Who doesn’t appreciate a good throwdown?

- Snake Eyes vs. Storm Shadow

- Han Solo vs. Boba Fett

- Mike Tyson vs. Evander Holyfield

- Hulk Hogan vs. Andre the Giant

- Kanye West vs. Taylor Swift, Jimmy Kimmel, the CEO of Zappos, and the entire world…

These are some of the best throwdowns in history! Well, at least to me. 🙂

Since I’m a financial planner and blogger, I don’t usually get many opportunities to throw down.

That is until today….. Introducing The Grow Your Dough Showdown.

Boom!

Look how serious I am about this (Warning: the following picture may be scary to young children):

If you haven’t guessed it yet, investing is kind of my thing. I love investing and equally love encouraging others to invest for themselves.

The purpose of this throwdown is the following four reasons:

1. Show you how easy it is to get started investing.

2. Show you the plethora of online options available.

3. Show you different strategies that you can try.

4. Erase any doubts that you can’t do this on your own. Because you can.

Sound like fun?

Table of Contents

The Players

There are a ton of online platforms that exist nowadays that you can invest in. In fact, a quick Google search for “online brokers” yielded over 62 million results.

Yowzers!

I don’t have time to use all of them (I wish!), so I had to weed it down to the 7 that I thought would be the most interesting and applicable to all of you.

Wanting a diverse selection, I include a few traditional online brokers (like TD Ameritrade and Ally Invest) and a few unique ones (Prosper).

NOTE:

Related:

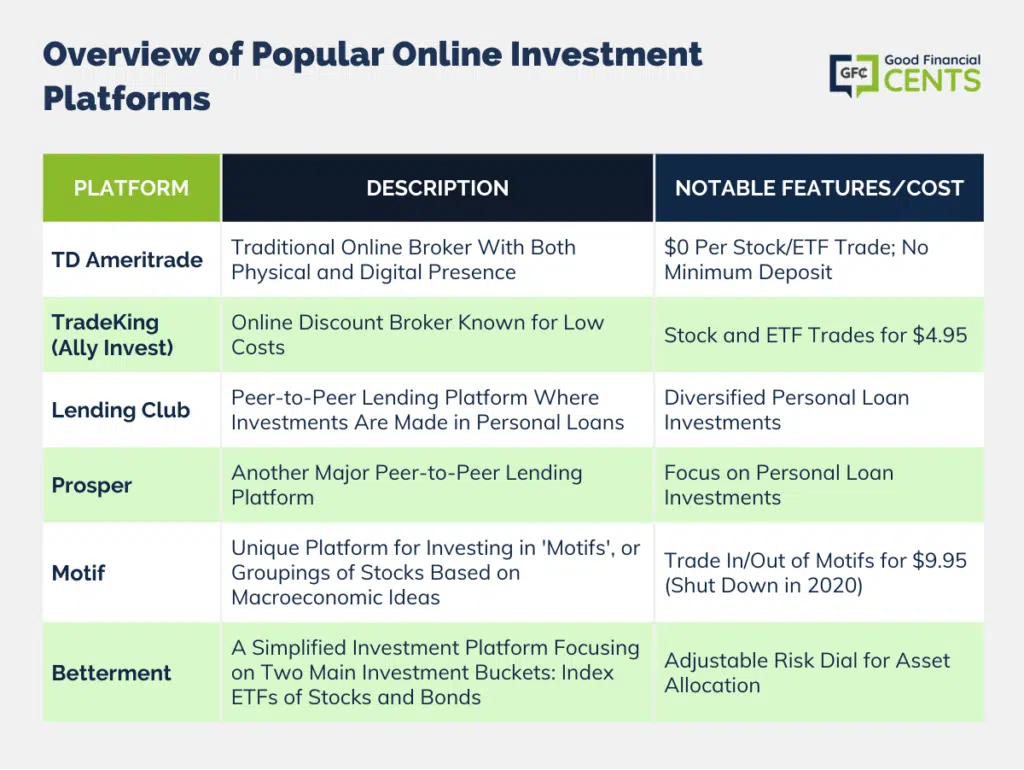

Here’s a brief rundown of each online platform:

TD Ameritrade

TD Ameritrade is another strong contender, and I’m excited to try out their platform myself. They’ve got 125 brick-and-mortar locations, but again, the idea here is to be able to open and manage your account from the house. (In your pajamas. Eating cookies in bed. No excuses.)

They also brag about how you can open a Roth IRA in 15 minutes or less. And y’all know how I feel about Roth IRAs.

The company charges $0 per stock and ETF trade, which is in line with where we want to be. (The $49.99 mutual fund trades are a no-no in my book, so I’ll stay away from these in this account.)

Even better? No minimum deposit is required to open an account, and there are zero account maintenance fees.

TradeKing

If I had to pick two words to describe Ally Invest, it would be… low… cost. Seriously, low costs.

The company recently merged with Zecco, another online discount brokerage firm, in order to fight some of the bigger names listed here. Both companies made a name for themselves by driving costs down as low as possible.

They actually kind of remind me of Southwest Airlines or JetBlue with their crazy low prices that undercut the competition.

In short, TradeKing offers stock and ETF trades for just $4.95. That’s 50% lower than TD Ameritrade. If I were going to trade a lot, this is the brokerage I’d pick in order to keep my costs down.

Lending Club

This is where we start getting into some alternative investment ideas. We leave behind the relatively safe and understood realm of stocks, bonds, ETFs, and mutual funds and enter the personal loan marketplace.

With Lending Club (and Prosper, below), you aren’t investing in ownership of a company. Instead, you are buying ownership of a loan issued to a borrower through the website in what is called peer-to-peer lending.

Borrowers use the site to do one of my favorite things ever: pay off high-interest debts like credit cards. They’ll get a loan for 11% and pay off debts at 22%, which is what I call a major win.

Then, those wonderful investors like you and me get to enjoy the interest from that loan.

Diversification is key here, but I’ll be sharing some strategies on how to minimize risk and maximize returns with Lending Club.

NOTE:

Prosper

Prosper was the first peer-to-peer lending website to really take off. Lending Club has given them a run for their money, and I kind of feel like Prosper has taken a bit of a reputation hit.

So, I’ll open an account with both P2P websites with the exact same starting capital amount and the same investing principles, and we’ll see where everything turns out.

Motif

Motif Investing has a completely different take on investing. Instead of investing in mutual funds, ETFs, or individual stocks, the company lets you invest in something called motifs.

Motif investing is a grouping of up to 30 stocks based on a macroeconomic idea. The company looks for macro trends like “people are fixing their homes” and then asks the question of which companies would benefit. The answer to that is home supply stores, home furniture stores, and the like.

They then seek out companies that fit that mold and weigh them differently after doing an analysis of the firms. So you might end up with 25% with Home Depot, 1% with Pier One, and 7% in Bed Bath and Beyond.

That’s a motif.

A motif can be up to 30 stocks, and what’s even better is you can add and subtract from the motif to give you a completely customized investment. It’s like building your own personal ETF.

Once you have a motif or build one yourself, you can trade in and out of that motif for a $9.95 trade cost. Instead of having to invest in each individual company and tailor your trades toward the allocation you want, you can instead just invest and trade in one motif.

The ability to create what is essentially my own ETF fascinates me, so I’m going to give this a try, too.

NOTE:

Betterment

Betterment believes that investing is too complicated. Figuring out what asset allocation is, how and when to rebalance a portfolio, or just understanding which mutual fund to select can be overwhelming, especially when you first start out.

Betterment Investing does away with that and instead offers you two investment buckets and a turn dial of risk. One bucket is index ETFs of stocks, and the other is index ETFs of bonds.

The risk dial lets you determine what kind of a split you want between these two investments: 50/50, 75/25, or some other combination in between.

In short, it is simple and really easy to get started with.

Tracking Progress

To make it easy to track the performance, we’re using Personal Capital to track each outfit.

How It’s Going to Work

I’m funding each account with $1,000. Starting January 1st (or the 1st day the market opens), I’m going to invest the money using various strategies. We’ll then provide ongoing updates so you can see how I’m doing.

To make this more fun, I’ve solicited my wife to join me on this. Here’s how it’s going to break:

- TD Ameritrade: I’m going to pick some stock so you can see how awful awesome my stock picking isn’t. Remember, this is the same guy who lost $5,000 on a penny stock.

- Ally Invest: Picking some blue chip dividend stocks and letting them ride

- Motif: Selecting a “motif” that I believe is a good one. I’m not even sure what Motiff means, so this should be interesting.

- Prosper: Going with the most aggressive portfolio with both. May the best P2P lender win!

Those are the online players that I’ll be utilizing for the year-long experiment. We’ll be using the S&P500 as a relative benchmark. Timing-wise, this experiment might be the worst since we’re fluttering with all-time highs in the market. To address that…..

A Quick Disclaimer:

Please see the bottom of the post for a more in-depth disclaimer.

The Throwdown Just Got Serious

In true throwdown fashion, this wouldn’t be fun unless I had some other people throw down with me, would it?

I’ve recruited some of my personal blogger friends to join in on the action with me. They have all agreed to open an account with an online broker of their choosing.

They will then begin investing on the first day of the trading year and then write a post on why they invested the way they did.

They will also report back with performance results on how their $1,000 portfolio is doing.

The crew joining me for the ride:

- Paula Pant – AffordAnything.com

- Hank Coleman – MoneyQandA.com

- Rob Berger – DoughRoller.net

- Julie Rains – WorkingtoLive.com

- Miranda Marquit – PlantingMoneySeeds.com

- Robert Farrington – TheCollegeInvestor.com

- Larry Ludwig – InvestorJunkie.com

- Tom Drake – MapleMoney.com

- Doug Nordman – The-Military-Guide.com

- LaTisha – YoungFinances.com

- John Schmoll – FrugalRules.com

- Luke Landes ‘aka’ Flex0 – ConsumerismCommentary.com

- Joe Saul-Sehy – StackingBenjamins.com

- Phil Taylor – PTMoney.com

- Glen Craig – FreeFromBroke.com

We have some good diversity with the crew, so I’m pumped to get this going.

Wanna Join?

If you’re interested in throwing it down with you, you still have time. Here are the rules that we have:

1. Open a new broker account of your choosing and deposit $1,000.

2. On January 1st (anytime around the 1st), you can invest any way you want (stocks, ETFs, mutual funds, whatever). No margin allowed.

3. You can buy/sell as much as you want.

4. You cannot add any more than the original $1,000.

5. Write a blog post that publicly shares what you bought.

6. Track your return and report back to me so I can keep track of everyone that’s taking part.

Just contact me, and I’ll get you added to the list.

Next Steps

At the beginning of the year, I’ll be publishing a mega post that outlines everything I’ve bought with each account. I’ll have screenshots showing you everything.

In fact, this will probably be the most in-depth post I’ve ever completed on the blog, and I can’t wait!

Stay tuned…..

P.S.

Hope you caught that. 😉

****

Disclaimer:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and cannot be invested directly. Content posted by third parties on this site is screened in order to protect clients’ privacy and comply with regulatory requirements.

Content containing sensitive personal information, inappropriate language, information about specific investments, misleading information, information about other companies or websites, or information related to litigation will be removed.

Content posted by third parties on this site remains the responsibility of the party posting the content and is not adopted or endorsed by GoodFinancialCents.com or Alliance Wealth Management, LLC.

Any opinions or statements posted by third parties are their own and may not be representative of the experience of others, and are not indicative of future performance or success.

Third-party content on this site does not reflect the views of GoodFinancialCents.com and has not been reviewed by the principal owner, Jeff Rose, as to accuracy or completeness.

Hey Jeff,

I thought it would be fun to participate in this so I’ve setup my account and I’m trying to figure out where to go from there. Happy New Years!

http://worktonotwork.blogspot.com/2014/01/the-grow-your-dough-throwdown-beginning.html

Got my plan in place, and I’m ready to execute when the U.S. markets open on January 2. So excited, since I’m using this as a chance to help me grow my own ability.

I’m looking forward to this! I pretty much know what I’m going to invest in I just need to set up the trades. It will be interesting a year from now to see how everyone did.

Got my investment strategy setup and ready to execute. Happy New Year!

This is a sweet idea! I’m in for the next throwdown when I have a bit more cash to play with.

For this one my money’s on…..

Joe from Stacking Benjamins (sorry Jeff). Looking forward to see how this plays out!

I’m liking the name change! Looking forward to the competition, just got my account open and funded today!. 🙂

Sweet! I can’t wait to get started! Time for a good ole fashioned rumble!

Dude, that sounds like a lot of fun! I love hearing about different risk tolerances and various market returns. I’d join buy my investing strategy is quite boring.

However, I do have a Betterment account that I’m playing around with – just $100 going in every month. That’s the extent of my “madd money”.

I’ve already put in $1,300 and gained $127.01 on an all-stocks ETF portfolio (not great but not bad either).

I wish I’d known about the throwdown last year – I could’ve waited until now to start and become one of the control groups by which to measure the success of the other bloggers.

@ Steve Sometimes boring wins in the realm of investing. My predictions for the upcoming year is that my account that I actually choose stocks will lose to Betterment, the peer to peer lending companies and probably even my wife. 🙂