When applying for life insurance, there are several different criteria that will be important to consider. Certainly, these will include the kind and the total of the protection that you will be purchasing.

This is because you will want to be sure that your beneficiary (or beneficiaries) will have an ample amount of insurance protection to cover their ongoing financial needs.

One item that many buyers of life insurance may not deem to be of high importance – but they should – is the insurance business through which they purchase their coverage.

However, this too is key, because you will need to understand that the underlying coverage carrier is secure and firm financially and that it has a positive reliability for carrying out its payment of claims.

One particular insurer that has a great reputation in the industry is State Farm.

The History of State Farm

State Farm was founded back in 1922. In not quite a century, the insurer has grown substantially – and today it insures more homes and autos than any other insurance company in the United States.

This insurer is a mutual insurance carrier, which means that it is essentially owned by the policyholders that it serves. State Farm is also currently ranked number 44 on the overall list of Fortune 500 largest companies.

Today, the insurer still operates using it’s vision it has always had – in addition to being the primary, and the top pick in the services that the company offers.

State Farm Life Insurance Company Review

In addition to providing a broad variety of insurance products, State Farm also works to build strong communities, as well as to be a leader in the public.

The company has assisted in passing numerous seat belt laws, and it has continued to fight for the safety of our teens who are on the road.

The company has also worked in building stronger and safer areas across the U.S. It has made a true commitment to the future via its “green” efforts through activities that have been aimed at the prevention and the reduction of injuries and losses.

Currently, there are over 19,000 State Farm offices across the United States, and overall, the company employs more than 67,000 individuals. The home office for State Farm is located in Bloomington, Illinois.

As of 2023, State Farm had a total of approximately 91 million insurance policyholders. Of these, nearly 8 million were in life insurance. The company processes approximately 35,000 claims every day.

While State Farm offers roughly 100 different products in total, its primary product lines include the following:

- Property & Casualty Insurance

- Life Insurance

- Mutual Funds

- Banking

State Farm has been recognized as being a top employer in both the United States and Canada.

It has also won numerous awards as both an employer and as a company overall – many of which include its commitment to building safer, stronger, and better-educated communities, and for being a “green” partner.

The company makes it easy for its customers to contact its customer service representatives, as well as its claims reps if and when the time comes to file a claim. Local agents can also easily be found. All information may be located via the company’s website.

Contact may be made either online through an email form. Alternatively, representatives may be contacted through a toll-free phone line.

Financial Strength and BBB Grade of State Farm Life Insurance Company

State Farm’s ratings include the following:

- A++ from A.M. Best. This is the highest possible rating given by A.M. Best, and it is due to the superior financial condition, as well as operation performance.

- AA from Standard & Poor’s. This is based on the company’s strong claims-paying ability.

In addition, State Farm has been given the grade of A from the BBB (Better Business Bureau), even though the company is not an accredited company through the BBB. This is on an overall grade scale of A+ through F.

Life Insurance Products Offered Through State Farm

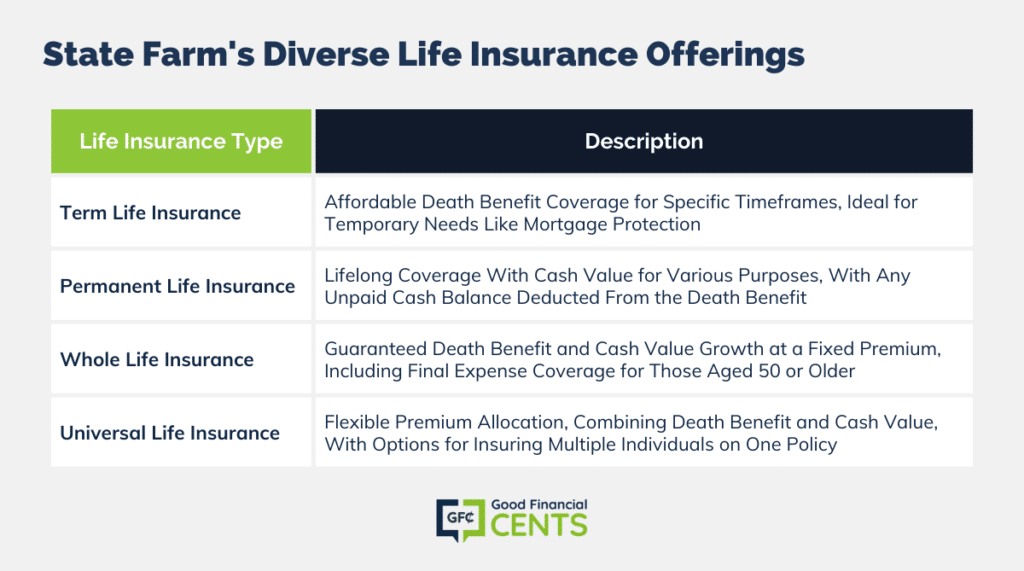

State Farm offers a variety of different life insurance coverage options. Doing so can allow customers to fit the coverage to their specific needs. Life insurance products include both term and permanent options.

Term Life Insurance Coverage

Term life insurance is thought to be a more elementary of all life insurance coverage. This is due to the fact that it offers just pure death benefit coverage alone, and no monetary value accumulates.

Because of this, term insurance is typically more affordable than a similar permanent life insurance policy.

As its name suggests, however, term life insurance is offered for a specific amount of time – or “term” – such as ten, fifteen, twenty, or thirty years.

With that in mind, term life insurance is often purchased for “temporary” needs such as covering the unpaid balance of a mortgage.

The term life insurance policies that are available via State Farm Life Insurance Company have coverage lengths of 10, 20, and 30 years. The 20 and 30-year plans also offer the opportunity for return of premium (within certain guidelines, and for an additional premium amount).

State Farm also offers a life mortgage term insurance policy. This plan offers coverage lengths of either 15 or 30 years. There is also a five-year term life insurance option that is offered through State Farm.

Permanent Life Insurance Coverage

Permanent life insurance differs from term life insurance in that it offers both death benefit security and a cash value element.

It is also different because, unlike a term that has a certain coverage length, permanent insurance will continue for the rest of the insured’s existence, given that the premium continues to be paid.

The cash value component of a permanent life insurance policy allows the funds inside to grow on a tax-deferred basis – meaning that there will be no tax due on the growth unless or until the policyholder withdraws the funds.

These funds may be either withdrawn, or borrowed, for any reason, including debt payoff, supplementing retirement income, paying off high medical bills, or even going on vacation.

Important to Note:

State Farm offers some options when it comes to permanent life insurance. These include whole life and universal life insurance.

Whole life insurance is held to be the most basic of permanent life insurance coverage. With this type of policy, the death benefit is guaranteed, and the cash value will grow based on a set interest rate.

The premium amount is locked in, and cannot be increased by the insurance company – even as the insured grows older, and even if the insured contracts an adverse health condition. This can be beneficial for those who may be on a fixed budget and may have difficulty with rising prices.

There are several types of whole life insurance plans that can be chosen by State Farm Life Insurance Company. One option allows the policyholder to pay premiums regularly throughout the life of the policy.

With the limited pay option, the policy will instead be paid up after either ten years, 15 years, or 20 years.

Or, if an individual would rather choose the single premium whole life option, they can just make one lump sum premium payment and have the policy completely paid up. With this option, the cash value will have a nice jump start right from the beginning.

State Farm also offers a final expense whole life insurance policy.

These plans are typically purchased by individuals who are age 50 or older, and they are for the primary purpose of paying funeral and other related final expenses such as for one’s burial plot and headstone.

The coverage on this plan through State Farm may vary in certain states.

Another type of permanent plan that is available via State Farm Life Insurance Company is Universal Life Insurance or UL. This type of life insurance is regarded to be more adaptable than whole life.

While it also offers both death benefit protection and cash value, the policyholder can decide what quantity of their premium dollars can go into each of these components (within certain guidelines).

In addition to basic UL, there are several other UL policies that may be chosen from through State Farm Life Insurance Company. These include Survivorship Universal Life and Joint Universal Life.

With survivorship policies, more than one individual is insured on the policy. These plans are typically less expensive than buying two separate life insurance policies.

Other Coverage Products That Are Offered

In addition to life insurance, State Farm provides numerous other options for insurance coverage. These include:

- Auto Insurance / Motorcycle / Boat / RV Insurance

- Sport & Leisure Vehicles

- Home, Condo, and Renters Insurance

- Health

- Long-Term Care

- Disability

- Liability

- Identity Protection

- Small Business Insurance

- Affordable Car Insurance for Young Adults

In addition, State Farm also provides financial and retirement planning assistance in order to help its customers grow and protect their wealth.

Products that are offered in this area include the following:

- Banking

- Loans

- Education Savings Plans

- Retirement and IRAs

- Mutual Funds

- Estate Planning

- Annuities

How to Get the Best Premium Quotes on Life Insurance Coverage

When seeking the very best premium quotes on life insurance that is offered through State Farm Life Insurance Company – or through any life insurance company – it is usually the best course of action to work with either an agency or a brokerage that has access to more than just one insurance carrier.

That way, you will be able to more directly compare, in an unbiased manner, the policies, the benefits, and the premium prices, and from there you can determine which will be the best for you.

If you are ready to move onward with comparing the life insurance options that may be the best for your specific needs, then we can help. All you need to do is complete the form in the sidebar to get your first set of life insurance quotes.

There are so many options to life insurance options to choose from – and you want to ensure that you are picking the one that is right for you and the protection needs of those you care about. So, contact us today – we are here to help.

How We Review Insurance Companies

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback.

By integrating this feedback with our research, we can offer a well-rounded evaluation. Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

State Farm Review

Product Name: State Farm

Product Description: State Farm is a well-established insurance provider in the United States, offering a diverse range of insurance products from auto and home to life and health. With a deep-rooted history, the company prioritizes building personal relationships with its clients, combining local agent knowledge with comprehensive coverage options.

Summary of State Farm

With nearly a century in the insurance industry, State Farm stands as one of America’s leading insurance companies, delivering a multifaceted product line tailored to the varying needs of its vast customer base. Their expansive network of local agents ensures personalized service, providing clients with a unique blend of localized expertise and the resources of a national insurer. Beyond insurance, State Farm also offers financial services and products, making it a one-stop shop for many individuals and families seeking comprehensive financial protection and planning solutions.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Local Agent Network: State Farm’s extensive local agent presence means customers can often find personalized, face-to-face assistance in their communities.

- Comprehensive Coverage: The company offers a wide array of insurance products, allowing customers to bundle services and potentially save on premiums.

- Financial Strength: State Farm has a strong financial foundation, indicating reliability and the ability to meet claim commitments.

- Additional Services: Beyond insurance, State Farm provides banking and financial products, streamlining services for clients.

Cons

- Price Points: Some customers find State Farm’s rates to be higher compared to other insurance providers, especially without bundling.

- Varied Customer Experiences: Customer service experiences can vary significantly based on the local agent, leading to some inconsistencies in satisfaction.

- Claim Process: While many claims are handled efficiently, some users have reported longer processing times or challenges with specific claim situations.