If you’re like most people, you’ve had at least one Nigerian prince contact you about a seven-figure inheritance. All you had to do was send them your bank account information, your Social Security number, and a few thousand bucks to claim your prize.

I mean, what could go wrong?

Obviously, this type of scam is easy to spot. You don’t know any Nigerian princes, and anyone who wanted to give you millions probably wouldn’t be emailing your old Hotmail account.

The thing is, fraud like this really does work sometimes, which is why hackers and thieves never seem to go away. In fact, the Federal Trade Commission (FTC) recently reported it received 2.1 million fraud reports from consumers in 2020.

Table of Contents

The most common type of scams reported were “imposter scams,” where a predator pretends to be someone they’re not. According to the agency, consumers lost more than $3.3 billion to fraud in 2020, up from $1.8 billion in 2019.

Cryptocurrency Scams on the Rise

With cryptocurrencies becoming more and more popular and with crypto being much harder to track than traditional bank transfers, it’s not surprising that cryptocurrency scams are wreaking havoc across the country.

According to May 2021 figures from the Federal Trade Commission (FTC), nearly 7,000 consumers reported losses caused by crypto scams since October 2020. Total losses from reported scams amounted to $80 million from October 2020 through May 2021, and individuals who reported the fraud lost a median amount of $1,900.

If you think it can’t happen to you, think again. Crypto scammers are notoriously savvy with their strategies, and they know exactly how to earn your trust along the way. I recently interviewed someone on my podcast who was targeted by a crypto scammer, and the way it went down is so surprising I could hardly believe what I was hearing.

Here’s the episode on Wealth Hacker:

If you rather listen to the podcast, please check out the Good Financial Cents podcast on Spotify. Here’s the episode:

Crypto Scams: A True Story

The guy I interviewed for my podcast wanted to stay anonymous, so I’ll have to tell you what happened from a third-party perspective. For the purpose of this story, let’s call him “John.”

Long story short, John had been somewhat into investing already, but then he met a girl through a dating app who was dabbling in crypto investing through a few different websites.

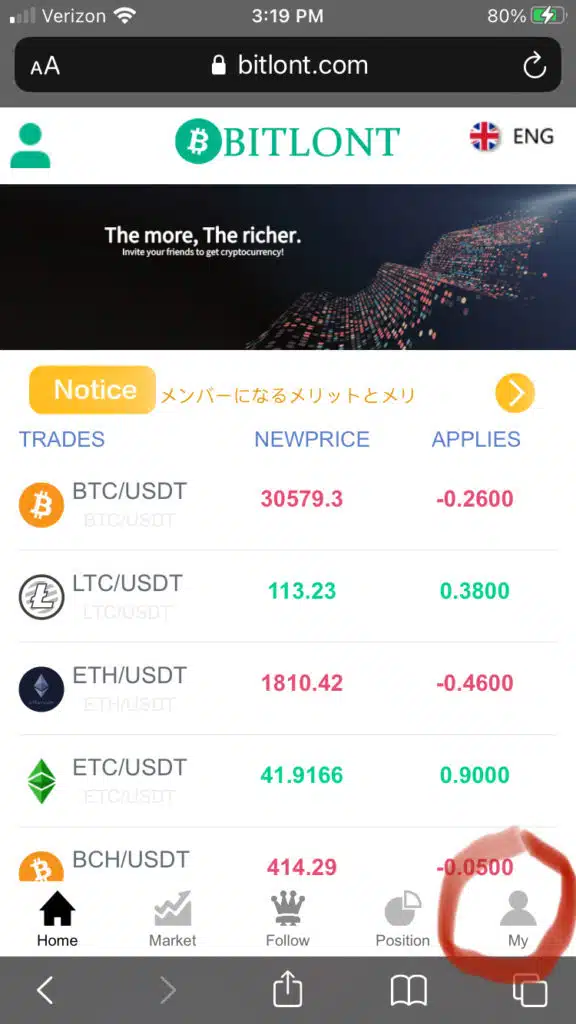

The woman was living out of the country at the time, but she had plans to move back to the United States. She and John talked endlessly about all sorts of topics, and she eventually convinced him he had to start investing with her through her preferred Bitcoin trading platforms, Binance.com and another website called “Bitlont.”

Now, we know that Binance is a legit crypto website, but John had never heard of Bitlont before. Either way, he started investing small sums of money by transferring crypto out of Coinbase and into Binance and Bitlont.

John was slightly skeptical at first, so he did some “testing” to make sure he could invest, earn profits, then ultimately cash out his crypto in the end. By this point, everything was working as it should.

While John wasn’t entirely sure how Bitlont worked, he said the website had a ton of useful features. It was basic but not necessarily generic, he said. And while it didn’t track any stock market metrics, the Bitlont website and app let you watch what other traders were doing in real-time. Crazy enough, he even talked to Bitlont customer service on the phone a few times, and he said their service was flawless.

Over time, John got accustomed to investing through Bitlont, making some money, then transferring it through Binance and back into his bank account.

Eventually though, the situation got heavy. The girl he had been talking to started telling him about a membership package Bitlont had. If you deposited $5,000 per month through the membership, they would guarantee a specific amount of profits per day. The same was true if you could commit to investing $10,000 per month, and the profits only went up from there.

In the meantime, John’s paramour was saying the two were going to meet and start dating once she arrived back in the States. Her texting became more romantic, and she sent him plenty of pictures of herself that looked absolutely real.

Apparently, the woman he was speaking with started nagging him about investing more before the end of the month with the implication they couldn’t earn profits the next month. That didn’t make any sense. Why couldn’t they earn profits the next month like they had done in the month prior?

Eventually, he asked the woman if all of what was happening was real. Instead of reassuring him or proving she was who she said she was, she got upset instead.

From there, John started researching the company and finding more red flags. Where Bitlont was listed as newly opened in June of 2021 in one place, elsewhere on the company website said they were celebrating 10 years of service. That didn’t make any sense.

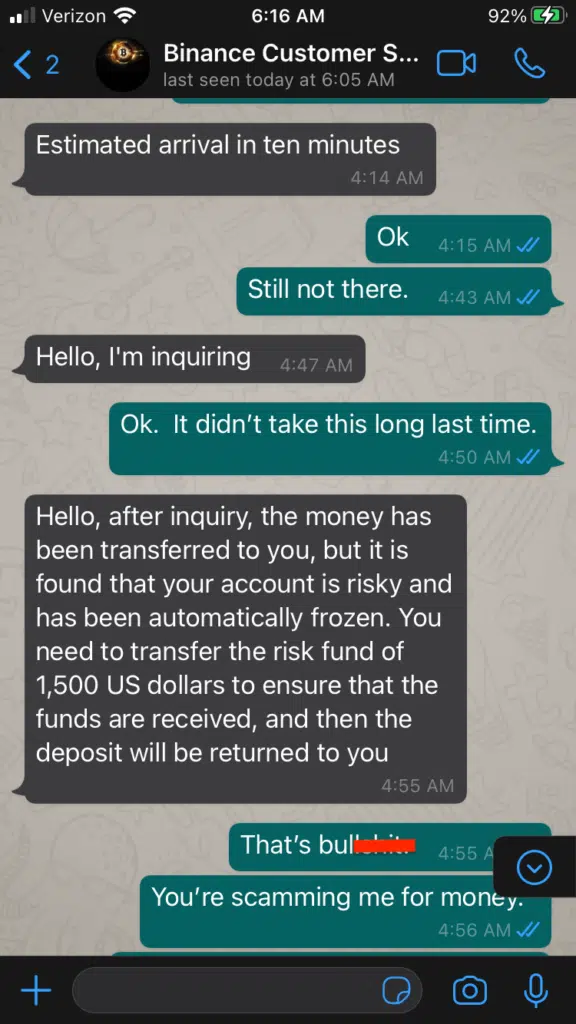

Fed up with all the nonsense, John tried to cash out his account with Bitlont. Through the process, they told him that there was suspicious activity on his account and that he needed to pay another $1,500 to access his money.

Obviously, we know what happened from there. All of John’s assets locked up in Bitlont were gone, and the website (and the woman) mysteriously disappeared right after that. John does say he was slightly lucky that some of his cash was still being held by Binance. If he would have discovered the scam just a few weeks later, he probably would have lost a lot more.

Other Crypto Scams to Watch Out For

If you start reading about common crypto scams, you can easily see that “John’s” fraud story is not uncommon at all. The FTC reports that crypto scammers usually try to blend into the scene, and they tend to pose as crypto enthusiasts who congregate online to talk about their investments.

Not only that, but the FTC says that cyber-romance and crypto can be a “combustible combination.”

“Fraudsters have been known to use the artifice of long-distance love to gain a person’s trust only to reel them into a cryptocurrency investment scam,” writes the FTC. They also note that 20% of individuals who lost money in financial scams sent crypto assets online and did so through the veil of romance.

Also note that you could be scammed by someone you know or by an industry professional you should be able to trust. According to a story in Inverse, a 24-year-old crypto hedge fund manager known as Stefan Quin pled guilty earlier this year after confessing he had been lying to investors for years about his returns. After sharing false data to lure his investors into pouring more of their money into his $90 million fund, he now faces 20 years in prison.

At the end of the day, there are numerous other scams you should be aware of and do your absolute best to avoid. Some of the most common crypto fraud scams include:

- Crypto Businesses That Fraudulently Use the Name of a Celebrity: In some cases, crypto thieves will try to use the name of a celebrity to lend credibility to their business. The FTC says that, due to this scam, people have reportedly sent more than $2 million in cryptocurrency to Elon Musk impersonators over the six-month period they profiled.

- Crypto Job Offer Scam: Some crypto scammers also try to recruit individuals to sell crypto to others and potentially even be paid in crypto. However, it’s all a ruse to get their hands on your banking details and personal information. According to Inverse, this scam is usually set up like a pyramid scheme, with the investors on the top raking in all the profits and defrauding those underneath.

- Blackmail Emails: Other times, scammers will send threatening emails demanding crypto payments in exchange for not releasing sensitive information or photos of the target.

- Social Media Crypto Scams: The FTC also notes that if you read a tweet, text, email, or get a message on social media that tells you to send cryptocurrency, it’s definitely a scam. This is true even if the message comes from a celebrity or someone you know.

- Giveaway Scams: The story in Inverse also describes a kind of giveaway scam, which usually involves a promise to “double” or “triple” the amount of crypto someone has in their account. In instances where the scam works and the victims send crypto to the scammer’s wallet, those assets simply “disappear.”

The Bottom Line: Crypto Scams to Watch Out For

If something seems too good to be true, then it probably is. This is something our friend John probably realized far too late, but it’s a lesson we can all learn and apply to our everyday lives.

Crypto scams are already common, but they will probably only increase in prevalence from here. If you want to get ahead by investing in crypto, you need to steer clear of scammers who promise the world but leave you holding the bag.