Options trading is becoming increasingly popular, especially as investors look for new and different strategies to improve retirement portfolio performance. Options trading is a higher-risk activity than other types of investing, but it can be profitable if you are knowledgeable and understand those risks.

To help you improve your options trading game, we offer this guide with what we believe to be the six best options trading platforms of 2024.

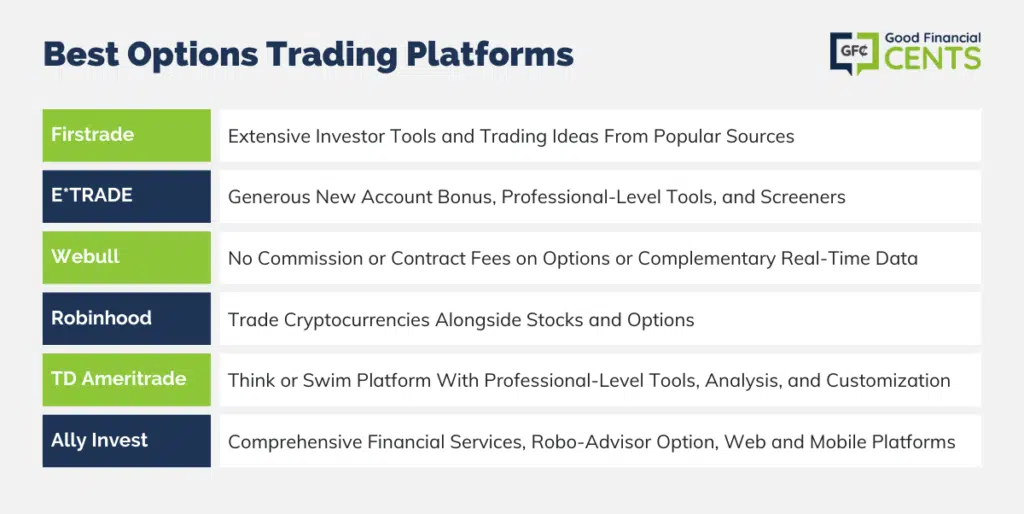

The table below lists all six, with a summary of the top features of each. That will be followed by a deeper analysis of each platform to help you choose the one that will work best for you.

Table of Contents

Our Picks for the 6 Best Options Trading Platforms July 2024

Here is our numerical ranking of the six best options trading platforms of 2024:

1. Firstrade: Best All-Around

2. E*TRADE: Best for New Account Bonus

3. Webull: Best for No-Fee Options Trading

4. Robinhood: Best for No-Fee Options Trading

5. TD Ameritrade: Best for Trading Platform

6. Ally Invest: Best for Comprehensive Financial Services

Feel free to read the detailed summaries of any of the six you feel might be of interest to you.

Best Options Trading Platforms – Reviews

Firstrade gets our vote as the best all-around options trading platform of 2024. Not only do they charge no commission or contract fees on options, but they offer a whole lot more. For example, they offer one of the deepest platforms for investor tools and research for options and other types of investing. That includes trading ideas and strategies from popular investment news sources like Morningstar, Zacks, and Benzinga. And you can trade on both the web platform and the mobile app.

- Minimum Initial Investment: $0

- Fees: Commission-free trades of stocks, ETFs, and mutual funds; no commissions or contract fees on options.

- Other Investments Offered: Stocks, bonds, ETFs, mutual funds

- Available Accounts: Individual and joint taxable accounts; traditional, Roth, and rollover IRAs

Firstrade also gets high marks for the diversity of investments they offer. In addition to stocks, bonds, and ETFs, they also offer investing in more than 11,000 mutual funds. That might be the largest selection of mutual funds offered anywhere. And they charge no commissions for trading those funds.

E*TRADE takes second place on our list, not only because it pays a very generous new account bonus but also because it’s an excellent options trading platform. They provide independent analyst research, quotes, news, and charts, as well as investing tools and screeners to help you spot emerging trading opportunities. It all happens on the Power E*TRADE platform but includes easy-to-use tools for stocks, options, and futures trading.

- Minimum Initial Investment: $0

- Fees: Commission-free trades of stocks, ETFs, and options (+ $0.65 per contract fee); more than 4,000 no-transaction-fee mutual funds

- Other Investments Offered: Stocks, bonds, ETFs, mutual funds, currencies, and futures

- Available Accounts: Individual and joint taxable accounts; traditional, Roth and rollover IRAs

E*TRADE has what might be the most generous new account bonus being offered in the brokerage universe. They pay on a sliding scale, based on the amount you deposit in your new account within 60 days of opening. That starts with $50 for opening a $10,000 account and goes as high as $3,500 for an account of $1.5 million or more.

E*TRADE provides commission-free trading of stocks and ETFs but also offers more than 4,400 no-transaction-fee mutual funds. You can also trade currencies and futures on the platform.

Webull is less of a full-service stock broker and more of an investment app. In fact, it’s one of the very best investment apps in the space. Of particular interest to options traders is that not only do they charge no commission on options trades, but there’s also no contract fee. That will give you the ability to trade options without regard to transaction costs. And that will maximize your profits and minimize your losses.

Otherwise, Webull is a pretty solid all-around investing platform. Customer service is limited to email, but the platform provides complementary real-time OPRA and CSMI data, as well as 10 options trading strategies. It’s available on both desktop and mobile.

- Minimum Initial Investment: $0

- Fees: Commission-free trades on stocks or ETFs; no commissions or contract fees on options

- Other Investments Offered: Stocks, ETFs, and cryptocurrencies

- Available Accounts: Individual taxable investment accounts; traditional, Roth, and rollover IRAs

Webull also offers commission-free trades of both stocks and ETFs. And if you’re interested in trading cryptocurrency, you can do it on this app.

We would put Robinhood in a tie with Webull for third place as best for no-fee options trading but instead placed them #4 due to the lack of IRA account availability.

But in most other respects, Robinhood works just like Webull. You can make commission-free trades of stocks and ETFs, and while the platform is fairly limited in tools and resources, it does provide you with all you need for options trading, at least if you’re a knowledgeable trader.

- Minimum Initial Investment: $0

- Fees: Commission-free trades on stocks or ETFs; no commissions or contract fees on options

- Other Investments Offered: Stocks, ETFs, and cryptocurrencies

- Available Accounts: Individual taxable investment accounts only

Robinhood is also unique among investment brokers/apps in that, like Webull, it enables you to trade cryptocurrencies right alongside stocks, options, and ETFs. There is a bit of a limitation in trading foreign stocks, however. This feature is available only through American Depositary Receipts (ADRs) and applies to just a few hundred securities.

TD Ameritrade is a full-service investment broker providing commission-free trades of stocks, ETFs, and options. On the fee side, they don’t quite stack up as well against some of the other platforms on this list since they do charge a $0.65 per contract fee on options. But in every other respect, TD Ameritrade is one of the best options trading platforms in the industry.

- Minimum Initial Investment: $0

- Fees: Commission-free trades of stocks, ETFs, and options (+ $0.65 per contract fee); $49.99 per trade on no-load mutual funds

- Other Investments Offered: Stocks, bonds, ETFs, mutual funds, FOREX, and futures

- Available Accounts: Individual and joint taxable accounts; traditional, Roth and rollover IRAs

This starts with their award-winning trading platform, “Think or Swim.” It provides professional-level trading for serious traders. It includes elite-level tools to perform analysis and test strategies, as well as idea generation with market trends and the ability to analyze the risk and reward of trades.

It also offers onboarding tools, including platform tutorials to help you get out of the starting gate quickly. It offers fully customizable and downloadable software.

Ally Invest is another full-service investment brokerage platform offering all types of investments, including options. And while they mirror the competition with commission-free options trades, they do have a per-contract fee, though it’s at the lower end of the range at $0.50 per contract. And they offer one of the better options trading packages in the industry. You can trade on both the Web version and the mobile app.

- Minimum Initial Investment: $0

- Fees: Commission-free trades of stocks, ETFs, and options (+ $0.50 per contract fee); $9.95 for mutual funds

- Other Investments Offered:

- Available Accounts: Individual and joint taxable accounts; traditional, Roth and rollover IRAs

But where Ally Invest really stands out is in their offering of financial services. They offer one of the most comprehensive packages in the brokerage field. Much of that is provided through Ally Bank, which offers some of the highest-yielding savings instruments in the industry. And as the former GMAC, they also offer one of the widest varieties of auto loans in the industry. They also provide mortgages and personal loans, as well as checking accounts.

While the platform may be best known for self-directed trading, you can also take advantage of Ally Invest’s robo-advisor. It’s perfect if you’d like to have at least some of your portfolio professionally managed while you also trade options. You can invest in the robo-advisor with as little as $100 and no advisory fees.

Options Trading Platforms for Beginners

What Are Options?

An option is a financial activity tied to the value of the underlying security, which is usually a stock. They’re offering contracts to either buy or sell a security at a specific price within a certain timeframe. However, though the option holder has the option to buy or sell the security, he or she does not have a legal obligation to do so. The option will be completed only if it will result in financial gain to the holder.

Options come in two types, calls and puts. Call options give the holder the right to buy the underlying security once it reaches a certain price. A put option gives the holder the right to sell the underlying security once it reaches a certain price.

For example, a call option may give the holder the ability to sell a certain stock at $75 per share. At the current price of $60, the holder doesn’t want to purchase the stock and takes the chance it may not reach that price. Instead, he or she will pay a small premium for the right to sell the stock at $75.

If the stock does reach $85 within the listed option date, say, 90 days, the option holder can purchase the stock at $75, then immediately sell it at a $10 per share profit, less the cost of the call option.

A put option does the exact opposite. It may give you the ability to sell a $75 stock if and when it reaches $60. If the price drops to $50, the put holder will buy the stock at that price and then sell it for $60 at a $10 per share profit.

Options are usually sold in 100-share lots, so a $10 profit would translate into $1,000 on either of the above trades.

How to Find the Best Options Trading Platform

There are many investment brokers offering options trading. If you’ve never traded options in the past, finding the best options trading platform can be a difficult task.

The first question you must ask is, what is a brokerage account? You need to learn the basics of brokerage accounts to make an informed choice.

The best choices are usually selected from the best online stockbrokers. Not only do they enable you to trade online, which is how trading takes place today, but many also offer mobile app trading.

You should also familiarize yourself with other investment types. Those include the best long-term investments, as well as the best short-term investments for your money. You’ll need both to create a balanced portfolio before you begin trading options.

Along the same line, you’ll need to learn a bit about investing in ETFs. Exchange-Traded Funds (ETFs) are tied to specific stock and bond indexes, like the S&P 500. They are a valuable way to add a ready-made portfolio of securities to your existing holdings. In addition, familiarize yourself with the difference between an ETF and a mutual fund. Mutual funds are actively managed, have high fees, and don’t always outperform the market.

As an alternative, you can investigate the best robo-advisors. These are online, automated investment services that provide professional investment management for a very low fee. They invest primarily in ETFs and can provide you with a balanced portfolio to go with your options trading.

Learning Basic Investing

Options trading isn’t a standalone type of investing. You should start by understanding stock investing. Take advantage of a good guide to basic investing to help you learn the ropes. Ultimately, options trading is a more advanced version of stock trading.

You should also understand that options trading is not about making money fast. It’s more about finding ways to invest small amounts of money profitably.

If you’re a small investor, check out Jeff Rose’s guides on how to invest with various small amounts of money:

Crypto Investing With Options Investing

Options trading is a higher-risk form of investing than holding stocks, bonds, or funds. But many people who trade options also invest in cryptocurrency.

If investing in crypto also interests you, learn how to invest in Bitcoin, then investigate the best crypto exchanges. Bitcoin is the primary crypto and the one most widely held by investors. You’ll typically need a crypto exchange to invest in crypto, though Robinhood and Webull, mentioned earlier in this guide, also offer crypto trading.

How We Found the Best Options Trading Platforms

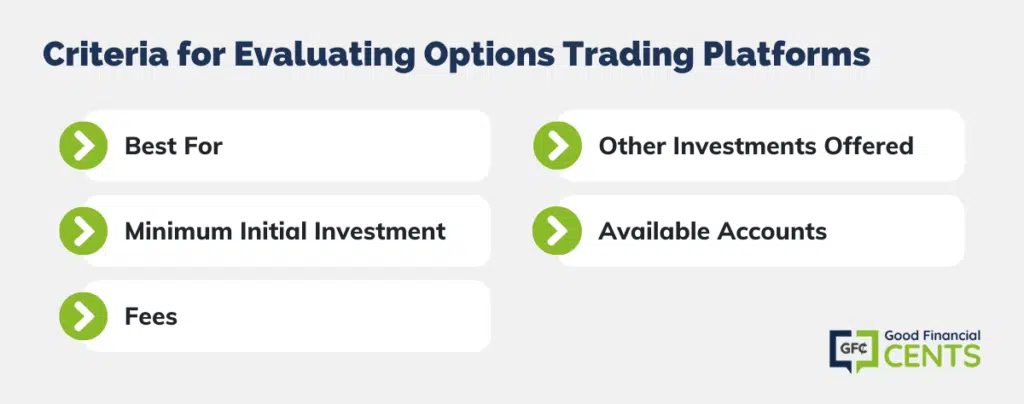

In coming up with this list of the six best options trading platforms for 2024, we leaned heavily in favor of the following five criteria:

1. Best For: We zeroed in on the best feature or features of each platform to determine where each truly excels.

2. Minimum Initial Investment: The lower the minimum requirement, the more investors can participate.

3. Fees: We naturally favored platforms with low or no fees, particularly for options trading.

4. Other Investments Offered: Very few investors invest in a single asset class. We favored those that offer a broad range of more traditional or alternative investment choices.

5. Available Accounts: The more account types offered, the greater the participation in options trading could be. We prefer those that offer both taxable and tax-sheltered accounts.

We also extended our search to consider the reputation each platform has with individual investors.

Summary of the Best Options Trading Platforms of 2024

Once again, below is our summary of the six best options trading platforms for 2024:

- Firstrade: Best All-Around

- E*TRADE: Best for New Account Bonus

- Webull: Best for No-Fee Options Trading

- Robinhood: Best for No-Fee Options Trading

- TD Ameritrade: Best for Trading Platform

- Ally Invest: Best for Comprehensive Financial Services

Any of these trading platforms will be a solid choice if you are a knowledgeable, self-directed options trader. That being the case, pick the platform that will most closely match your investment style and preferences.

Leave a Reply