefits and services, beyond simply investing in crypto.

We’ve also included one increasingly popular investment trading app that accommodates crypto investing, along with more traditional investments. If you’re keen on investing in crypto through a broker, check out our best online stock brokers.

Coinbase

Coinbase is one of the largest crypto exchanges in the industry, and it’s one I use for my crypto investments. It has one of the largest menus of services, and you can begin investing with as little as $2.

Coinbase offers trading in 70 cryptos, which is one of the reasons why the exchange is so popular. Their trading fees are available either at a flat rate – starting at $0.99 – or on a percentage basis, ranging from 0.05% to as much as 4.00%. They provide a digital wallet, or you can use your own – it’s up to you.

If that isn’t enough, they also offer a Visa debit card that will not only allow you to access your crypto balance but also earn up to 4% cashback using the card for purchases.

eToro

eToro is a global investment brokerage, though general brokerage services are not yet available in the US. But you can currently participate in crypto investing on the platform. You can trade in 27 different cryptocurrencies, with fees ranging from 0.75% to 5.0%, based on the specific crypto the trade involves.

One of the best features eToro has is a virtual trading account to help you understand how crypto is traded. The account will start you off with $100K in virtual money, enabling you to participate in trading activities. They also offer copy trading, which enables you to observe the trading patterns of successful crypto investors, which you can then replicate.

Robinhood

Robinhood is the one entry on this list that is not a crypto exchange. Instead, it’s a popular investment app where you can trade stocks, options, and ETFs, commission-free. You can also invest in cryptocurrencies. Additionally, Robinhood charges no commissions on crypto trading, relying instead on bid and ask spreads for both purchases and sales. They currently offer seven different cryptocurrencies.

Robinhood can be the perfect crypto investment platform, given that you can hold more conventional investments in your account. But an important limitation to be aware of is that crypto can only be bought and sold on the app. It cannot be withdrawn and transferred to another exchange or account.

Final Thoughts on Why Is Crypto Valuable

The question of value persists, as it lacks physical substance and institutional backing. Similar to traditional assets, crypto’s worth hinges on what people are willing to pay. Unlike historical barter systems, national currencies derive value from public acceptance. As crypto evolves, its acceptance as a medium of exchange contributes to its worth.

While Bitcoin leads due to familiarity, thousands of others lag behind. With no centralized regulation, crypto operates on blockchain technology. Exchanges facilitate crypto transactions, growing as mainstream institutions consider participation. Amidst uncertainty, the path towards universal recognition and potential global currency status awaits, as crypto’s unique attributes continue to shape its value.

Leave a Reply