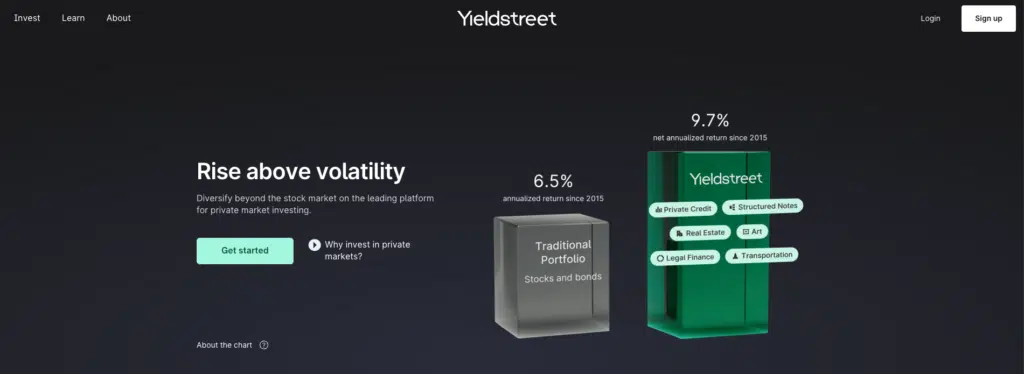

We all witnessed the stock market’s volatility in 2022, as soaring inflation led to aggressive rate hikes over the course of the year.

Many stocks plummeted, with investors selling off their shares due to concerns about a possible recession. Those fears have many investors concerned about where to invest their money in 2023.

If you’re tired of watching your stock investments drop in value and are looking for a way to diversify, you may want to consider alternative investments. One way to do that is through Yieldstreet.

- Access to wide array of alternative asset classes

- Access to ultra-wealthy investments

- Can invest for income or growth

Table of Contents

What Is Yieldstreet?

Yieldstreet is an alternative investment platform for people looking to diversify beyond mainstream investments, like stocks and bonds. Yieldstreet investments vary from artwork to multi-family real estate properties.

Yieldstreet is ideal for sophisticated investors willing to take on riskier projects they can’t find elsewhere, with the potential for higher returns.

With over 400,000 investors, Yieldstreet’s platform is unique for its alternative investment vehicles. Because the platform holds various assets – real estate, cryptocurrencies, artwork, and more – the average user holds about seven investments.

You can build a custom Yieldstreet portfolio starting at $10,000 across various asset classes as an accredited investor.

There is also an option for non-accredited investors to get involved by investing a minimum of $2,500 in Yieldstreet’s Prism Fund. The fund allocates the money towards art, commercial property, consumer, legal, and corporate asset classes.

Key Features of Yieldstreet

| Minimum investment | $2,500 for the Prism Fund. $10,000 for All Other Investment Options. |

| Management fees | 1.5% For the Prism Fund. 0% To 2.5% Management Fee for Other Investments. |

| Customer service options | Live Chat or Email [email protected]. |

| Mobile app availability | iOS and Android |

| Promotions | None Are Available at This Time. |

Yieldstreet Features

You may wonder what makes Yieldstreet stand out from other investing platforms. Here are some key features the platform has to offer.

Unique Asset Classes

The truth is that most of us only have access to certain investment vehicles, while other assets have been reserved for the wealthy or commercial purposes. Yieldstreet allows you to invest in assets like private art and income notes that you won’t find anywhere else.

When you go through the Yieldstreet offerings, you can filter your results by asset classes, including art, crypto, legal, multi-asset class fund, private credit, private equity, real estate, short-term notes, transportation, and venture capital.

You can also select your preferred investment strategy from the following options:

1. Income. For investors looking to generate income with set distribution payments.

2. Growth. Investments that should gain value throughout the term.

3. Balance. For investors who want a mix of growth and income throughout the investment term.

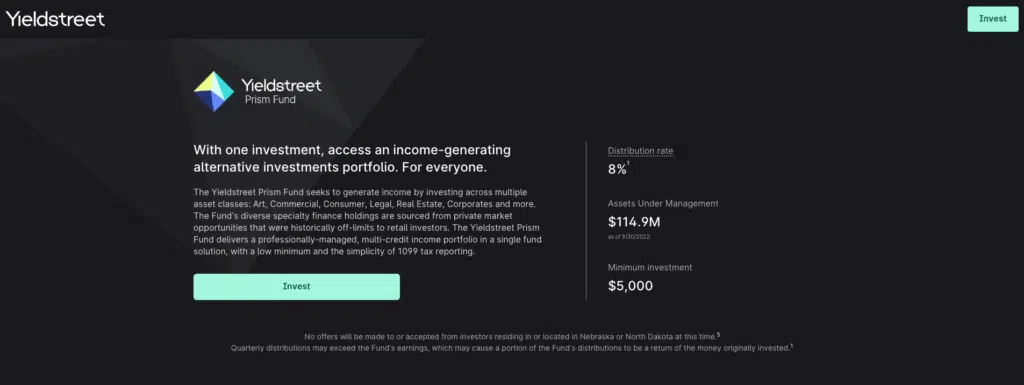

The Yieldstreet Prism Fund

This fund is for non-accredited investors looking to get started with unique investment options. The Yieldstreet Prism Fund offers a professionally managed, multi-credit income portfolio under one fund. You can invest $2,500 or more, and it comes with 1099 tax reporting.

As of September 2022, this fund has $114.9M in assets under management and an 8% distribution rate.

The distributions are made quarterly every February, June, September, and December and are automatically reinvested into Yieldstreet’s Dividend Reinvestment Program (DRIP) unless you opt-out.

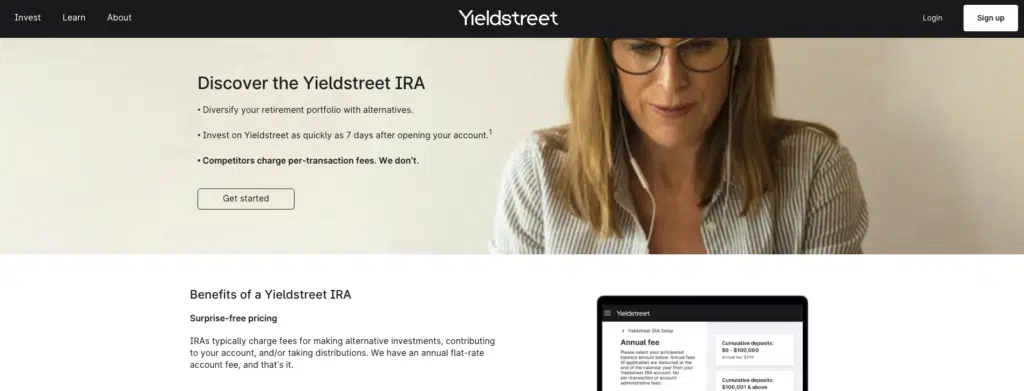

Yieldstreet IRA

The Yieldstreet IRA allows you to invest in alternative assets while ensuring that your investments are tax-efficient so you can keep more of your money in the long term.

The Yieldstreet IRAs allow you to diversify your portfolio without worrying about getting hit with per-transaction fees. Account balances of $100,000 or less have a flat fee of $299, while account balances of $100,001 and higher come with a fee of $399.

Yieldstreet supports both Traditional and Roth IRAs, and customers who wish to transfer a 401k or other IRA account to Yieldstreet can do so.

Yieldstreet Wallet

Another benefit of signing up for an account with Yieldstreet is that you can access a checking account with a higher interest rate than you would otherwise find.

Your Yieldstreet Wallet is an FDIC-insured checking account with Evolve Bank & Trust. You can currently earn an APY of 2.75% in your Yieldstreet Wallet, and you automatically get your wallet account when your investor account is activated.

There are no account minimums or limits, so you can hold your cash there while building up the capital for your next investment.

Yieldstreet’s Unique Investment Features

| Feature | Description |

|---|---|

| Unique Asset Classes | Access Exclusive Assets, Including Private Art and Income Notes Customize Investments by Class and Strategy |

| Yieldstreet Prism Fund | For Non-Accredited Investors, Offering an 8% Distribution Rate and Quarterly Distributions with $2,500 Minimum |

| Yieldstreet IRA | Tax-Efficient Alternative Asset Investments With Flat Fees of $299 (Under $100,000) or $399 (Higher Balances) |

| Yieldstreet Wallet | High-Yield Checking Account With 2.75% APY, No Minimums, Perfect for Holding Funds Between Investments |

Yieldstreet Fees

You will pay fees to invest with Yieldstreet. The offerings you see come with an annual management fee that ranges from 0 to 2.5%, as stated in the offering details.

There are also annual fund fees that investors pay which come out of the cash flow from the investment, and the fees depend on the legal structure of every offer you see.

This fee structure also means that the advertised net target returns you see on all offerings listed on the platform are net of the management fee.

The Yieldstreet Prism Fund has a $2,500 minimum requirement to get started and a fee of around 1.5% annually on the money invested.

Yieldstreet Pros & Cons

As with any investment platform, there are pros and cons that you should think about before investing your hard-earned money.

The pros of using Yieldstreet:

- Access to Alternative Investments: There aren’t many platforms that allow you to put your money into art, crypto, private equity, and venture capital all on one platform.

- You Can Diversify Your Portfolio: We’ve all seen the benefits of diversification during the volatile times in the market. If you’re ready to shift some of your money away from stocks, Yieldstreet provides several alternative investment vehicles.

- You Can Browse Through Offer Details Without Signing Up: Skim through the Yieldstreet offerings to see the available information, including investment type, minimum investment, term, payment schedule, and tax documents.

Here are the cons of using Yieldstreet:

- You Have to Wait to See Any Returns on Your Money Invested: Some platforms will begin paying dividends within three months, while Yieldstreet requires investing for an extended period on some holdings.

- The Investments Are Illiquid: You can’t cash out after a year, so you’re locking your money up for an extended time (unless you invest in the Prism Fund).

- A Certain Degree of Expertise Is Required: Looking through the investment options, it’s evident that you need some understanding of advanced investments. For example, putting $15,000 into car insurance financing with a 5.5-year term is a confusing proposition for the average investor.

Yieldstreet Alternatives

Before you sign on with Yieldstreet, I recommend checking out some similar platforms. And while Yieldstreet is pretty unique in its offering, suitable alternatives for real estate investing exist. Fundrise and HappyNest are two that you should consider.

Fundrise

Fundrise is a top alternative to Yieldstreet because it allows you to begin investing with a minimum investment of $10. If you’re looking to dip your toes in the real estate and private asset platform, you can start with Fundrise.

The significant difference between the two investing platforms is that you don’t have to invest $10,000 to start at Fundrise. It also has a transparent fee structure for its REITs, charging only 0.85% in annual management fees.

Fundrise touts that you can earn anywhere from 8-10% in dividends, and the company has been around for over a decade now with a proven, successful track record. What Fundrise lacks is the variety of asset classes that Yieldstreet offers.

| I’ve been investing with Fundrise since 2018. Disclosure: when you sign up with my link, I earn a commission. All opinions are my own. |

HappyNest

HappyNest is similar to Fundrise because you can get started with as little as $10. With a user-friendly mobile app, HappyNest is simple enough to navigate, even if you’re intimidated by the concept of real estate crowdfunding.

With the round-up savings feature, you can connect your debit card to the HappyNest app and round up every purchase to the next dollar. When this round-up pool reaches $5, the app automatically invests the money into buying more shares.

The major setbacks of using HappyNest are that the app doesn’t have a proven track record yet, and there are fewer investment options. You certainly won’t find the unique offerings here that are present on Yieldstreet.

It’s worth mentioning that the competition varies within the real estate investment space, and there are investment apps for every profile and budget.

How We Review Brokers and Investment Companies

Good Financial Cents conducts a thorough review of U.S. brokers, focusing on assets under management and notable industry trends.

Our primary objective is to offer a balanced and informative assessment, assisting individuals in making informed decisions about their investment choices. We believe in maintaining a transparent editorial process.

To achieve this, we gather data from providers through detailed questionnaires and take the time to observe provider demonstrations. This hands-on approach, combined with our independent research, forms the basis of our evaluation process.

After considering various factors, we assign a star rating, ranging from one to five, to each broker.

For a deeper understanding of the criteria we use to rate brokers and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

The Bottom Line on Yieldstreet

If you want to spread your portfolio across asset classes, Yieldstreet can be a convenient way to do that. Other crowdfunded real estate platforms tend to be REIT-only, and Yieldstreet has options you won’t find anywhere else.

But while Yieldstreet allows more investors to access asset classes typically reserved for the 1%, the platform isn’t for everyone. Most retail investors lack the expertise required to invest in auto insurance financing or global artwork investing.

If you struggle to understand how an investment works, there’s a good chance you’ll come out on the losing end.

Yieldstreet Review

Product Name: Yieldstreet

Product Description: Yieldstreet is a leading investment platform that offers a wide range of alternative investment opportunities to diversify your portfolio. Through Yieldstreet, investors can access asset classes such as real estate, art, and commercial finance, providing a unique way to potentially enhance returns and reduce risk.

Summary of Yieldstreet

Yieldstreet is a robust investment platform that has gained significant recognition in the alternative investment space. It caters to investors looking to diversify beyond traditional stocks and bonds. One of its key strengths is the diverse range of investment offerings, including real estate, litigation finance, art, and marine finance. This diversity allows investors to spread risk across various asset classes, potentially improving their overall risk-adjusted returns.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Access to Alternative Investments

- You Can Diversify Your Portfolio

- Browse Through Offer Details Without Signing Up

Cons

- You Won’t See Returns Immediately

- Investments Are Illiquid

- A Degree of Expertise Is Required