LendingTree is the nation’s leading online loan marketplace. It provides borrowers with a one-stop shop where they can search for lenders on one online platform. It gives the borrower the ability to find the best loans available and allows you to shop among the various loan offers available.

More than this, LendingTree creates an environment in which multiple lenders compete for your business. This gives you an outstanding chance of identifying the best loan offers available. The platform offers all kinds of consumer loans and offers business loans.

LendingTree isn’t a direct lender, but a lender aggregator who brings many lenders together on one web platform. It is perhaps the largest anywhere on the internet.

The platform has facilitated more than 55 million loan requests since being introduced in 1998. LendingTree, Inc. is a publicly traded company (NASDAQ: TREE) based in Charlotte, North Carolina, and operates across the United States.

Table of Contents

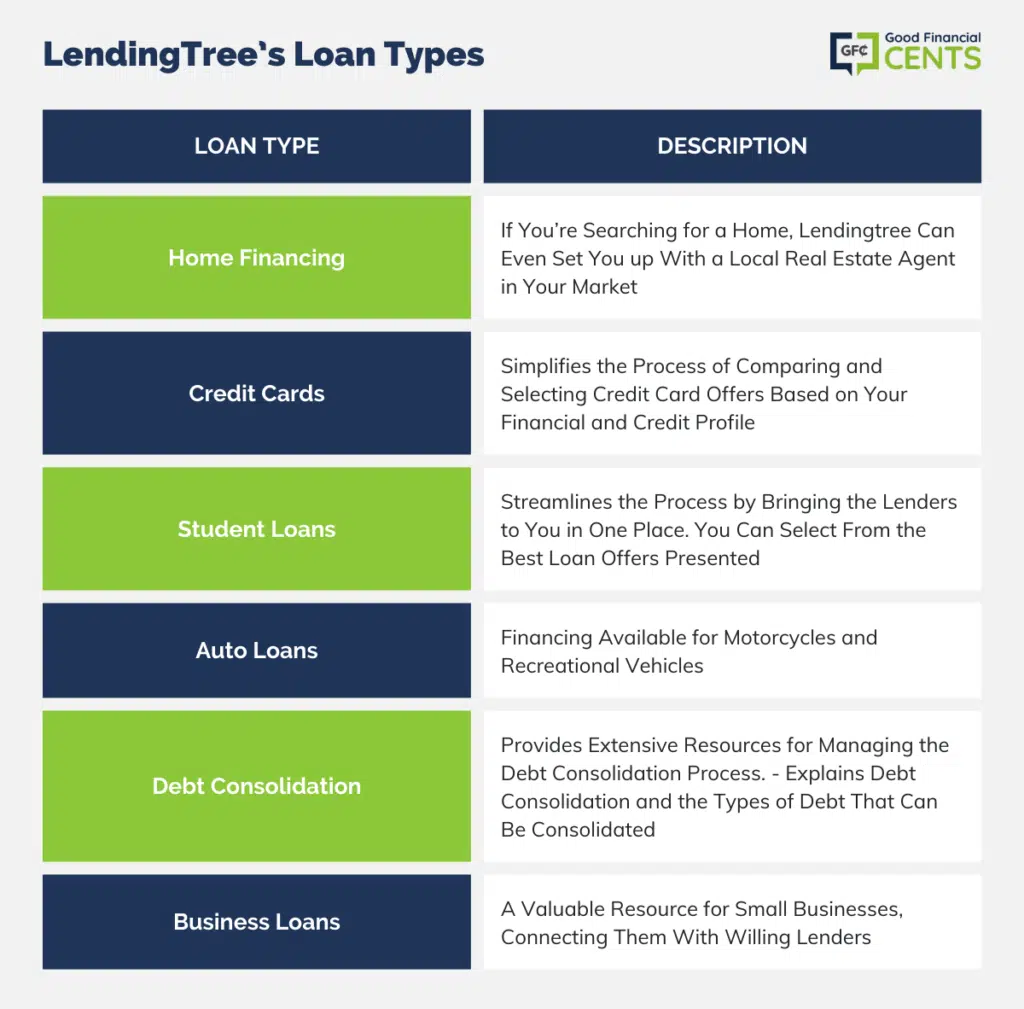

LendingTree’s Available Loan Types

If it has anything to do with consumer finance, it’s available on LendingTree. The loan types included are as follows:

Home Financing

This is a core lending area for LendingTree. In fact, LendingTree is a licensed mortgage broker. Loans available include first mortgages for both purchase and refinance. There are also home equity loans and reverse mortgages.

Both conventional and FHA/VA mortgages are available, as well as construction financing.

First mortgages are available for single-family homes, multi-family homes, townhomes and condominiums, and manufactured or mobile homes. They can be primary residences, second homes, or rental properties.

If you’re searching for a home, LendingTree can even set you up with a local real estate agent in your market.

Get started With LendingTree Home Financing>>

Credit Cards

Everyone’s experienced being thoroughly exhausted sifting through all the details of individual credit card offers, but LendingTree can seriously simplify the process.

Based on your financial and credit information, LendingTree will present offers from various credit card issuers specific to your profile. You’ll have an opportunity to see the various offers side by side so you can pick the right one for you. The process also avoids the need to make separate applications to multiple credit card issuers. This can save you time, effort, and money.

For each credit card offered, they provide interest rates and fees, bonuses, and rewards, card features and benefits, annual fees, and the credit needed to obtain the card. What’s more, you can even select the criteria for the card offers you are interested in viewing. You can see offers from credit card issuers based on rates, rewards programs, and even the credit rating required.

Student Loans

Shopping for student loans can be as time-consuming and tedious as the search for credit cards. There are a large number of programs, each with its own details. LendingTree streamlines the process by bringing the lenders to you in one place. You can select from the best loan offers presented.

They have student loan programs available for both new loans and refinancing existing debt.

Auto Loans

In addition to loans for cars, trucks, and vans, LendingTree also has financing available for motorcycles and recreational vehicles. There are even loans for boats.

The application process works similarly for mortgages. You complete a series of input screens that help determine the specific financing you need. Once that’s done, competing loan offers will be presented.

In addition to asking for general information and financial and credit data, LendingTree will ask you a series of questions about the type of vehicle you are purchasing. For example, you’ll be asked if it’s a refinance or purchase, the approximate amount of the loan, and the down payment you plan to make.

Debt consolidation

LendingTree has a surprisingly extensive debt consolidation section. It includes not just available loans, but also a wide variety of resources to help you in managing the consolidation process. This is more important than it seems since there is no single debt consolidation loan. Consolidation loans can come from different loan types.

They start by explaining debt consolidation and how it works.

They also explain the type of debt you can consolidate. This can be an important part of the debt consolidation decision, since a borrower may not be entirely certain which debts can be included.

Most people think of credit card debt for debt consolidation, but LendingTree offers a long list of other debts that can be included:

- Unsecured personal loans, including payday loans

- Utility bills, including cell phone bills

- Money owed to collection agencies

- Taxes

- Court judgments

They also go into the different types of loans which can be used for debt consolidation. In the process, they discuss the pros and cons of each type of financing. These can include balance transfers, a cash-out refinance on your home, home equity loans and home equity lines of credit (HELOCs), and student loan consolidations.

They also discuss the pros and cons of debt consolidation versus debt management, versus debt settlement. LendingTree is an excellent resource for debt consolidation, even if you never actually take a loan.

They also provide an easy-to-use Debt Consolidation Calculator. It can help you see how the process can benefit you.

Business Loans

LendingTree is a particularly valuable lending source for small businesses. That’s because this sector ordinarily has difficulty finding willing lenders. Banks are more than willing to lend to large businesses but avoid small ones. LendingTree balances this out by bringing many small business lenders onto one web platform. As a small business owner, you can choose the lender and the loan program which will work best for you.

It isn’t just one type of loan either. LendingTree provides a wide variety of loans for small businesses. Loan types include:

- Small business loans

- SBA loans

- Short-term business loans

- Long-term business loans

- Business lines of credit (LOCs)

- Working capital loans

- Equipment financing

- Accounts receivable financing

See Current Business Loan Rates

Other LendingTree Services

One thing you notice about LendingTree very quickly is it’s a comprehensive credit site. If it has anything to do with credit, you’ll find it on the platform. But LendingTree goes beyond credit with some of the services they provide – like auto insurance.

Here are some of the additional services LendingTree offers…

Your Free Credit Score

You can sign up to get your free credit score through LendingTree, and they won’t even ask you to keep a credit card on file. It’s a true free offering. You’ll have to complete a simple application, but checking your score will not impact your credit.

The score provided is the VantageScore 3.0 from TransUnion, which is one of the three major credit bureaus. It’s not your actual FICO score used by lenders, but an educational score that parallels FICO.

In addition to the free credit score, LendingTree provides information to help you understand your credit report and the credit scoring process. They explain how credit scores are calculated, why you need to check them periodically, and ways to improve your score.

Credit Repair

LendingTree’s Credit Repair page provides you with a short list of credit repair providers who can help you to improve your credit or work out settlements with lenders. They even include the fees charged by those services.

They then go on to explain the basics of credit repair, and what your options are if you’re having credit troubles. The information could be a good bit deeper if it could instruct you on the specifics of how to dispute errors on your credit report. But it’s still a good starting point. And if you have enough credit issues, you may need the services of one of the credit repair specialists they offer.

Auto Insurance

This is a category isn’t directly related to credit. But since auto insurance is required by law in virtually every state (except New Hampshire), and since it’s necessary in order to get car financing, it’s a welcome topic on the LendingTree web platform.

The Auto Insurance page gives you an opportunity to shop among auto insurers who do business in your state. Much as is the case with shopping for a loan, you’ll have a chance to compare plans side-by-side, making your choice easier.

The page also provides some basic information on car insurance and even how to get the best rate.

Mortgage Calculators

It’s not surprising LendingTree offers perhaps the most comprehensive collection of mortgage calculators on the web. They are, after all, a licensed mortgage broker. They provide calculators for virtually any type of mortgage scenario you can imagine, including:

- Home Affordability Calculator

- Mortgage Payment Calculator

- Refinance Breakeven Calculator

- Debt Consolidation Calculator

- Reverse Mortgage Calculator

- Mortgage Negotiator Calculator

- FHA and VA Loan Calculators

- Rent vs. Buy Calculator

Even if you don’t get a mortgage through LendingTree, these calculators can provide a wealth of insight to help guide you in the home financing process. Like everything else available on the platform, there is no cost to you for using the calculators.

Ratings and Reviews

As an indication of just how comprehensive LendingTree is, they also provide a Lender Ratings & Reviews service. They are specific ratings and reviews of lenders in each loan category and they’re done by actual borrowers. Those are the best kinds of reviews since they represent direct experience with a specific lender.

You can use Ratings and reviews to help guide you in choosing your lender. Ratings and reviews cover lenders for mortgages, personal loans, business loans, student loans, and auto loans.

How to Use the LendingTree Website

Using the LendingTree platform is a pretty straightforward process. You must complete a series of screens that will determine your location, your general credit score range, your occupation and income, investments and liquid assets available, the type of loan you need, and the loan amount. In order to get loan information, you must also provide your email address, and create a password.

When completing the initial application, it’s important to be as accurate as possible. For example, you’ll be asked to provide your credit score range and a lender will verify this by pulling your credit report. If your actual credit score varies a good bit from the one you supplied, the offers you receive through LendingTree may no longer be valid. The same is true with employment, income, and, if you are applying for a mortgage, the value of the property you are purchasing or refinancing.

LendingTree Fees

Should You Get Financing Through Lendingtree?

Whatever type of financing you’re interested in getting – mortgages, auto loans, business loans, student loans, or credit cards – LendingTree is worth a close look. Apart from the many free services it offers to help you in the loan decision and with your credit situation, the platform represents perhaps the largest number of lenders on one platform. Lenders will compete for your business and give you the opportunity to make an informed decision about the best loan offer for you.

Probably the biggest negative with LendingTree is you should expect to be solicited by various lenders, even after you make your loan choice. LendingTree doesn’t hide the fact they are a marketing lead generator, and this means your contact information will be available to participating lenders on the platform.

But, if you’re in the market for a loan of any kind, check out the LendingTree website and see what it can do for you.

Bottom Line: LendingTree Overview

LendingTree stands out as a premier online loan marketplace, offering a vast array of financial solutions by aggregating multiple lenders on a single platform. With its roots dating back to 1998, the platform has processed over 55 million loan requests, making it a go-to for consumers seeking tailored loan options.

From mortgages and credit cards to business and student loans, LendingTree provides a comprehensive suite of offerings, fostering competition among lenders to secure optimal deals for borrowers. However, users should anticipate marketing solicitations, given LendingTree’s lead generator role. In essence, for those navigating the loan landscape, LendingTree offers an unparalleled, user-centric experience.

How We Review Lenders:

Good Financial Cents evaluates U.S. lenders with a focus on loan offerings, customer service, and overall trustworthiness. We strive to provide a balanced and detailed perspective for potential borrowers. We prioritize editorial transparency in all our reviews.

By obtaining data directly from lenders and carefully reviewing loan terms and conditions, we ensure a comprehensive assessment. Our research, combined with real-world feedback, shapes our evaluation process. Lenders are then rated on various factors, culminating in a star rating from one to five.

For a deeper understanding of the criteria we use to rate mortgage lenders and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: LendingTree Product Description: LendingTree is a leading online loan marketplace that connects borrowers with multiple lenders, offering a range of financial solutions. By aggregating various lenders on one platform, it simplifies the loan comparison process and fosters competitive rates, allowing consumers to find optimal deals tailored to their needs. Summary of LendingTree Launched in 1998, LendingTree revolutionized the lending sector by giving power back to borrowers, allowing them to compare offers from multiple lenders simultaneously. Whether seeking mortgages, credit cards, student loans, or business financing, LendingTree streamlines the search process. With a focus on transparency and user experience, the platform provides not only loan solutions but also various tools and educational resources. This ensures that users are equipped with the necessary knowledge to make informed financial decisions. Pros Cons

LendingTree Review

Overall

LendingTree provides you with a large number of potential lenders in one location.

take me off your adevertiesments