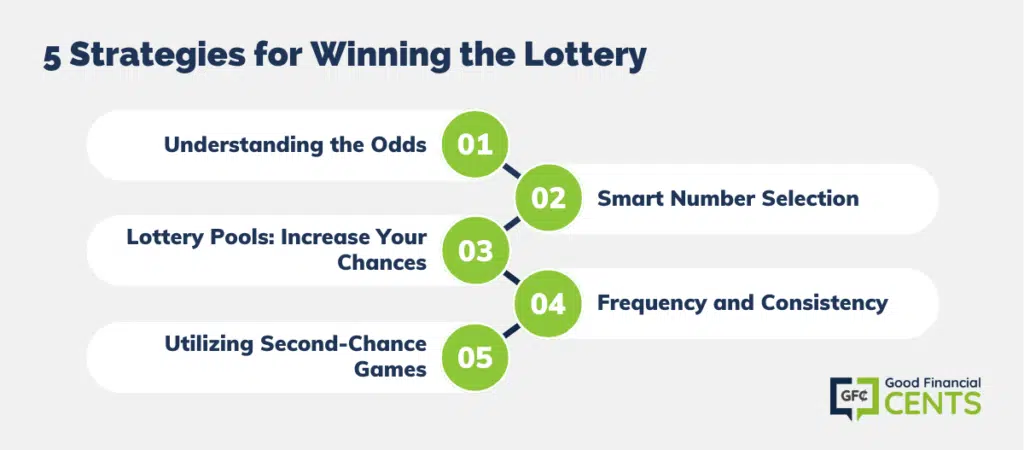

The allure of the lottery lies in its ability to transform lives with a single stroke of luck. However, winning the lottery is not purely about luck; certain strategies can slightly tilt the odds in your favor. This comprehensive 1000-word article explores five critical strategies to maximize your chances of winning the lottery.

Table of Contents

1. Understanding the Odds

Grasping the odds of various lottery games is crucial in formulating a winning approach. Different lotteries offer different odds of winning, and these can vary widely between large-scale national lotteries and smaller, local ones.

Analyzing Different Lottery Games

- Thoroughly research and compare the odds of different lotteries.

- Smaller games typically have better odds compared to national lotteries.

- Games with fewer numbers or a more limited range offer improved chances of winning.

Probability Theory

- Apply basic probability theory to understand the likelihood of different combinations.

- Each number combination has an equal chance of being drawn, regardless of past draws.

- Analyzing historical data can provide insights but does not guarantee future outcomes.

2. Smart Number Selection

The debate on whether there’s a strategy for choosing lottery numbers has been long-standing. While each number theoretically has an equal chance of selection, some methods can guide the choice process.

Avoiding Common Pitfalls

- Popular methods like selecting numbers based on birthdays limit your range, potentially reducing your chances.

- Patterns and sequences might look appealing but don’t increase your odds of winning.

Balanced Mix

- Opt for a mix of both odd and even numbers.

- Spread your number choices across the entire number pool.

- Some players favor using a balanced mix of high and low numbers.

3. Lottery Pools: Increase Your Chances

Lottery pools allow players to buy more tickets collectively, thereby significantly enhancing the group’s odds of winning without requiring a substantial individual investment.

Organizing a Pool

- Form a pool in your workplace or with a group of friends.

- Set clear rules for contribution, ticket purchasing, and distributing winnings.

- Legal documentation of the pool’s terms can prevent future disputes.

Advantages and Considerations

- More tickets mean a higher chance of winning.

- The excitement and fun of playing as a group can be a rewarding experience.

- Understand that the prize is divided among all participants, which could mean a smaller individual share.

4. Frequency and Consistency

Though each lottery draw is an independent event, regularly participating can marginally improve your odds over time. Being consistent in your lottery play can be an integral part of your strategy.

Regular Play

- Dedicate a specific budget for regular lottery participation.

- Repeatedly playing the same numbers may offer emotional comfort, although it doesn’t statistically increase your chances of winning.

Responsible Gaming

- Stick to a set budget to avoid overspending on lottery tickets.

- Recognize that the lottery is a form of entertainment, not a reliable investment or income strategy.

5. Utilizing Second-Chance Games

Many lotteries offer second-chance drawings for non-winning tickets, providing another opportunity to win. These games often have fewer participants, thereby offering better odds.

Taking Advantage of Second Chances

- Always check the availability of second-chance drawings for your lottery.

- Enter your non-winning tickets in these draws to fully utilize your initial investment.

Strategy and Persistence

- Keep a diligent record of second-chance drawing dates and participate consistently.

- Persistence in entering these drawings can occasionally pay off, as they typically have fewer entries and thus, slightly better odds.

Conclusion

Employing these strategies can enhance your chances of winning the lottery. However, it’s crucial to approach lottery play as a form of entertainment rather than a financial plan. Understanding the odds, selecting numbers judiciously, participating in lottery pools, maintaining regular and consistent play, and taking advantage of second-chance drawings are all strategies that can optimize your chances of a lottery win.

Remember, while these strategies can improve your odds, they cannot guarantee a win, and it’s essential to play responsibly and within your means. The thrill of the lottery lies in its unpredictability and the hope it inspires, making it a beloved pastime for many.

Using the lottery as a wealth building tool is moronic. However, the enthusiasm I feel each time I check my numbers against the drawn numbers, even though it’s “pie in the sky”, is worth the few bucks I spend to maintain that hope. At my age and health, I feel it is money well spent.”Hope” is what keeps me getting out of bed every morning and looking forward to my day.

I’ve also studied previous winners to learn their strategy. One tip I’ve learned: buy scratch off in bulk from the same roll. Also, don’t waste $ on $1,2 games.I need money for donor eggs/sperm so since I can’t prostitue, rob a bank, I’ll do it the legal way by playing the lottery.

I’ve made playing the lottery 2018 new resolution because is the only 1 I’ll keep. I don’t go crazy but I’m playing to win to take care of some serious financial needs. My new strategy is buying a bunch of tiix from the same role. If u don’t play u don’t have a chance. Play responsibly!! I’m not addicted! I do buy mega, lotto etc, playing the same #s weekly. I even pray and beg God to help us win..

There are many individuals who prefer on dealing with lottery since the prize is always big. In this matter, it is best to be acquainted on the lotto system to determine the ways on how win in this game.

Although $21,817.15 isn’t a massive amount after 30 years of saving, imagine if you won the same amount on tonight’s lottery draw…you’d likely be jumping and screaming about the place! It just goes to show you can win amounts like that – you just have to be patient and avoid playing the lottery!

I think you should enter contests instead that are free to enter and from reputable companies. My wife was really upset that I made her enter the “hot button” event at a GM dealership. Upset that is until she found out she won a car!

True Story.

I have to agree with tip #5. The chances of winning the lotto are very slim. Instead of spending money on lottery tickets, it is best to just put your money on a bank account. You can also use that weekly lotto money to buy additional grocery or even gas.

Lottery pool? OMG, that’s the last thing I’ll ever do. Say the jackpot hits $100M. I don’t kid myself, I’ll probably split it with 2 other people, so $33M gross. The instant payment (lump sum) is about $20M or so, and after getting hit with Federal and State tax, I’m left with $12M. Not buying my own jet rich, but I don’t want my own jet, and it’s just enough to invest wisely, live a good life, and donate enough to make a difference to a select few organizations.

But. Pool that among 10 people, and I’m at $1.2M. Not even enough to fly in Billy Joel to sing at my daughter’s wedding. At 4%/yr withdrawal, it’s $48K/yr more than I have now, which is good, but not what I want from a $100M lotto.

You can tell, I’ve give great thought to the jackpot I actually know I’ll never win. But if I did, guess who’s singing at Jane 2.0’s wedding?

I seriously question the reason for writing such a post. Sorry, promoting the lottery is not something I can take lightly, which options 1-4 do. Option #5 should have been the only content in this article.

I guess I could write an article, Tips for smoking responsibly, but to me that would be harming more people than it would be helping.

However, this article was well written. (I had to leave you with a positive note)

I tend to agree with you Steve, but I think if someone understands that they will likely lose money there’s no problem with playing from time to time. For instance J money is addicted to buying lottery tickets but he’ also financially responsible, has savings, a budget, and retirement covered. It’s hard to knock every instance of someone playing the lottery when not everyone is financially irresponsible but I definitely think a majority of people should avoid it especially those who think that’s how they’re going to build wealth. Did I say build? What I meant to say was have wealth “fall into their lap.” 😀

Playing the lottery is like going to Vegas without all the razzle dazzle. I’d go to Vegas to gamble a little for fun but I wouldn’t bet my retirement fund to do so. 🙂 (and for the record, I’ve never been to Atlantic City or Vegas. LOL)

That said, someone who has debt shouldn’t even be considering playing the lottery.

I like option #5. I haven’t bought a lottery ticket in so many years. I just can’t force myself to waste the money and I do find myself irritated by those who spend $50 or more a week, make me stand in a super long line, all in hopes of winning it big. haha! It’s a free country but it’s still annoying to watch people flush their money down the drain like that. LOL

My daughters and I buy scratch offs sometimes at 7-11. Becuase it’s fun. Sometimes we win $2 or something, but honestly, they get the thrill of scratching off the ticket and I get to watch the fun. *shrug* Seems worth it to me. Well, and we dont’ do it every day.

HAHA! Smart Tip! I like that 5th advice. I wasn’t gonna scroll way down to number 5 but here i am. I agree that it’s everybody’s dream to win the lottery, but getting there can sometimes mean spending more than what you can possibly win.

Sadly though many would hate to agree you are right! To many people want to win the lotto and take the easy way out. I know people that spend 50$ per week on lotto and nothing in their 401k. Stupid if you ask me.

Building a savings and wealth takes time, patience, and a little bit of luck. The lotto well all I have to say is good luck!

Is there any benefit to playing while visiting another state? Usually, we buy a ticket while we are on vacation. It seems like you always hear about people visiting from other states winning;)

Seriously though, 21% really believe that winning the lottery is an important wealth building strategy? For realzies?