Definition and Purpose of Power of Attorney (POA)

A Power of Attorney (POA) is a legal instrument that grants one person, referred to as the agent or attorney-in-fact, the authority to act on behalf of another person, known as the principal. This delegation of power can cover a range of activities from making financial decisions to making medical choices.

The primary purpose of a POA is to ensure that a trusted individual can manage the affairs of another, especially if they become incapacitated or are unable to act on their own.

Table of Contents

- Definition and Purpose of Power of Attorney (POA)

- Types of Power of Attorney

- Importance of Power of Attorney in Financial Planning

- Determining the Need for a Power of Attorney

- Choosing the Right Power of Attorney for Your Needs

- The Process of Setting up a Power of Attorney

- The Responsibilities and Limitations of an Agent

- Risks and Misconceptions About Power of Attorney

- Power of Attorney and Financial Institutions

- Power of Attorney in the Event of Incapacity or Death

- Conclusion: The Need for a Power of Attorney

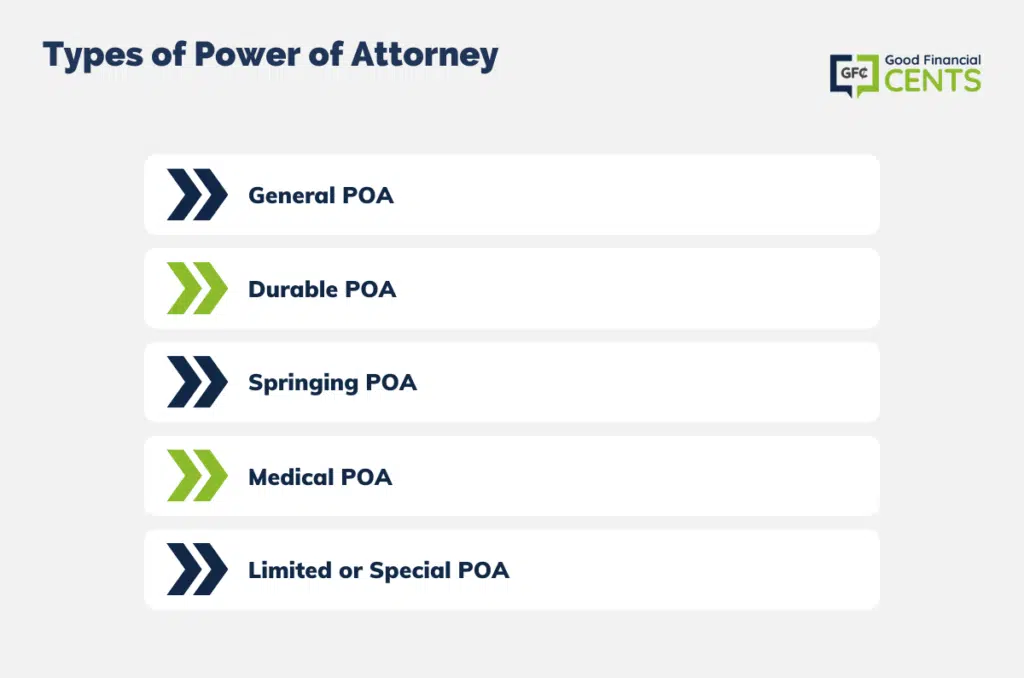

Types of Power of Attorney

There are various types of POAs, each tailored to specific needs and situations:

1. General POA: This provides the agent with broad powers to act on behalf of the principal in a variety of situations.

2. Durable POA: Unlike the general POA, a durable POA remains in effect even if the principal becomes incapacitated.

3. Springing POA: This type of POA comes into effect only under certain conditions, usually when the principal becomes incapacitated.

4. Medical POA: As the name suggests, this grants the agent the authority to make medical decisions on behalf of the principal.

5. Limited or Special POA: This type of POA is restricted to a specific transaction or period.

Importance of Power of Attorney in Financial Planning

Having a POA is integral to financial planning. It ensures that even in the event of unexpected incapacitation, a trusted individual can manage the financial affairs, investments, and other related matters. This helps in preventing financial losses or mismanagement and ensures the financial well-being of the principal.

Determining the Need for a Power of Attorney

Anticipating Future Incapacitation

Nobody can predict the future. Events like illnesses, accidents, or other unforeseen circumstances can render an individual unable to manage their own affairs. A POA acts as a safeguard, ensuring that decisions can be made on the principal’s behalf if needed.

Managing Business and Personal Affairs

A POA can be an invaluable tool for individuals who frequently travel or are otherwise unavailable to manage their ongoing business and personal transactions. This ensures that critical decisions can be made in their absence.

Estate Planning and Asset Management

As part of estate planning, a POA ensures that assets are managed and protected according to the principal’s wishes, especially during times when they might be unable to make decisions due to health reasons or other personal circumstances.

Making Health Care Decisions

A medical POA ensures that someone the principal trusts is making health-related decisions aligned with their values and preferences, especially when they cannot communicate or make those decisions themselves.

The Role of POA in Elderly Care

For seniors, a POA can be essential. With the potential for age-related cognitive decline or health issues, having a trusted individual to manage affairs can bring peace of mind to both the elderly and their families.

Choosing the Right Power of Attorney for Your Needs

Assessing Your Personal Circumstances

The first step in choosing the right POA is a thorough examination of your personal and financial situation. Are you setting up a POA for a temporary situation like overseas travel? Or is it for potential health reasons as you age? Understanding your unique needs will guide the type of POA you require.

Understanding State Laws and Regulations

POA regulations can vary significantly from one jurisdiction to another. Some states might have specific requirements for a POA to be considered valid. Before drafting or executing a POA, it’s crucial to be familiar with local regulations to ensure its validity and effectiveness.

Evaluating the Scope of Authority Needed

You must decide on the scope of the authority you’re granting. This involves choosing between a broad general POA or a more narrowly defined limited or special POA. It’s crucial to ensure that the agent has just the right amount of power needed to accomplish the desired tasks without unnecessary excess.

Deciding Between a Durable and Non-durable Power of Attorney

The choice between a durable and non-durable POA often hinges on the reason for setting up the POA. If the principal’s main concern is potential incapacitation, a durable POA is preferable. For short-term situations, a non-durable POA might suffice.

The Process of Setting up a Power of Attorney

Identifying the Agent or Attorney-In-Fact

Choosing the right agent is perhaps the most critical aspect of setting up a POA. This should be someone trustworthy, responsible, and aligned with the principal’s values and wishes. Often, this is a close family member or friend, but professionals can also be chosen based on specific needs.

Determining the Powers to Grant

Clearly outline the powers granted to the agent. This can range from buying or selling property and managing bank accounts to making medical decisions. Clarity at this stage prevents potential conflicts or misunderstandings in the future.

Drafting the Power of Attorney Document

While there are standard POA templates available, it’s advisable to tailor the document to specific needs. This ensures that all unique requirements and stipulations are adequately addressed.

Legal Requirements for Execution

Depending on the jurisdiction, there may be specific requirements for executing a POA, such as the presence of witnesses or notarization. It’s essential to meet these requirements to ensure the document’s validity.

Notarization and Witnesses

Having the POA notarized adds an extra layer of validation. In many places, the presence of one or more witnesses during the POA execution is mandatory. This offers further assurance of the principal’s intent.

The Responsibilities and Limitations of an Agent

Understanding the Fiduciary Duty

The agent or attorney-in-fact holds a fiduciary duty to the principal. This means they are obligated to act in the principal’s best interest, making decisions that align with the principal’s wishes and avoiding conflicts of interest.

Knowledge of the Principal’s Intentions and Wishes

The agent should have a deep understanding of the principal’s values, desires, and objectives. This ensures that all actions taken align with what the principal would have wanted.

Limitations on the Agent’s Powers

While the agent has been granted specific powers, there are boundaries. They cannot act outside the scope of the authority provided in the POA document. For instance, if the document doesn’t specify real estate transactions, the agent can’t sell the principal’s property.

Record Keeping and Accountability

The agent should maintain meticulous records of all transactions and decisions made on behalf of the principal. This promotes transparency and can be useful for any necessary audits or reviews.

Termination of the Power of Attorney

A POA can be terminated under various conditions such as the principal’s death, revocation by the principal, or expiration of the POA’s duration. The agent should be aware of these conditions to avoid overstepping their mandate.

Risks and Misconceptions About Power of Attorney

- Misuse and Abuse of Power of Attorney: One of the significant risks associated with a POA is the potential misuse or abuse by the agent. While the agent has a fiduciary duty to act in the best interests of the principal, there have been instances where agents misused their power for personal gain or acted contrary to the principal’s wishes.

- Myths Surrounding Power of Attorney: There are several misconceptions about POAs. Some believe that having a POA allows the agent to act without any boundaries, while others think that a POA can’t be revoked. It’s essential to understand the actual stipulations of a POA and be aware of the rights and responsibilities it entails.

- Addressing Potential Conflicts of Interest: An agent must always act without any conflict of interest. If there’s a situation where the agent’s personal interests might clash with their responsibilities under the POA, they must either avoid the situation or consult with other involved parties to reach a solution that aligns with the principal’s best interests.

- Revocation and Alteration of Power of Attorney: A common myth is that once granted, a POA is set in stone. In reality, as long as the principal is mentally competent, they can alter or revoke a POA at any time, ensuring they always retain control over their affairs.

Power of Attorney and Financial Institutions

Interacting With Banks and Other Financial Entities

Once an agent has a POA, they might need to interact with banks and other financial institutions on the principal’s behalf. Financial institutions often have stringent guidelines to prevent fraud, so the agent must be prepared with all necessary documentation to demonstrate their authority.

Special Considerations for Business Owners

For business owners, a POA can have implications on business operations, especially if the principal is the sole proprietor or a significant stakeholder. It’s essential to ensure that the POA explicitly covers business-related transactions and that other stakeholders are informed.

The Role of Power of Attorney in Investment Decisions

An agent with a POA might have the authority to make investment decisions. They must make choices that align with the principal’s financial goals, risk tolerance, and long-term objectives.

Financial Record-Keeping Requirements

Maintaining accurate and comprehensive financial records is crucial. This not only ensures transparency but can also be vital for tax purposes or any potential legal disputes.

Power of Attorney in the Event of Incapacity or Death

Activation of Springing Power of Attorney

A springing POA becomes effective under specific conditions, usually the incapacitation of the principal. It’s vital to understand the exact conditions and have the necessary documentation to prove that they have been met.

Continuity of Financial Affairs

In the event of the principal’s incapacitation, the agent ensures the continuity of financial affairs, from paying bills to managing investments, ensuring that the principal’s assets are protected and liabilities addressed.

Power of Attorney vs. Guardianship or Conservatorship

While a POA grants someone the power to act on the principal’s behalf, guardianship or conservatorship is a court-appointed role where someone is given responsibility for an individual who cannot make decisions for themselves. It’s crucial to understand the differences and implications of each.

The Effect of the Principal’s Death on Power of Attorney

A common misconception is that a POA continues after the death of the principal. In reality, a POA becomes void upon the death of the principal. Subsequent affairs, such as distributing assets, fall under the realm of the executor of the will.

Conclusion: The Need for a Power of Attorney

Establishing a Power of Attorney is a proactive measure that offers peace of mind. It ensures that trusted individuals can step in to make decisions when one is unable to. Whether for health, travel, business, or planning for the uncertainties of life, a POA provides a safety net.

By understanding its intricacies and potential pitfalls, one can harness its benefits while safeguarding against misuse. It’s not just a legal document; it’s a testament to care, foresight, and responsibility.