As unemployment numbers continue to rise, many employees are stressed about whether they’ll have a job next week or not. Some have already lost their jobs and are scrambling to find new employment. At this time, financial planning is crucial.

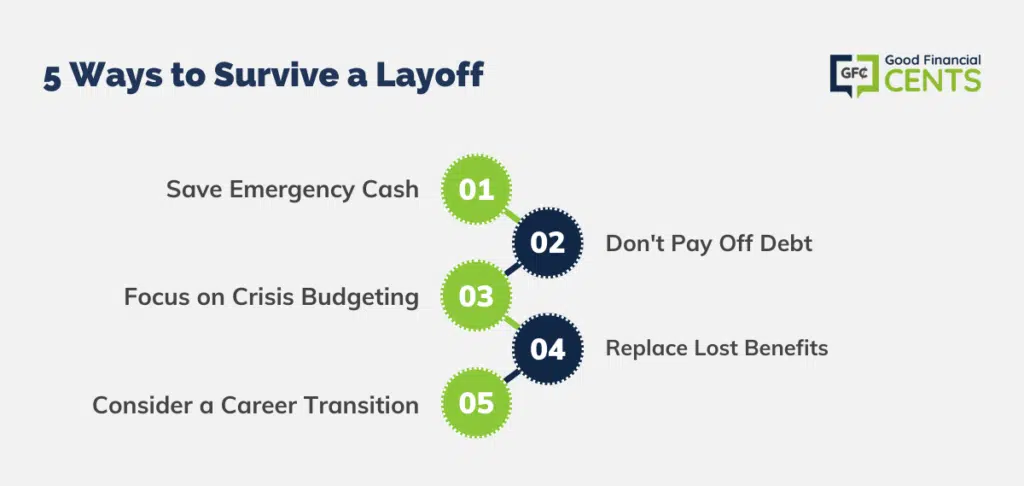

This is a time when people are feeling and desperately need guidance. If you think that you are about to encounter a layoff, you need to focus your attention on what can be controlled: cutting expenditures, figuring out emergency funds, evaluating how to replace lost benefits, and making a game plan for the job search.

Table of Contents

1. Save Emergency Cash

For those who are still employed but the future of their job is uncertain, I would encourage them to have at least 12 months of savings in cash. Unfortunately, many will not have enough. But if they’re still employed, and the emergency funds are not there, tapping into their 401(k) might be a viable option.

I know what you’re thinking. Tapping into your 401(k) usually goes against all that I stand for. And with this dismal market, it might be a dangerous move, but if they become unemployed, that option might now be available to them.

Typically, if you’re still employed, you’re allowed to borrow up to half of your 401(k) balance, up to a maximum of $50,000. Running these numbers, you can guesstimate the period of how long you think it will take you to find a new job and then how much you would need to borrow to get you by until the new job is done.

If you borrow from your 401(k) while you are still employed, then you avoid the 10% withdrawal penalty. Sure, there is some speculation in this move, but if you’re in a high-demand field, you may be able to use this move to your advantage.

Warning:

2. Don’t Pay Off Debt

Another common misconception after being laid off is that most people want to take their savings or their retirement savings and pay off debt, such as credit cards or even 401(k) debt. But in this type of market, paying off debt should not be the priority, especially if you are unemployed.

The priority is to keep your savings intact and make sure that you have plenty of cash on hand. Sure, credit card debt is bad, but just focus on making the minimum payment until you get your job situation in check.

3. Focus on Crisis Budgeting

If you’re used to going shopping every weekend or eating out every other night at fancy restaurants, then most likely, those changes are just around the corner. You need to sit down and seriously hammer out a budget of things that you need and things that you don’t need.

You may even consider working out two budgets, one for while you’re working and one for when you’re not working, so that way you can truly see how much you’re spending per month. And then, you can contemplate whether you can go on a cheaper cell phone plan or cut your cable bill services.

Sometimes, adding that extra payment per month might not seem like a big deal, but $50 here and $50 there will surely add up, especially on a limited budget. Also, knowing which expenses you absolutely must be covered will help you realistically search for your future job.

4. Replace Lost Benefits

In the aftermath of a job loss, people should take stock of what benefits have been lost, which ones they are entitled to by law, which ones may be portable, and how to continue health care coverage, especially if there are dependents.

Typically, employees are eligible to keep the same coverage through COBRA for at least 18 months. But, they may have to pay 102% of the cost of their insurance premium. If their employer has subsidized their premium, then that cost will be a rude shock.

COBRA can often be a good bridge choice, but it ends up being a health benefit. For families paying $200 a month for insurance under COBRA, it could be $1,000.

Luckily, the government just passed a new law concerning COBRA benefits that the qualifying period will be only responsible for paying for 35% of the benefit. This comes at a time that should be very helpful to many who are facing layoffs ahead.

Many employers offer life insurance, long-term care insurance, and disability policies, and they may be portable as well. For another person or one who is not in good health, the ability to take over the payments on an existing $100,000 life insurance policy may save the worry of having to find another carrier. It’s better to keep it for a few months, although make sure they don’t need it, and drop it later.

5. Consider a Career Transition

Many people will be forced by an unforeseen job layoff to reassess what they want in their lives and what is meaningful to them. They may have to craft resumes and cover letters for the first time in years and feel at a loss, especially if they are switching to a new career path, which is an unfamiliar field.

If you haven’t jumped on the social media bandwagon, it’s time. Consider Facebook, LinkedIn, Twitter, and other social media sites to reconnect with old networks and also create new ones. The more people that know your situation, the better.

Also, consider starting a blog to showcase your talents. Need a good blog for inspiration? Guess what, you’re already here.

by Steve Rhodes

The Bottom Line – 5 Ways to Survive a Layoff

Navigating the uncertain waters of potential unemployment can be daunting, but one can weather the storm with the right strategies in place.

Preparing for a layoff necessitates prudent financial planning, from accumulating emergency funds to making informed decisions about debt.

Crisis budgeting ensures optimal utilization of existing resources while understanding and replacing lost benefits is imperative. Equally crucial is being open to career transitions and leveraging social media to amplify job-seeking efforts.

By adopting these measures and maintaining a proactive stance, individuals can not only survive a layoff but also emerge stronger, ready for new opportunities and challenges.